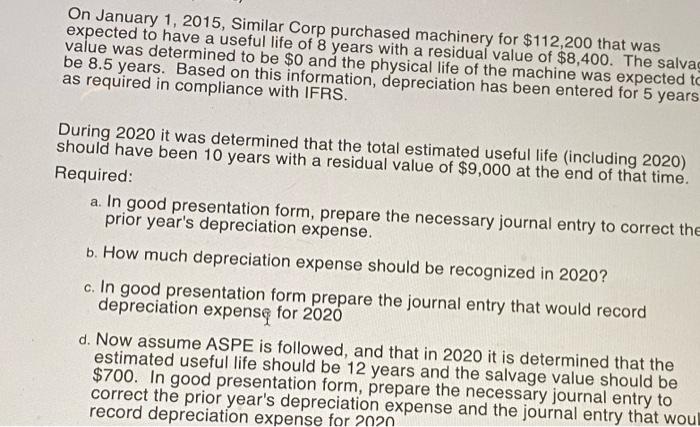

On January 1, 2015, Similar Corp purchased machinery for $112,200 that was expected to have a useful life of 8 years with a residual value of $8,400. The salvag value was determined to be $0 and the physical life of the machine was expected to be 8.5 years. Based on this information, depreciation has been entered for 5 years as required in compliance with IFRS. During 2020 it was determined that the total estimated useful life (including 2020) should have been 10 years with a residual value of $9,000 at the end of that time. Required: a. In good presentation form, prepare the necessary journal entry to correct the prior year's depreciation expense. b. How much depreciation expense should be recognized in 2020? c. In good presentation form prepare the journal entry that would record depreciation expense for 2020 d. Now assume ASPE is followed, and that in 2020 it is determined that the estimated useful life should be 12 years and the salvage value should be $700. In good presentation form, prepare the necessary journal entry to correct the prior year's depreciation expense and the journal entry that woul record depreciation expense for 2020 On January 1, 2015, Similar Corp purchased machinery for $112,200 that was expected to have a useful life of 8 years with a residual value of $8,400. The salvag value was determined to be $0 and the physical life of the machine was expected to be 8.5 years. Based on this information, depreciation has been entered for 5 years as required in compliance with IFRS. During 2020 it was determined that the total estimated useful life (including 2020) should have been 10 years with a residual value of $9,000 at the end of that time. Required: a. In good presentation form, prepare the necessary journal entry to correct the prior year's depreciation expense. b. How much depreciation expense should be recognized in 2020? c. In good presentation form prepare the journal entry that would record depreciation expense for 2020 d. Now assume ASPE is followed, and that in 2020 it is determined that the estimated useful life should be 12 years and the salvage value should be $700. In good presentation form, prepare the necessary journal entry to correct the prior year's depreciation expense and the journal entry that woul record depreciation expense for 2020