Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2015, The Party Place sold inventory costing $65,000 to CanTech Supply. In return, The Party Place received a 4-year, 7% note

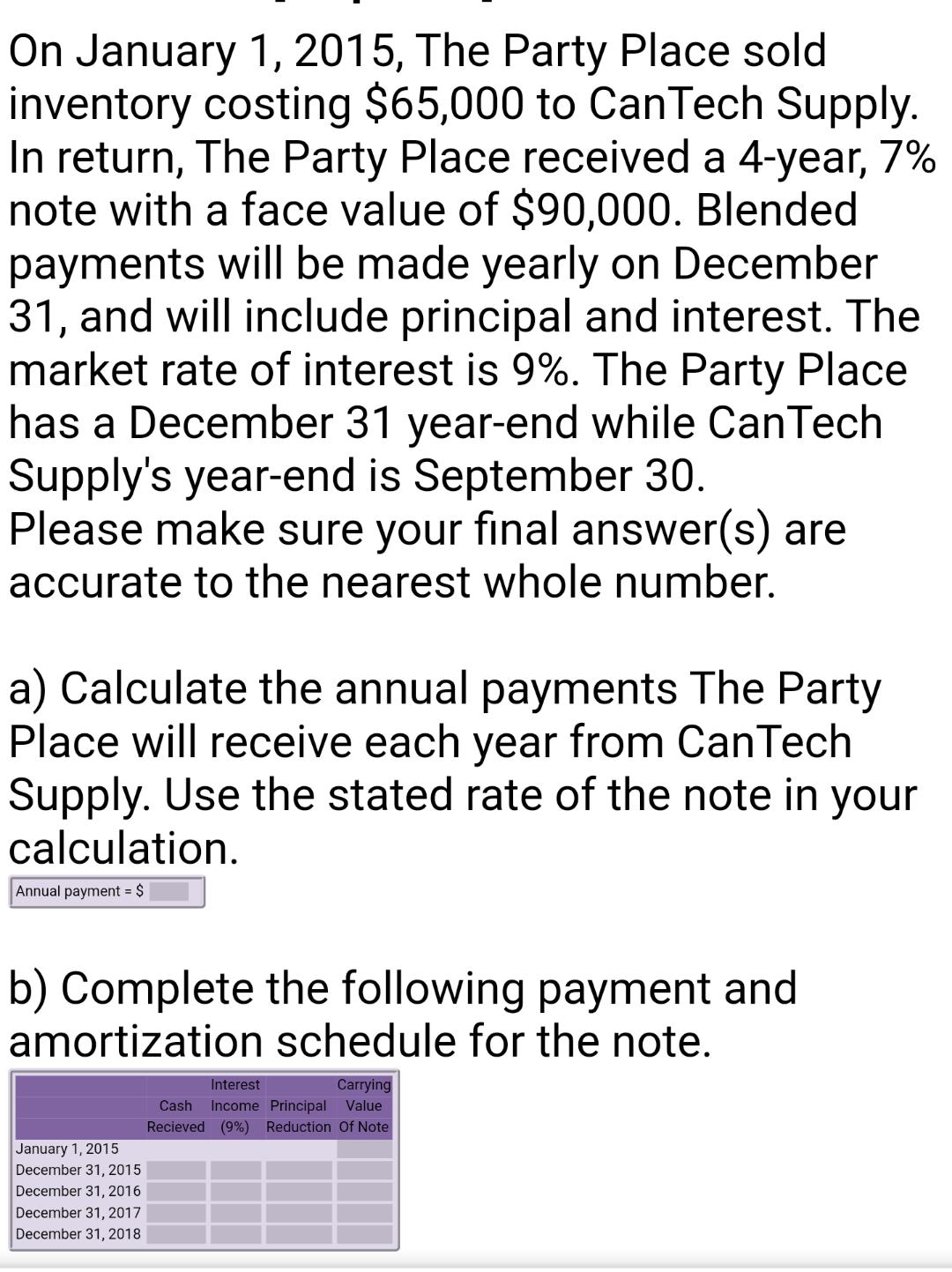

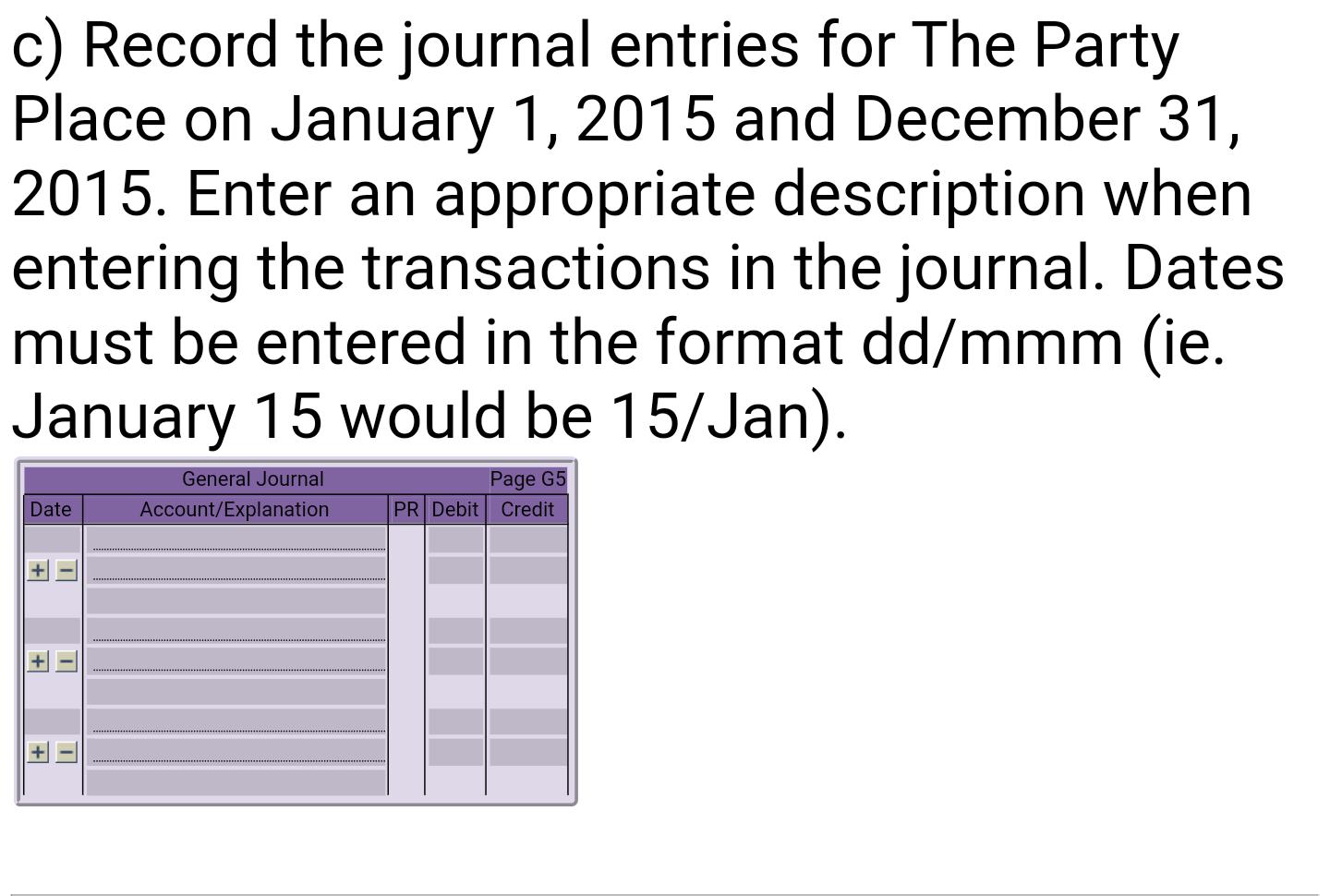

On January 1, 2015, The Party Place sold inventory costing $65,000 to CanTech Supply. In return, The Party Place received a 4-year, 7% note with a face value of $90,000. Blended payments will be made yearly on December 31, and will include principal and interest. The market rate of interest is 9%. The Party Place has a December 31 year-end while CanTech Supply's year-end is September 30. Please make sure your final answer(s) are accurate to the nearest whole number. a) Calculate the annual payments The Party Place will receive each year from CanTech Supply. Use the stated rate of the note in your calculation. Annual payment $ b) Complete the following payment and amortization schedule for the note. Carrying Income Principal Value Recieved (9%) Reduction Of Note Interest Cash January 1, 2015 December 31, 2015 December 31, 2016 December 31, 2017 December 31, 2018 c) Record the journal entries for The Party Place on January 1, 2015 and December 31, 2015. Enter an appropriate description when entering the transactions in the journal. Dates must be entered in the format dd/mmm (ie. January 15 would be 15/Jan). General Journal Page G5 Date Account/Explanation PR Debit Credit + +

Step by Step Solution

★★★★★

3.32 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

126 a PV 90000 127 N 4 128 IYR 900 129 FV 130 PMT 2778018 131 MTC128C12712...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started