Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2016, Masterwear Industries issued $700,000 of 12% bonds, dated January 1. Interest of $42,000 is payable semiannually on June 30 and December

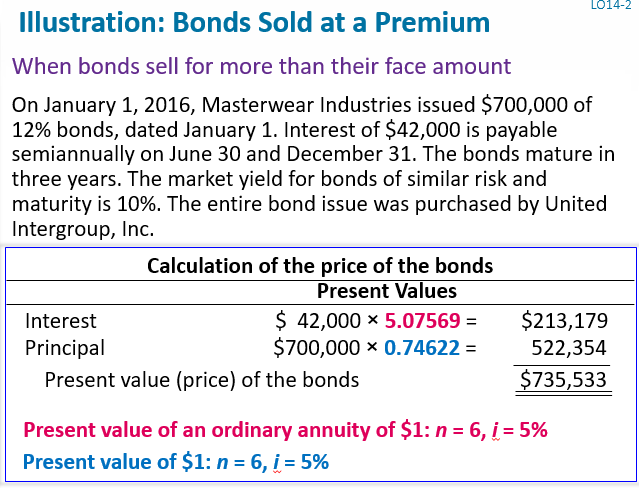

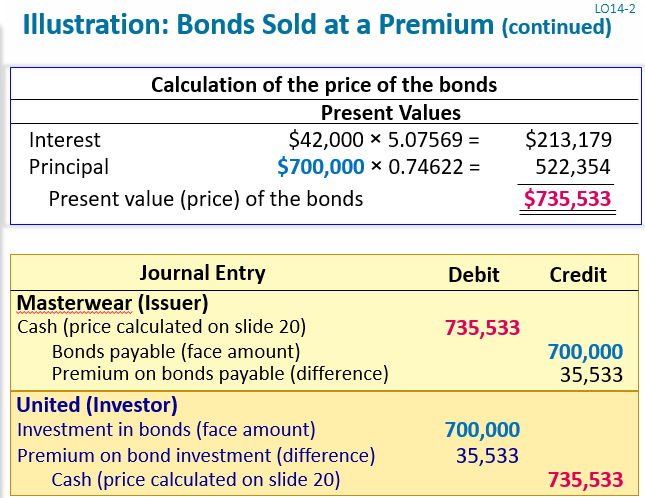

On January 1, 2016, Masterwear Industries issued $700,000 of 12% bonds, dated January 1. Interest of $42,000 is payable semiannually on June 30 and December 31. The bonds mature in three years. The market yield for bonds of similar risk and maturity is 10%. The entire bond issue was purchased by United Intergroup, Inc.

1.How can I use financial calculator to get 735,533?

2.Present value of an ordinary annuity of $1, why it's $1, instead of $700,000

3.How can I get the two numbers: 5.07569, 0.74622

LO14-2 Illustration: Bonds Sold at a Premium When bonds sell for more than their face amount On January 1, 2016, Masterwear Industries issued $700,000 of 12% bonds, dated January 1, Interest of $42,000 is payable semiannually on June 30 and December 31. The bonds mature in three years. The market yield for bonds of similar risk and maturity is 10%. The entire bond issue was purchased by United Intergroup, Inc. Calculation of the price of the bonds Present Values Interest Principal $42,0005.07569= $700,000 0.74622 $213,179 522,354 $735,533 Present value (price) of the bonds Present value of an ordinary annuity of $1: n-6, 1-5% Present value of $1: n-6, 5%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started