Question

On January 1, 2017, Bramble Company contracts to lease equipment for 5 years, agreeing to make a payment of $879,904 at the beginning of each

On January 1, 2017, Bramble Company contracts to lease equipment for 5 years, agreeing to make a payment of $879,904 at the beginning of each year, starting January 1, 2017. The leased equipment is to be capitalized at $4,000,000. The asset is to be amortized on a double-declining-balance basis, and the obligation is to be reduced on an effective-interest basis. Brambles incremental borrowing rate is 6%, and the implicit rate in the lease is 5%, which is known by Bramble. Title to the equipment transfers to Bramble at the end of the lease. The asset has an estimated useful life of 5 years and no residual value.

|

5. How would the value of the lease liability in part (b) change if Bramble also agreed to pay the fixed annual insurance on the equipment of $2,000 at the same time as the rental payments? (Round answers to 0 decimal places, e.g. 5,275.)

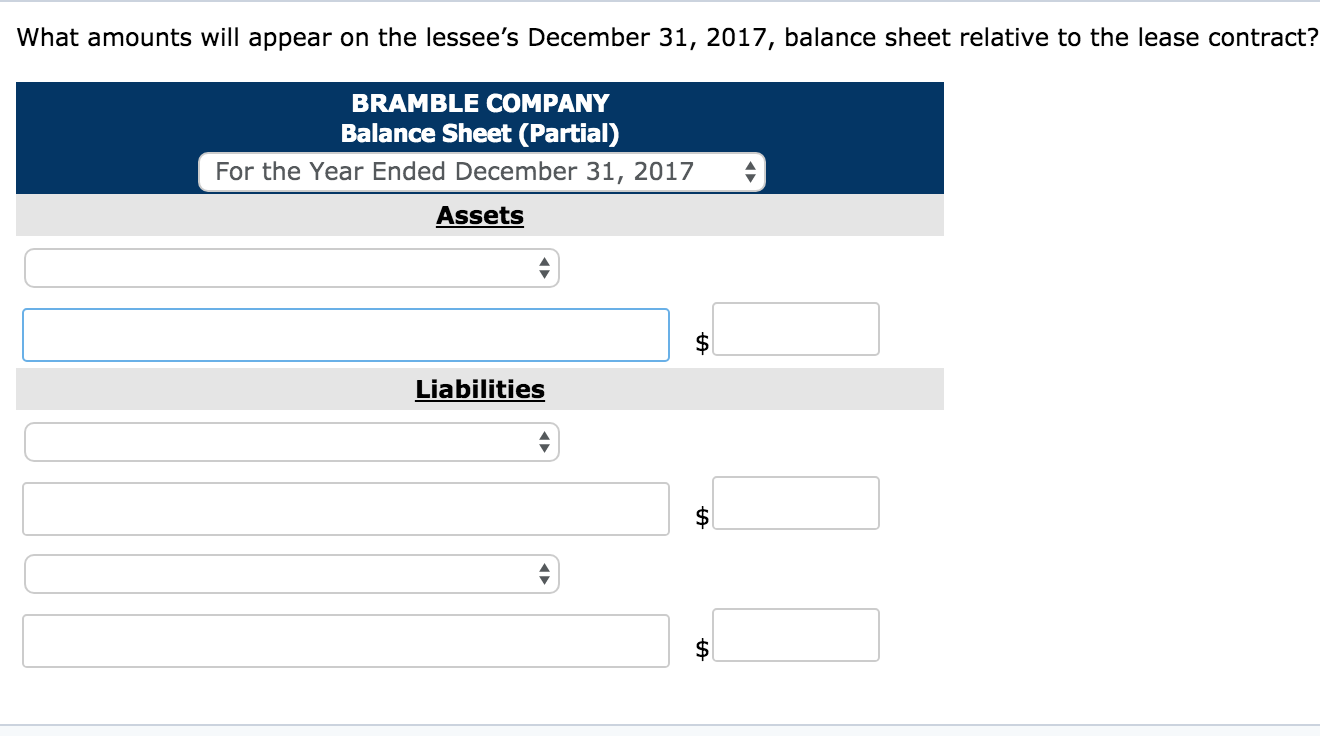

What amounts will appear on the lessee's December 31, 2017, balance sheet relative to the lease contract? BRAMBLE COMPANY Balance Sheet (Partial) For the Year Ended December 31, 2017 Assets , Liabilities $Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started