Answered step by step

Verified Expert Solution

Question

1 Approved Answer

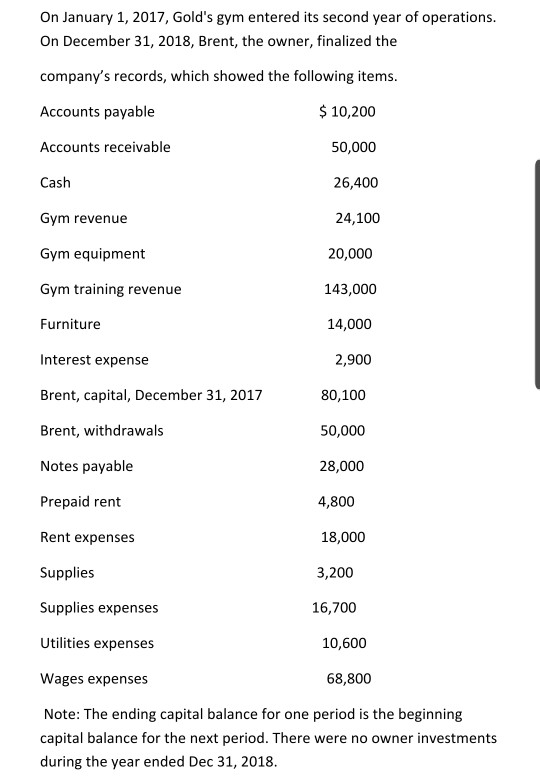

On January 1, 2017, Gold's gym entered its second year of operations. On December 31, 2018, Brent, the owner, finalized the company's records, which showed

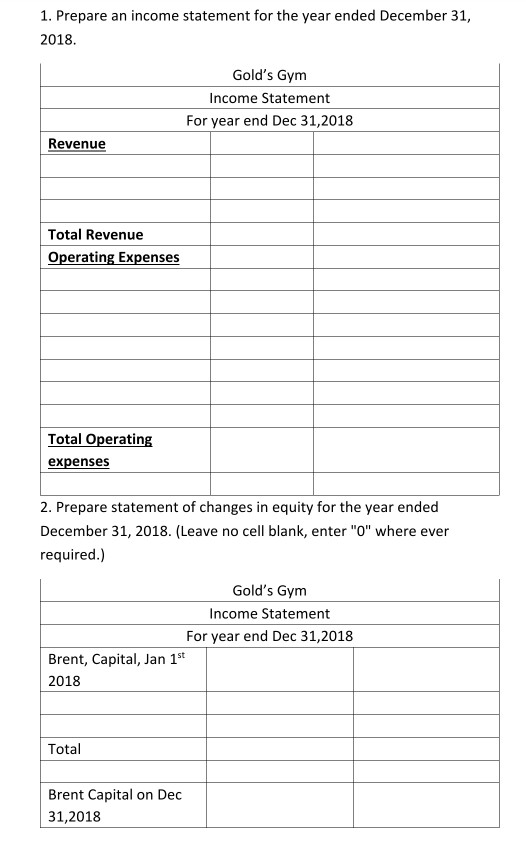

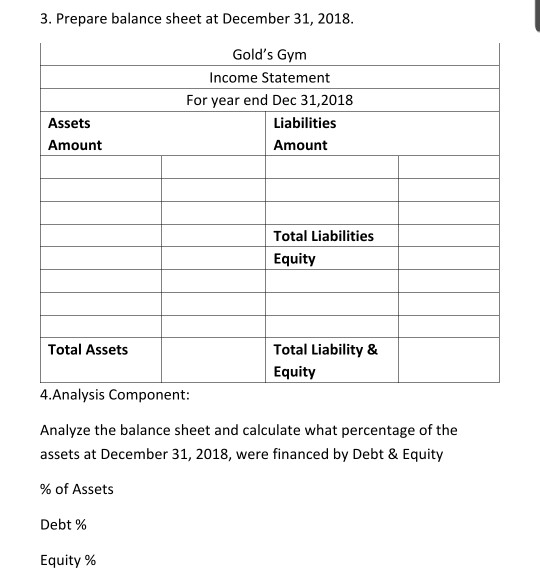

On January 1, 2017, Gold's gym entered its second year of operations. On December 31, 2018, Brent, the owner, finalized the company's records, which showed the following items. Accounts payable $ 10,200 Accounts receivable 50,000 Cash 26,400 Gym revenue 24,100 20,000 Gym equipment Gym training revenue 143,000 Furniture 14,000 Interest expense 2,900 Brent, capital, December 31, 2017 80,100 Brent, withdrawals 50,000 Notes payable 28,000 Prepaid rent 4,800 Rent expenses 18,000 Supplies 3,200 Supplies expenses 16,700 Utilities expenses 10,600 Wages expenses 68,800 Note: The ending capital balance for one period is the beginning capital balance for the next period. There were no owner investments during the year ended Dec 31, 2018. 1. Prepare an income statement for the year ended December 31, 2018. Gold's Gym Income Statement For year end Dec 31,2018 Revenue Total Revenue Operating Expenses Total Operating expenses 2. Prepare statement of changes in equity for the year ended December 31, 2018. (Leave no cell blank, enter "0" where ever required.) Gold's Gym Income Statement For year end Dec 31, 2018 Brent, Capital, Jan 1st 2018 Total Brent Capital on Dec 31,2018 3. Prepare balance sheet at December 31, 2018. Gold's Gym Income Statement For year end Dec 31,2018 Liabilities Amount Assets Amount Total Liabilities Equity Total Assets Total Liability & Equity 4.Analysis Component: Analyze the balance sheet and calculate what percentage of the assets at December 31, 2018, were financed by Debt & Equity % of Assets Debt % Equity %

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started