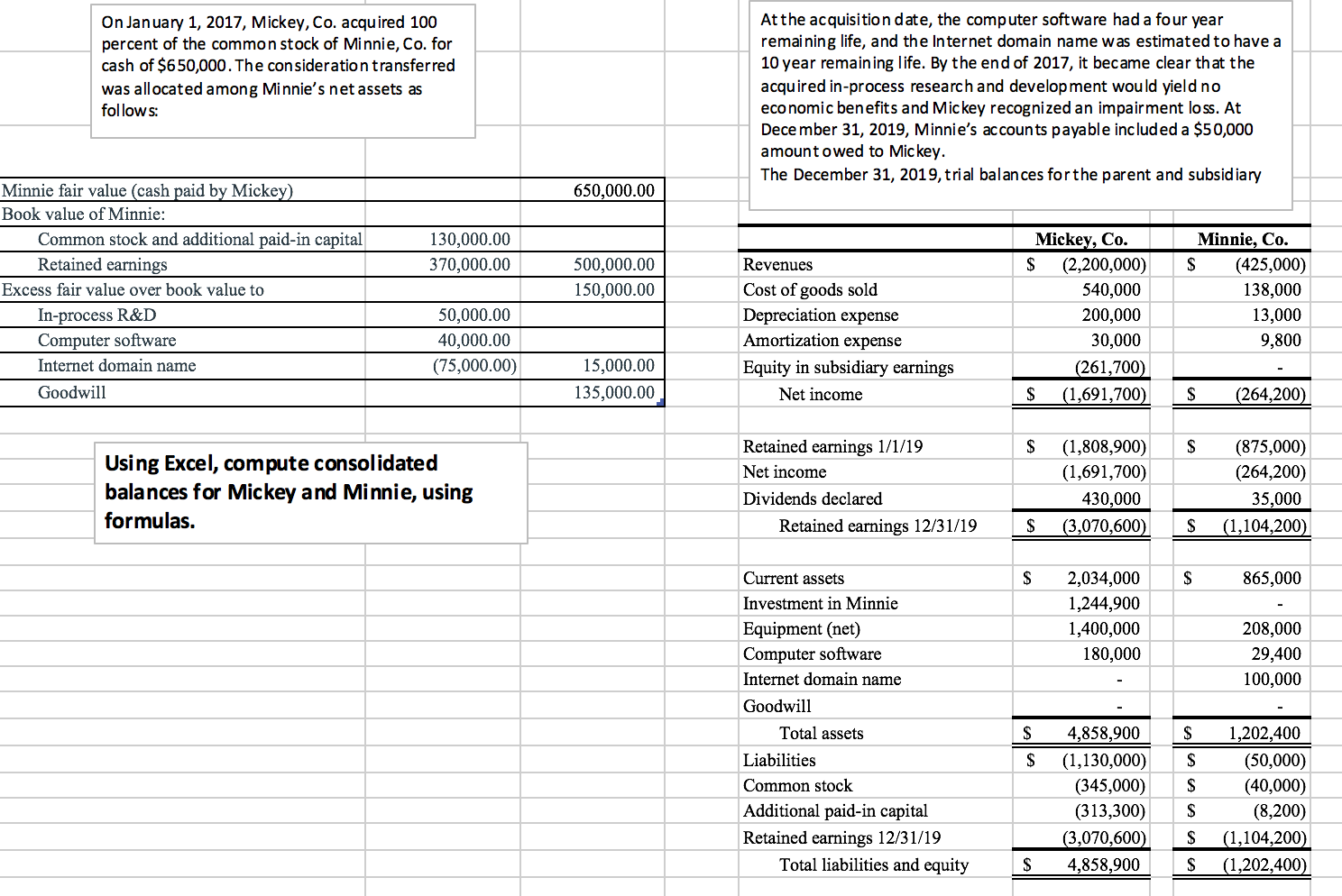

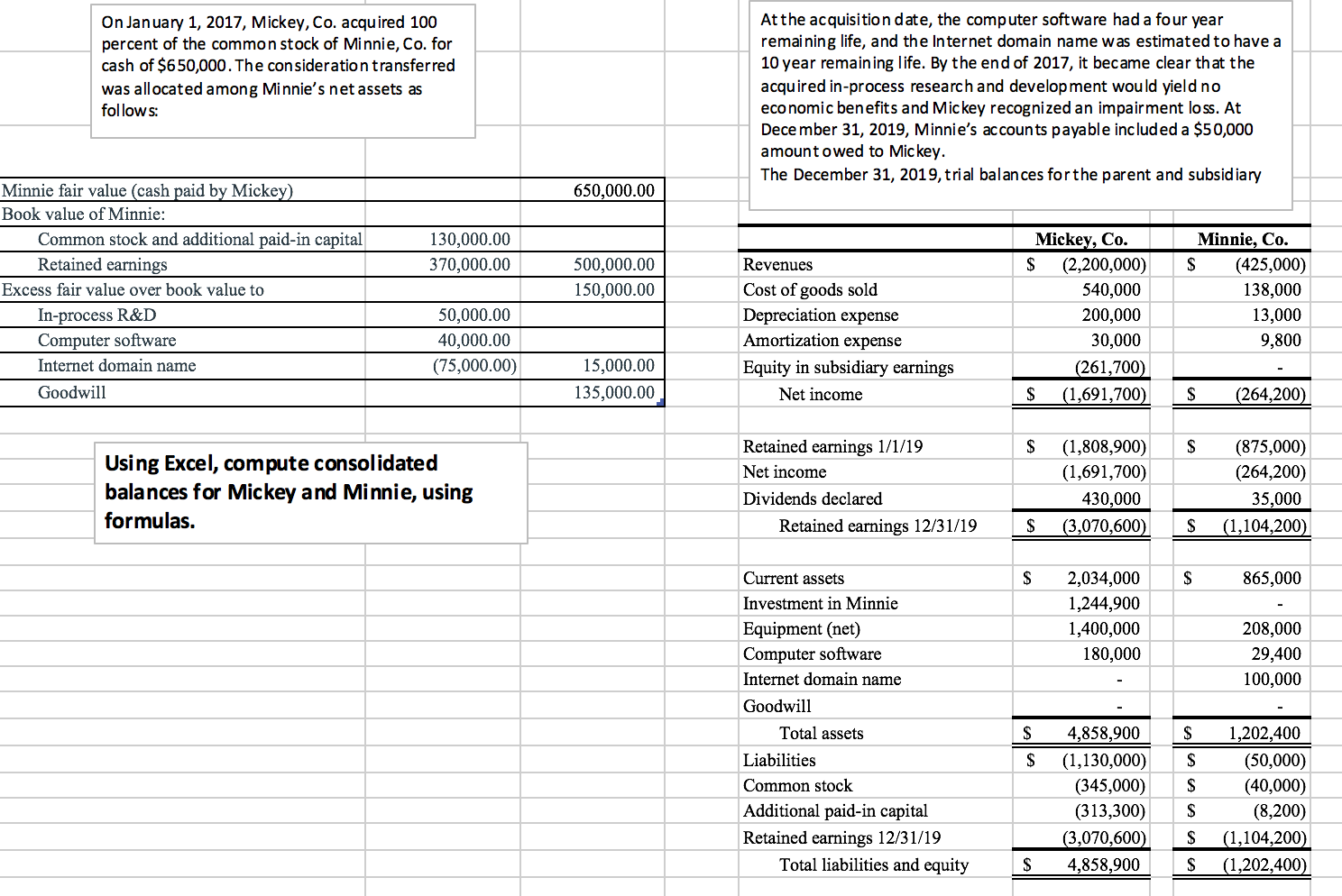

On January 1, 2017, Mickey, Co. acquired 100 percent of the common stock of Minnie, Co. for cash of $650,000. The consideration transferred was allocated among Minnie's net assets as follows: At the acquisition date, the computer software had a four year remaining life, and the Internet domain name was estimated to have a 10 year remain ing life. By the end of 2017, it became clear that the acquired in-process research and development would yield no economic benefits and Mickey recognized an impairment loss. At December 31, 2019, Minnie's accounts payable included a $50,000 amount owed to Mickey. The December 31, 2019, trial balances for the parent and subsidiary 650,000.00 130,000.00 370,000.00 Minnie fair value (cash paid by Mickey) Book value of Minnie: Common stock and additional paid-in capital Retained earnings Excess fair value over book value to In-process R&D Computer software Internet domain name Goodwill 500,000.00 150,000.00 Revenues Cost of goods sold Depreciation expense Amortization expense Equity in subsidiary earnings Net income 50.000.00 40,000.00 (75,000.00) Mickey, Co. $ (2,200,000) 540,000 200,000 30,000 (261,700) $ (1,691,700) Minnie, Co. $ (425,000) 138,000 13,000 9,800 15,000.00 135,000.00 $ (264,200) $ S Using Excel, compute consolidated balances for Mickey and Minnie, using formulas. Retained earnings 1/1/19 Net income Dividends declared Retained earnings 12/31/19 (1,808,900) (1,691,700) 430,000 (3,070,600) (875,000) (264,200) 35,000 (1,104,200) $ S $ $ 865,000 2,034,000 1,244,900 1,400,000 180,000 208,000 29,400 100,000 Current assets Investment in Minnie Equipment (net) Computer software Internet domain name Goodwill Total assets Liabilities Common stock Additional paid-in capital Retained earnings 12/31/19 Total liabilities and equity $ $ $ 4,858,900 (1,130,000) (345,000) (313,300) (3,070,600) 4,858,900 1,202,400 (50,000) (40,000) (8,200) (1,104,200) (1,202,400) $ $ $ $ On January 1, 2017, Mickey, Co. acquired 100 percent of the common stock of Minnie, Co. for cash of $650,000. The consideration transferred was allocated among Minnie's net assets as follows: At the acquisition date, the computer software had a four year remaining life, and the Internet domain name was estimated to have a 10 year remain ing life. By the end of 2017, it became clear that the acquired in-process research and development would yield no economic benefits and Mickey recognized an impairment loss. At December 31, 2019, Minnie's accounts payable included a $50,000 amount owed to Mickey. The December 31, 2019, trial balances for the parent and subsidiary 650,000.00 130,000.00 370,000.00 Minnie fair value (cash paid by Mickey) Book value of Minnie: Common stock and additional paid-in capital Retained earnings Excess fair value over book value to In-process R&D Computer software Internet domain name Goodwill 500,000.00 150,000.00 Revenues Cost of goods sold Depreciation expense Amortization expense Equity in subsidiary earnings Net income 50.000.00 40,000.00 (75,000.00) Mickey, Co. $ (2,200,000) 540,000 200,000 30,000 (261,700) $ (1,691,700) Minnie, Co. $ (425,000) 138,000 13,000 9,800 15,000.00 135,000.00 $ (264,200) $ S Using Excel, compute consolidated balances for Mickey and Minnie, using formulas. Retained earnings 1/1/19 Net income Dividends declared Retained earnings 12/31/19 (1,808,900) (1,691,700) 430,000 (3,070,600) (875,000) (264,200) 35,000 (1,104,200) $ S $ $ 865,000 2,034,000 1,244,900 1,400,000 180,000 208,000 29,400 100,000 Current assets Investment in Minnie Equipment (net) Computer software Internet domain name Goodwill Total assets Liabilities Common stock Additional paid-in capital Retained earnings 12/31/19 Total liabilities and equity $ $ $ 4,858,900 (1,130,000) (345,000) (313,300) (3,070,600) 4,858,900 1,202,400 (50,000) (40,000) (8,200) (1,104,200) (1,202,400) $ $ $ $