Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help with 1 and 2 and 3: Question 1: Question 2: Question 3: Current Attempt in Progress Barbara Ripley and Fred Nichols decide to

Please help with 1 and 2 and 3:

Question 1:

Question 2:

Question 3:

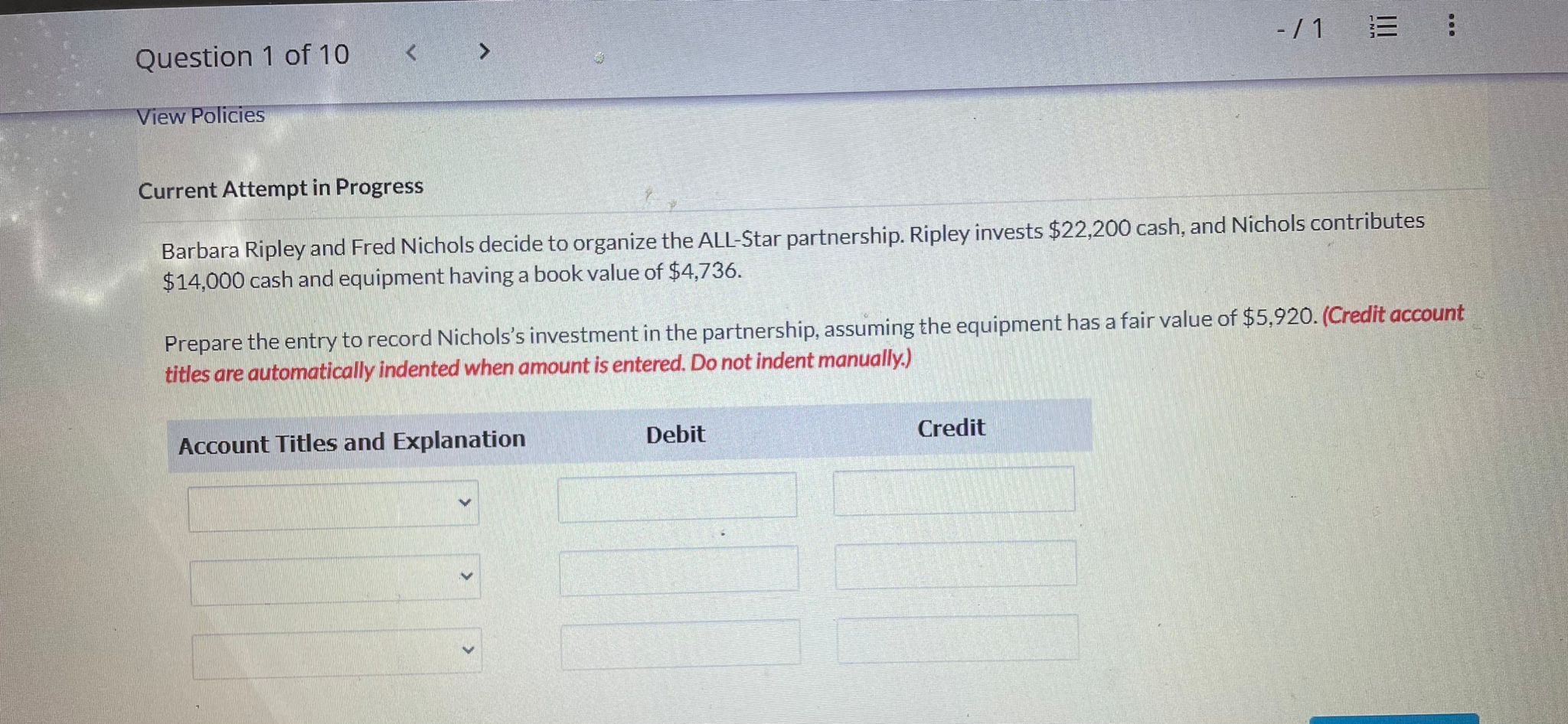

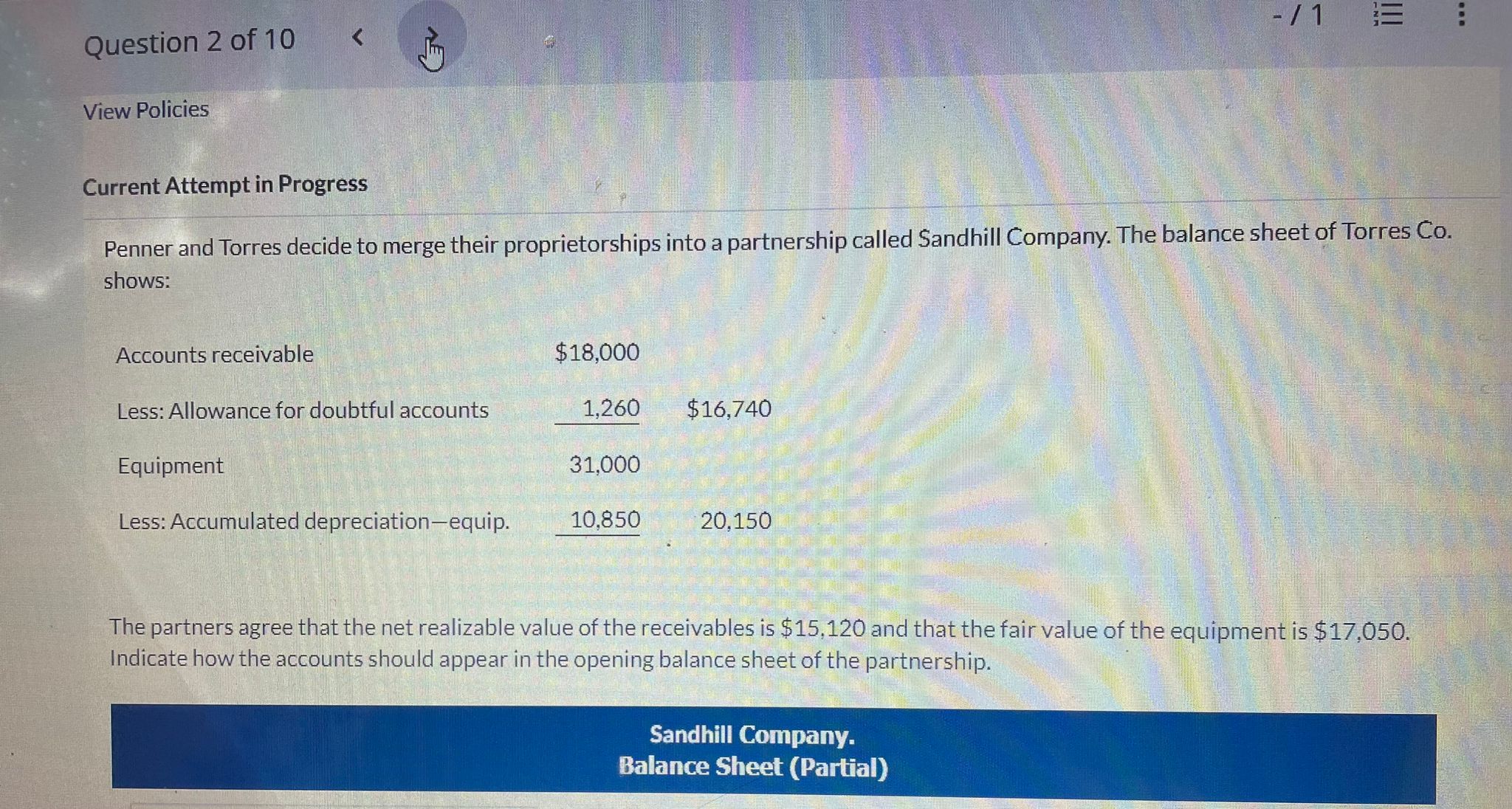

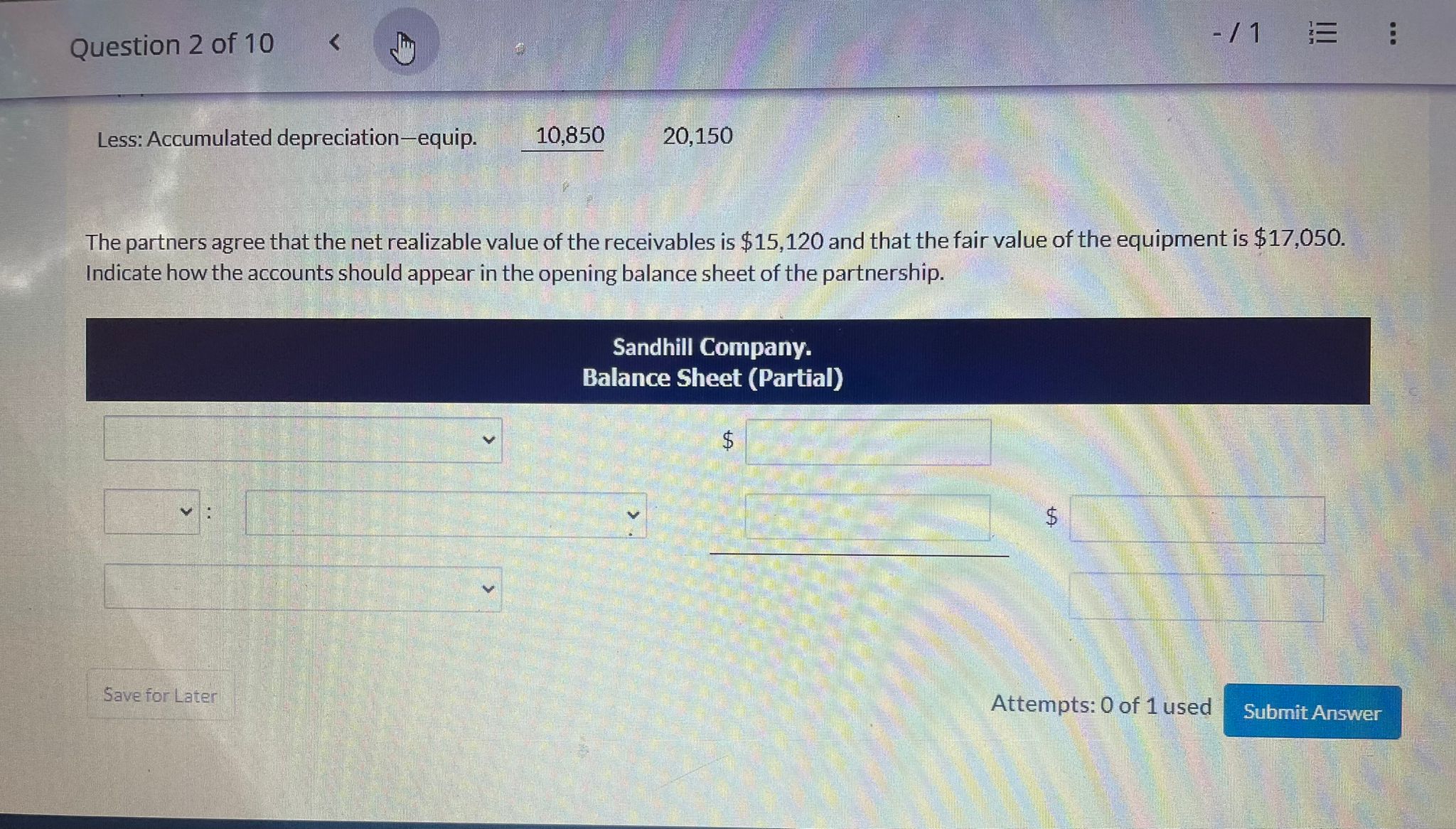

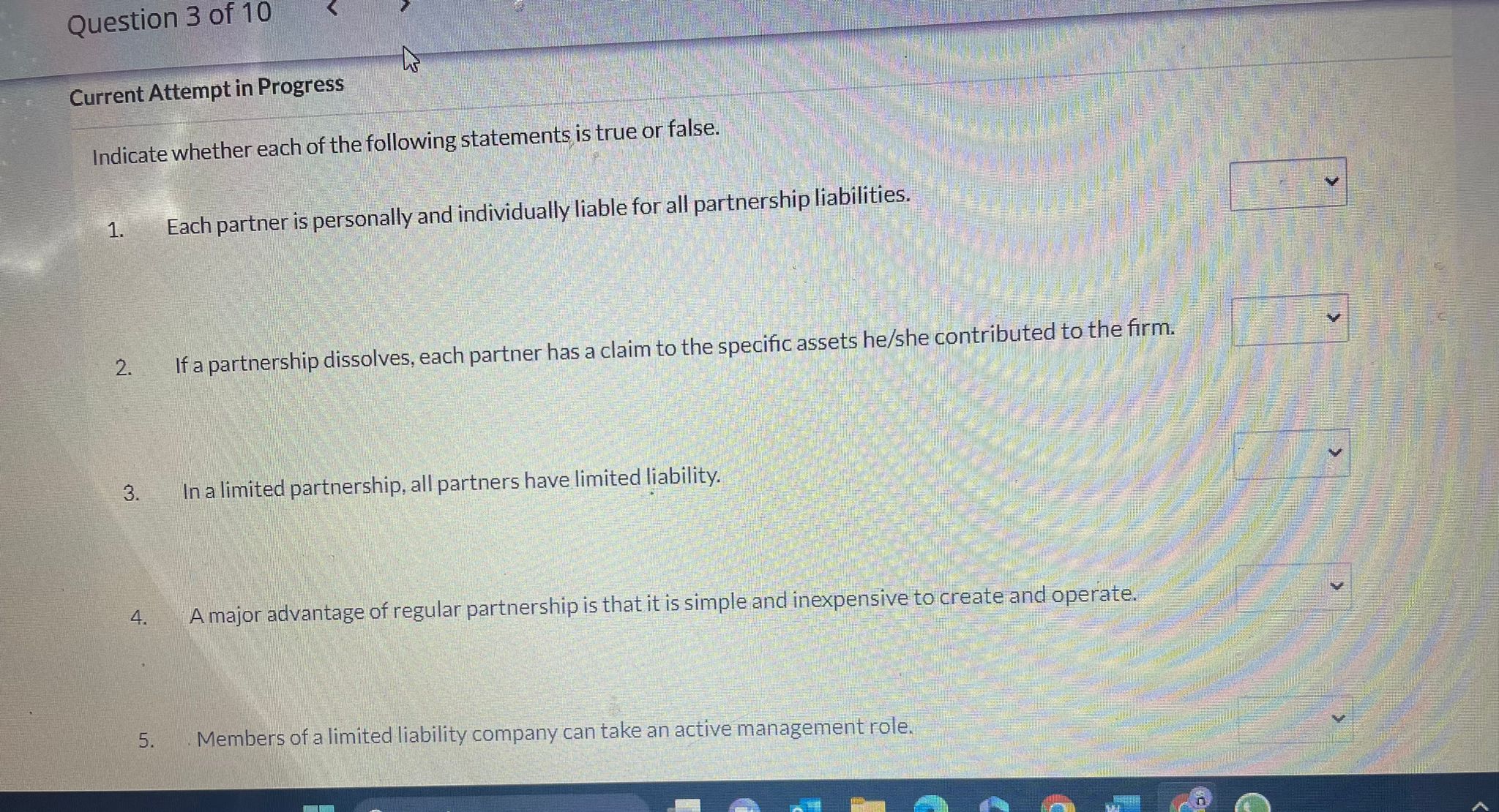

Current Attempt in Progress Barbara Ripley and Fred Nichols decide to organize the ALL-Star partnership. Ripley invests $22,200 cash, and Nichols contributes $14,000 cash and equipment having a book value of $4,736. Prepare the entry to record Nichols's investment in the partnership, assuming the equipment has a fair value of $5,920. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Penner and Torres decide to merge their proprietorships into a partnership called Sandhill Company. The balance sheet of Torres Co. shows: The partners agree that the net realizable value of the receivables is $15,120 and that the fair value of the equipment is $17,050. Indicate how the accounts should appear in the opening balance sheet of the partnership. Less: Accumulated depreciation-equip. 10,85020,150 The partners agree that the net realizable value of the receivables is $15,120 and that the fair value of the equipment is $17,050. Indicate how the accounts should appear in the opening balance sheet of the partnership. Current Attempt in Progress Indicate whether each of the following statements is true or false. 1. Each partner is personally and individually liable for all partnership liabilities. 2. If a partnership dissolves, each partner has a claim to the specific assets he/she contributed to the firm. 3. In a limited partnership, all partners have limited liability. 4. A major advantage of regular partnership is that it is simple and inexpensive to create and operate. 5. Members of a limited liability company can take an active management role

Current Attempt in Progress Barbara Ripley and Fred Nichols decide to organize the ALL-Star partnership. Ripley invests $22,200 cash, and Nichols contributes $14,000 cash and equipment having a book value of $4,736. Prepare the entry to record Nichols's investment in the partnership, assuming the equipment has a fair value of $5,920. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Penner and Torres decide to merge their proprietorships into a partnership called Sandhill Company. The balance sheet of Torres Co. shows: The partners agree that the net realizable value of the receivables is $15,120 and that the fair value of the equipment is $17,050. Indicate how the accounts should appear in the opening balance sheet of the partnership. Less: Accumulated depreciation-equip. 10,85020,150 The partners agree that the net realizable value of the receivables is $15,120 and that the fair value of the equipment is $17,050. Indicate how the accounts should appear in the opening balance sheet of the partnership. Current Attempt in Progress Indicate whether each of the following statements is true or false. 1. Each partner is personally and individually liable for all partnership liabilities. 2. If a partnership dissolves, each partner has a claim to the specific assets he/she contributed to the firm. 3. In a limited partnership, all partners have limited liability. 4. A major advantage of regular partnership is that it is simple and inexpensive to create and operate. 5. Members of a limited liability company can take an active management role Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started