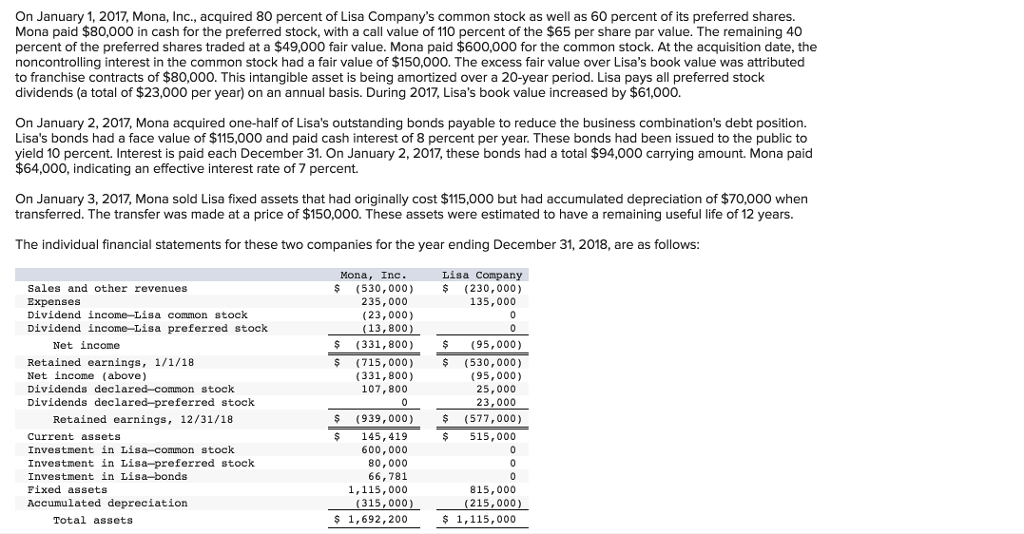

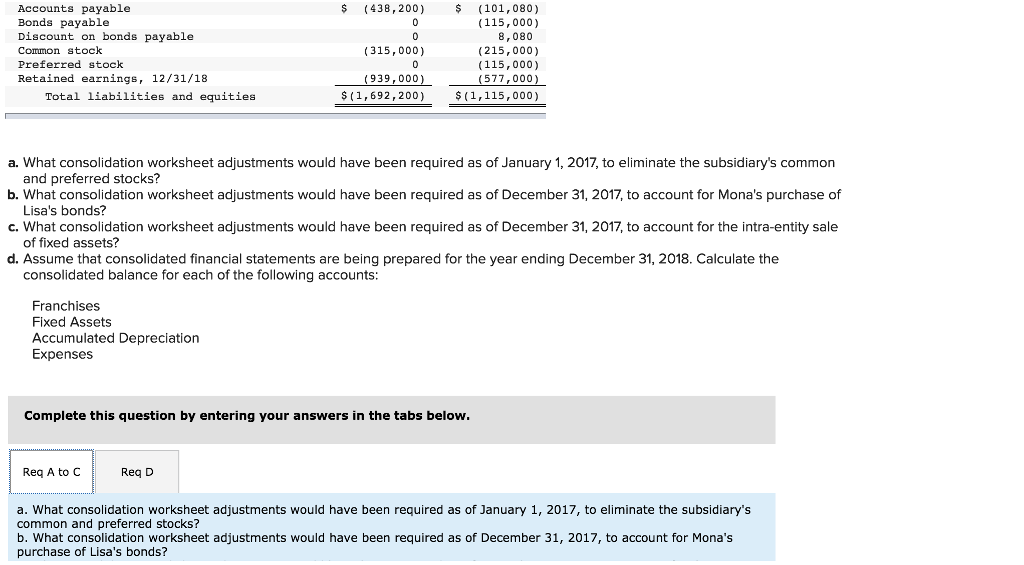

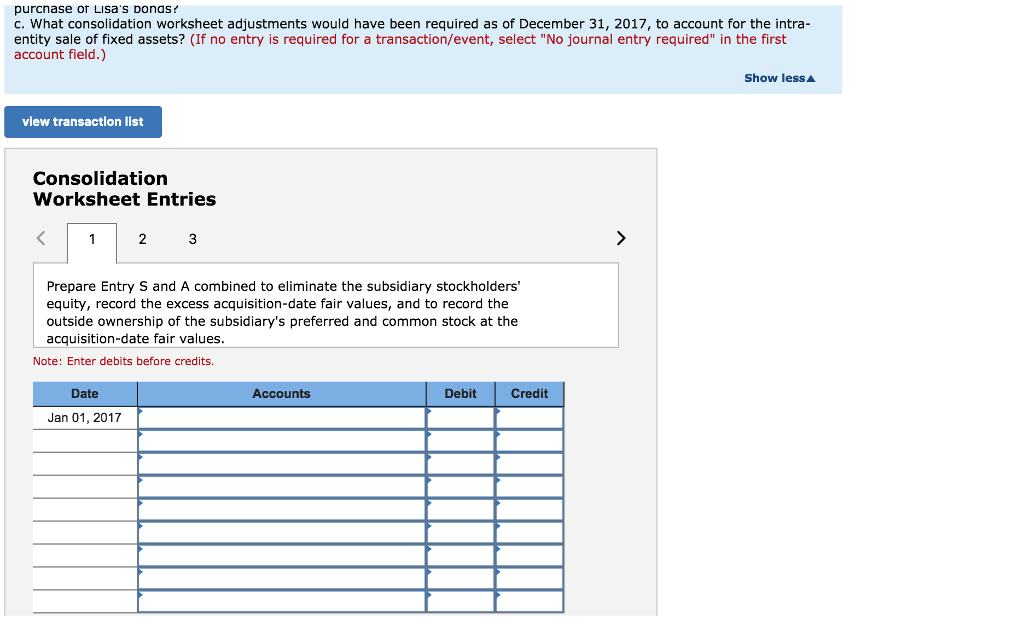

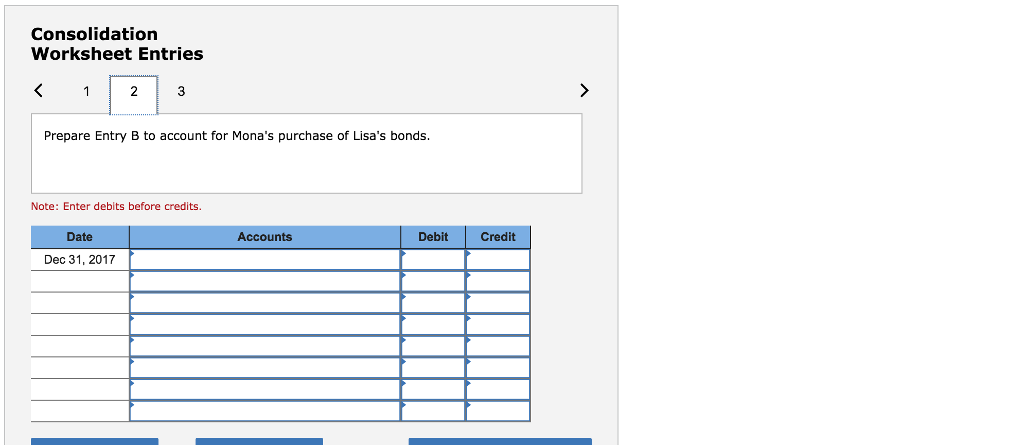

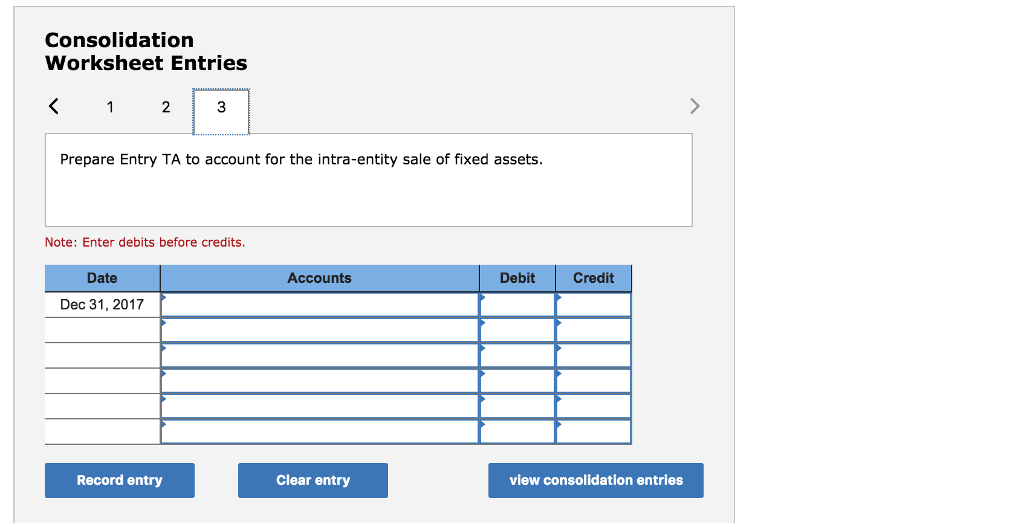

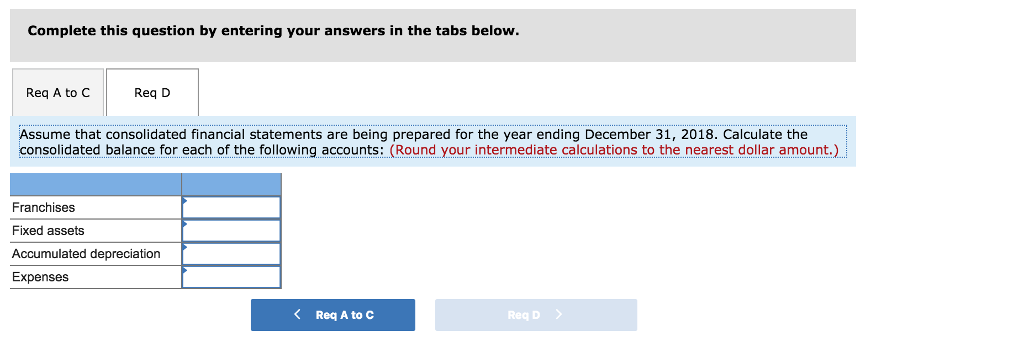

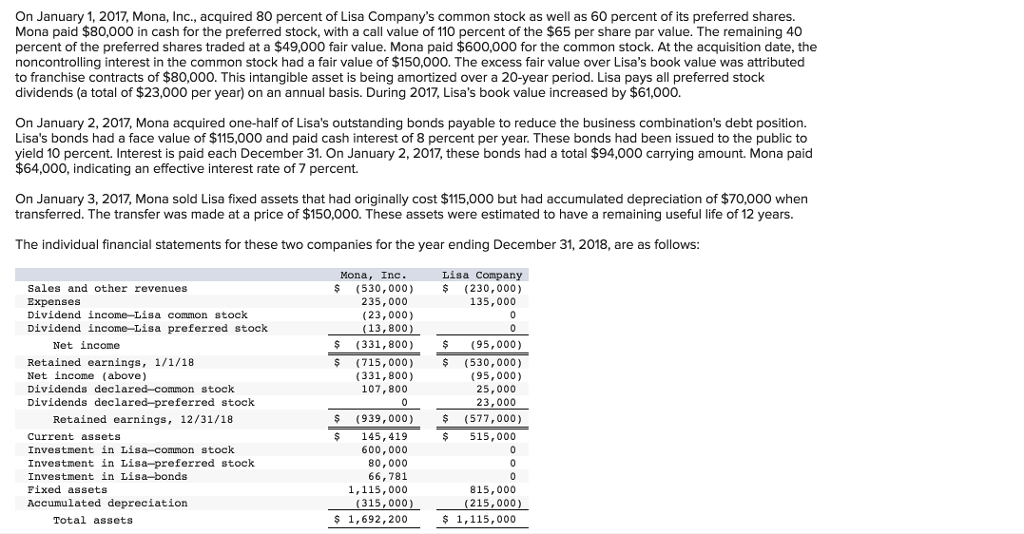

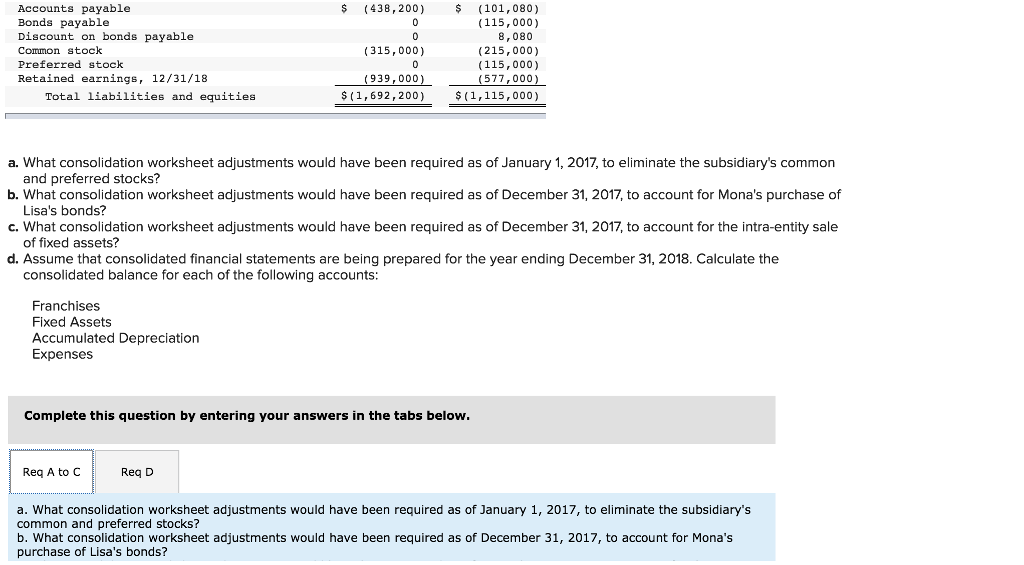

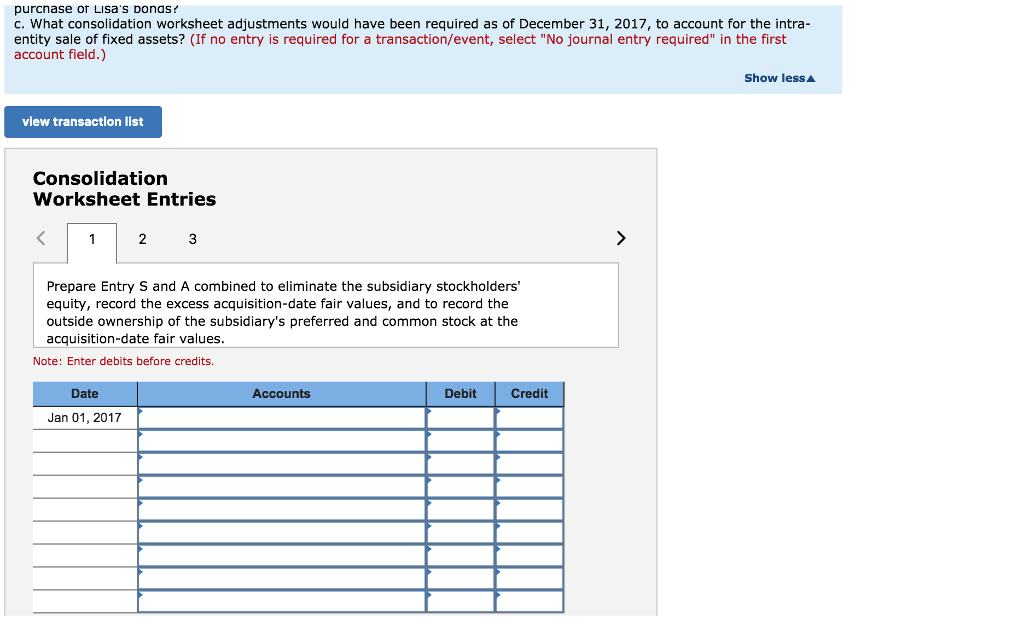

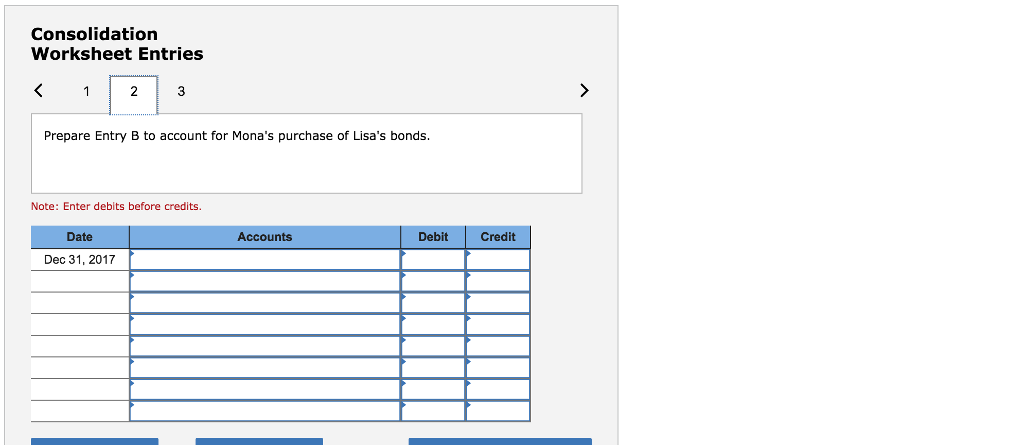

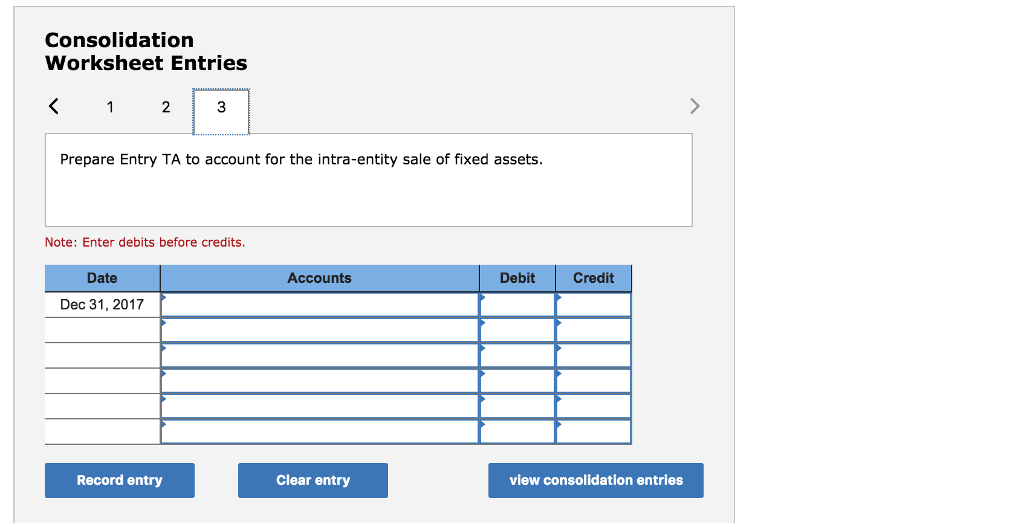

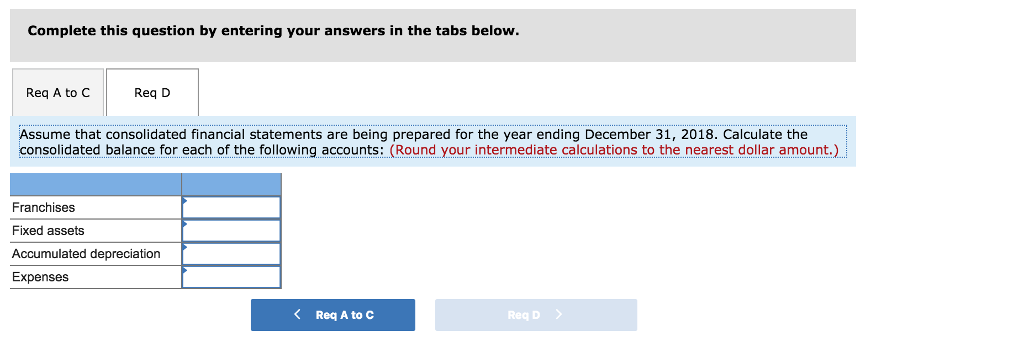

On January 1, 2017, Mona, Inc., acquired 80 percent of Lisa Company's common stock as well as 60 percent of its preferred shares. Mona paid $80,000 in cash for the preferred stock, with a call value of 110 percent of the $65 per share par value. The remaining 40 percent of the preferred shares traded at a $49,000 fair value. Mona paid $600,000 for the common stock. At the acquisition date, the noncontrolling interest in the common stock had a fair value of $150,000. The excess fair value over Lisa's book value was attributed to franchise contracts of $80,000. This intangible asset is being amortized over a 20-year period. Lisa pays all preferred stock dividends (a total of $23,000 per year) on an annual basis. During 2017, Lisa's book value increased by $61,000. On January 2, 2017, Mona acquired one-half of Lisa's outstanding bonds payable to reduce the business combination's debt position. Lisa's bonds had a face value of $115,000 and paid cash interest of 8 percent per year. These bonds had been issued to the public to yield 10 percent. Interest is paid each December 31. On January 2, 2017, these bonds had a total $94,000 carrying amount. Mona paid $64,000, indicating an effective interest rate of 7 percent. On January 3, 2017, Mona sold Lisa fixed assets that had originally cost $115,000 but had accumulated depreciation of $70,000 when transferred. The transfer was made at a price of $150,000. These assets were estimated to have a remaining useful life of 12 years. The individual financial statements for these two companies for the year ending December 31, 2018, are as follows Lisa Company $ (530,000) (230,000) Mona, Inc Sales and other revenues Expenses Dividend income Lisa common stock Dividend income-Lisa preferred stock 235,000 (23, 000) (13, 800) 135,000 $ (331,800) $(95,000) $ (715,000) (530,000) (95,000) 25,000 23,000 $ (577,000) Net income Retained earnings, 1/1/18 Net income (above) Dividends declared common stock Dividends declared-preferred stock (331,800) 107,800 Retained earnings, 12/31/18 $ (939,000) $ 145, 419 $ 515,000 Current assets Investment in Lisa-common stock Investment in Lisa preferred stock Investment in Lisa-bonds Fixed assets Accumulated depreciation 600,000 80,000 66,781 1,115, 000 815,000 (315,000)(215,000) Total assets 1,692,200 $ 1,115,000 On January 1, 2017, Mona, Inc., acquired 80 percent of Lisa Company's common stock as well as 60 percent of its preferred shares. Mona paid $80,000 in cash for the preferred stock, with a call value of 110 percent of the $65 per share par value. The remaining 40 percent of the preferred shares traded at a $49,000 fair value. Mona paid $600,000 for the common stock. At the acquisition date, the noncontrolling interest in the common stock had a fair value of $150,000. The excess fair value over Lisa's book value was attributed to franchise contracts of $80,000. This intangible asset is being amortized over a 20-year period. Lisa pays all preferred stock dividends (a total of $23,000 per year) on an annual basis. During 2017, Lisa's book value increased by $61,000. On January 2, 2017, Mona acquired one-half of Lisa's outstanding bonds payable to reduce the business combination's debt position. Lisa's bonds had a face value of $115,000 and paid cash interest of 8 percent per year. These bonds had been issued to the public to yield 10 percent. Interest is paid each December 31. On January 2, 2017, these bonds had a total $94,000 carrying amount. Mona paid $64,000, indicating an effective interest rate of 7 percent. On January 3, 2017, Mona sold Lisa fixed assets that had originally cost $115,000 but had accumulated depreciation of $70,000 when transferred. The transfer was made at a price of $150,000. These assets were estimated to have a remaining useful life of 12 years. The individual financial statements for these two companies for the year ending December 31, 2018, are as follows Lisa Company $ (530,000) (230,000) Mona, Inc Sales and other revenues Expenses Dividend income Lisa common stock Dividend income-Lisa preferred stock 235,000 (23, 000) (13, 800) 135,000 $ (331,800) $(95,000) $ (715,000) (530,000) (95,000) 25,000 23,000 $ (577,000) Net income Retained earnings, 1/1/18 Net income (above) Dividends declared common stock Dividends declared-preferred stock (331,800) 107,800 Retained earnings, 12/31/18 $ (939,000) $ 145, 419 $ 515,000 Current assets Investment in Lisa-common stock Investment in Lisa preferred stock Investment in Lisa-bonds Fixed assets Accumulated depreciation 600,000 80,000 66,781 1,115, 000 815,000 (315,000)(215,000) Total assets 1,692,200 $ 1,115,000