Answered step by step

Verified Expert Solution

Question

1 Approved Answer

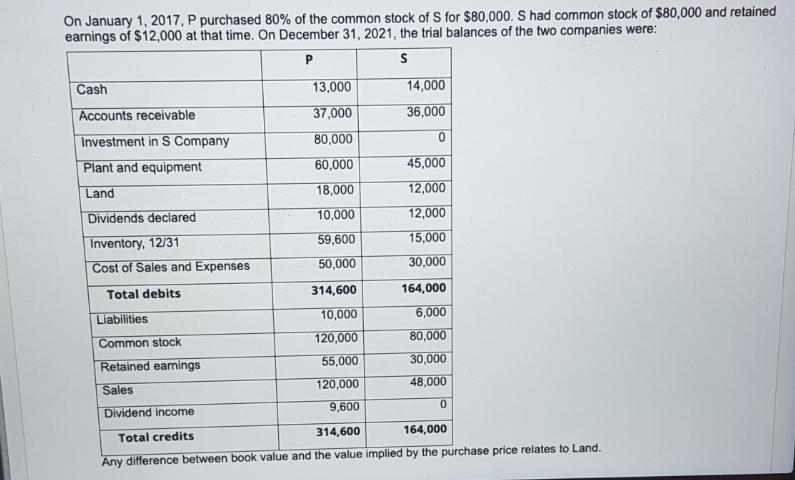

On January 1, 2017, P purchased 80% of the common stock of S for $80,000. S had common stock of $80,000 and retained earnings

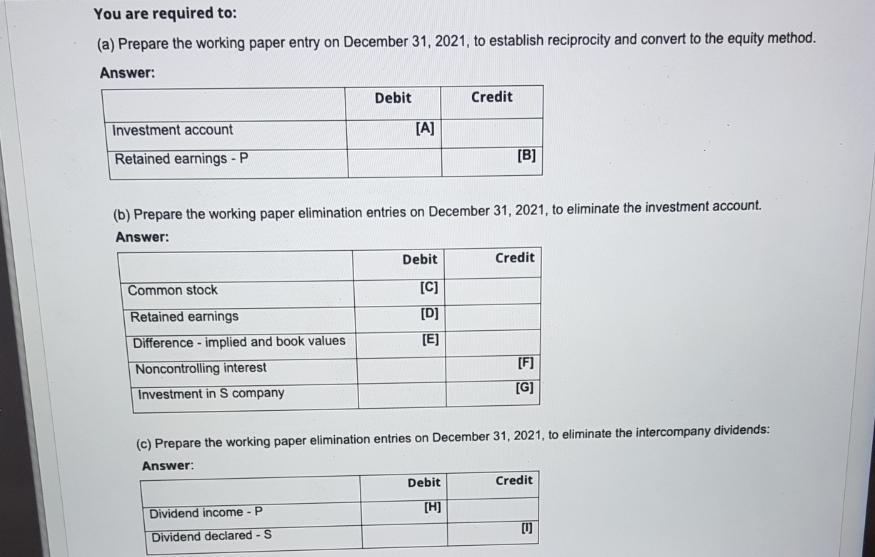

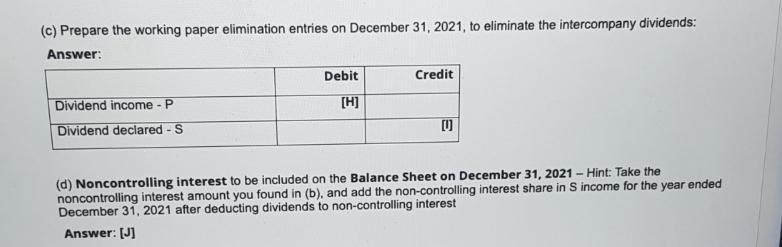

On January 1, 2017, P purchased 80% of the common stock of S for $80,000. S had common stock of $80,000 and retained earnings of $12,000 at that time. On December 31, 2021, the trial balances of the two companies were: P S Cash Accounts receivable. Investment in S Company Plant and equipment Land Dividends declared Inventory, 12/31 Cost of Sales and Expenses Total debits Liabilities Common stock Retained earnings Sales Dividend income Total credits 13,000 37,000 80,000 60,000 18,000 10,000 59,600 50,000 314,600 10,000 120,000 55,000 120,000 9,600 14,000 36,000 0 45,000 12,000 12,000 15,000 30,000 164,000 6,000 80,000 30,000 48,000 0 314,600 164,000 Any difference between book value and the value implied by the purchase price relates to Land. You are required to: (a) Prepare the working paper entry on December 31, 2021, to establish reciprocity and convert to the equity method. Answer: Investment account Retained earnings - P Common stock Retained earnings Difference - implied and book values Noncontrolling interest Investment in S company Debit [A] (b) Prepare the working paper elimination entries on December 31, 2021, to eliminate the investment account. Answer: Dividend income - P Dividend declared - S Debit [C] [D] [E] Credit [B] Debit [H] Credit (c) Prepare the working paper elimination entries on December 31, 2021, to eliminate the intercompany dividends: Answer: [F] [G] Credit [1] (c) Prepare the working paper elimination entries on December 31, 2021, to eliminate the intercompany dividends: Answer: Dividend income - P Dividend declared-S Debit [H] Credit [U] (d) Noncontrolling interest to be included on the Balance Sheet on December 31, 2021-Hint: Take the noncontrolling interest amount you found in (b), and add the non-controlling interest share in S income for the year ended December 31, 2021 after deducting dividends to non-controlling interest Answer: [J]

Step by Step Solution

★★★★★

3.54 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started