Question

On January 1, 2017, Prestige Corporation acquired 100 percent of the voting stock of Stylene Corporation in exchange for $2,227,500 in cash and securities. On

On January 1, 2017, Prestige Corporation acquired 100 percent of the voting stock of Stylene Corporation in exchange for $2,227,500 in cash and securities. On the acquisition date, Stylene had the following balance sheet:

| Cash | $ | 31,200 | Accounts payable | $ | 1,246,700 |

| Accounts receivable | 143,500 | ||||

| Inventory | 182,000 | ||||

| Equipment (net) | 1,560,000 | Common stock | 800,000 | ||

| Trademarks | 964,000 | Retained earnings | 834,000 | ||

| $ | 2,880,700 | $ | 2,880,700 | ||

At the acquisition date, the book values of Stylenes assets and liabilities were generally equivalent to their fair values except for the following assets:

| Asset | Book Value | Fair Value | Remaining Useful Life | ||

| Equipment | $ | 1,560,000 | $ | 1,690,000 | 8 years |

| Customer lists | 0 | 214,000 | 4 years | ||

| Trademarks | 964,000 | 1,026,500 | indefinite | ||

During the next two years, Stylene has the following income and dividends in its own separately prepared financial reports to its parent.

| Net Income | Dividends | |||

| 2017 | $ | 188,000 | $ | 25,000 |

| 2018 | 530,000 | 45,000 | ||

Dividends are declared and paid in the same period. The December 31, 2018, separate financial statements for each company appear below. Parentheses indicate credit balances.

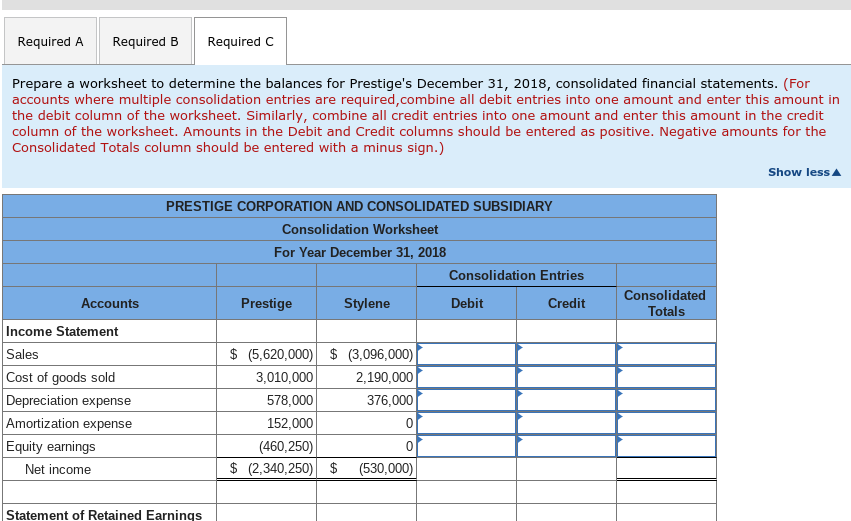

| Prestige | Stylene | ||||||

| Income Statement | |||||||

| Revenues | $ | (5,620,000 | ) | $ | (3,096,000 | ) | |

| Cost of goods sold | 3,010,000 | 2,190,000 | |||||

| Depreciation expense | 578,000 | 376,000 | |||||

| Amortization expense | 152,000 | 0 | |||||

| Equity earnings in Stylene | (460,250 | ) | 0 | ||||

| Net income | $ | (2,340,250 | ) | $ | (530,000 | ) | |

| Statement of Retained Earnings | |||||||

| Retained earnings 1/1 | $ | (3,250,000 | ) | $ | (997,000 | ) | |

| Net income (above) | (2,340,250 | ) | (530,000 | ) | |||

| Dividends declared | 150,000 | 45,000 | |||||

| Retained earnings 12/31 | $ | (5,440,250 | ) | $ | (1,482,000 | ) | |

| Balance Sheet | |||||||

| Cash | $ | 594,000 | $ | 64,000 | |||

| Accounts receivable | 856,000 | 102,000 | |||||

| Inventory | 957,000 | 544,000 | |||||

| Investment in Stylene | 2,736,000 | 0 | |||||

| Equipment | 6,150,000 | 1,612,500 | |||||

| Customer lists | 122,000 | 0 | |||||

| Trademarks | 2,590,000 | 988,000 | |||||

| Goodwill | 249,000 | 0 | |||||

| Total assets | $ | 14,254,000 | $ | 3,310,500 | |||

| Accounts payable | $ | (313,750 | ) | $ | (1,028,500 | ) | |

| Common stock | (8,500,000 | ) | (800,000 | ) | |||

| Retained earnings, 12/31 | (5,440,250 | ) | (1,482,000 | ) | |||

| Total liabilities and equity | $ | (14,254,000 | ) | $ | (3,310,500 | ) | |

-

Determine the fair value in excess of book value for Prestiges acquisition date investment in Stylene.

-

Determine Prestige's December 31, 2018, Investment in Stylene balance.

-

Prepare a worksheet to determine the balances for Peregrines December 31, 2018, consolidated financial statements.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started