Answered step by step

Verified Expert Solution

Question

1 Approved Answer

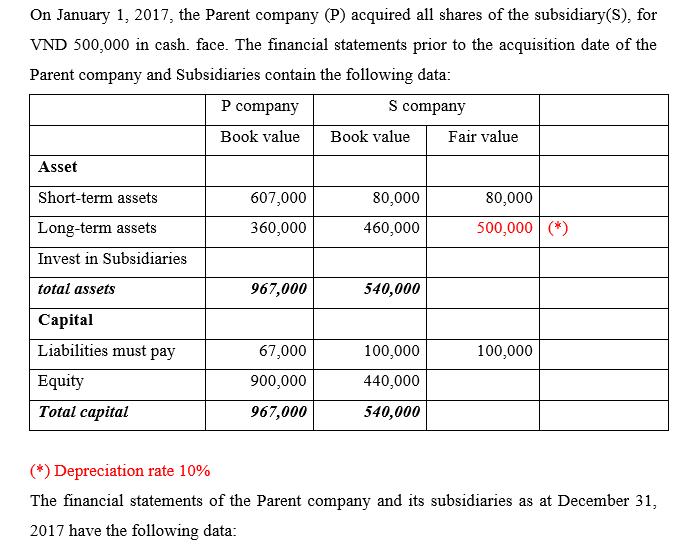

On January 1, 2017, the Parent company (P) acquired all shares of the subsidiary(S), for VND 500,000 in cash. face. The financial statements prior

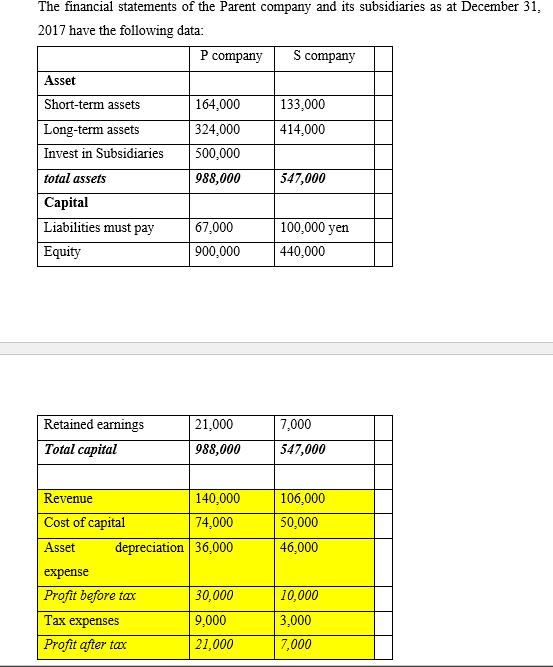

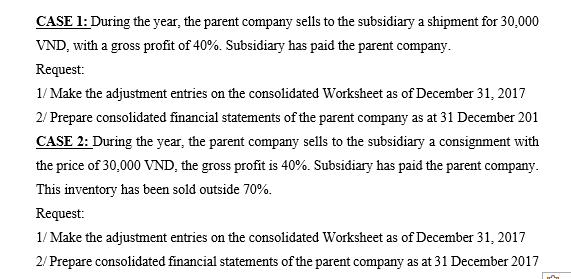

On January 1, 2017, the Parent company (P) acquired all shares of the subsidiary(S), for VND 500,000 in cash. face. The financial statements prior to the acquisition date of the Parent company and Subsidiaries contain the following data: P company S company Book value Book value Asset Short-term assets Long-term assets Invest in Subsidiaries total assets Capital Liabilities must pay Equity Total capital 607,000 360,000 967,000 67,000 900,000 967,000 80,000 460,000 540,000 100,000 440,000 540,000 Fair value 80,000 500,000 (*) 100,000 (*) Depreciation rate 10% The financial statements of the Parent company and its subsidiaries as at December 31, 2017 have the following data: The financial statements of the Parent company and its subsidiaries as at December 31, 2017 have the following data: P company S company Asset Short-term assets Long-term assets Invest in Subsidiaries total assets Capital Liabilities must pay Equity Retained earnings Total capital Revenue Cost of capital Asset 164,000 324,000 500,000 988,000 expense Profit before tax Tax expenses Profit after tax 67,000 900,000 140,000 74,000 depreciation 36,000 21,000 988,000 30,000 9,000 21,000 133,000 414,000 547,000 100,000 yen 440,000 7,000 547,000 106,000 50,000 46,000 10,000 3,000 7,000 CASE 1: During the year, the parent company sells to the subsidiary a shipment for 30,000 VND, with a gross profit of 40%. Subsidiary has paid the parent company. Request: 1/Make the adjustment entries on the consolidated Worksheet as of December 31, 2017 2/ Prepare consolidated financial statements of the parent company as at 31 December 201 CASE 2: During the year, the parent company sells to the subsidiary a consignment with the price of 30,000 VND, the gross profit is 40%. Subsidiary has paid the parent company. This inventory has been sold outside 70%. Request: 1/Make the adjustment entries on the consolidated Worksheet as of December 31, 2017 2/ Prepare consolidated financial statements of the parent company as at 31 December 2017

Step by Step Solution

★★★★★

3.47 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started