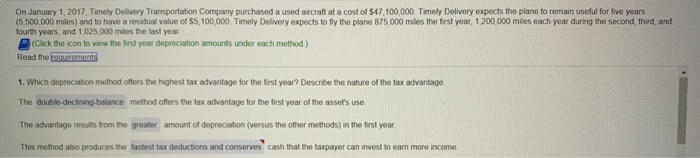

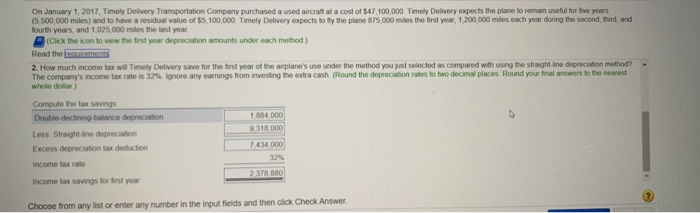

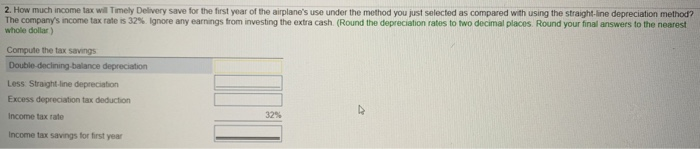

On January 1, 2017, Timely Delivery Transportation Company purchased a used aircraft at a cost of $47,100,000. Timely Delivery expects the plane to remain useful for five years (5,500,000 miles) and to have a residual value of $5,100,000 Timely Delivery expects to fly the plane 875,000 miles the first year, 1.200,000 miles each year during the second third, and fourth years, and 1,025,000 miles the last year. (Click the icon to view the first year depreciation amounts under each method.) Read the requirements 1. Which depreciation method offers the highest tax advantage for the first year? Describe the nature of the tax advantage. The double-declining balance method offers the tax advantage for the first year of the asset's use The advantage results from the greater amount of depreciation (versus the other methods) in the first year This method also produces the fastest tax deductions and conserves cash that the taxpayer can invest to earn more income On January 1, 2017 Timely Delivery Transportation Company purchased and a t a cost of $47 100 000 Tomay Devery expects the plane to remanus for five years (5 500 000 miles) and to have a result of 55 100 000 Timely Delivery expects to try the plane 875 000 miles the best w 1.200.000 miles each year during the second hand and fourth years, and 1 025 000 miles the last year Click the icon to view the first year depreciation amounts under each method) Read the comments 2. How much income tax will Timely Delivery save for the first year of the plane's use under the method you just selected as compared with the straight line depreciation method The company's income tax rate is 32% onore any is from investing the extra cash (Round the depreciation as to wo decimal places Round your finanswers to the nearest whole do . Compute the tax savings Double declining balance depreciation Less Straight line depreciation Excess depreciation tax doduction 134000 31000 7434000 Income taxe 2373330 Income tax savings for test year Choose from any list or enter any number in the input fields and then click Check Answer 2. How much income tax will Timely Delivery save for the first year of the airplane's use under the method you just selected as compared with using the straight-line depreciation method? The company's income tax rate is 32% Ignore any earnings from investing the extra cash (Round the depreciation rates to two decimal places. Round your final answers to the nearest whole dollar) Compute the tax savings Double-declining balance depreciation Less Straight line depreciation Excess depreciation tax deduction Income tax rate Income tax savings for first year