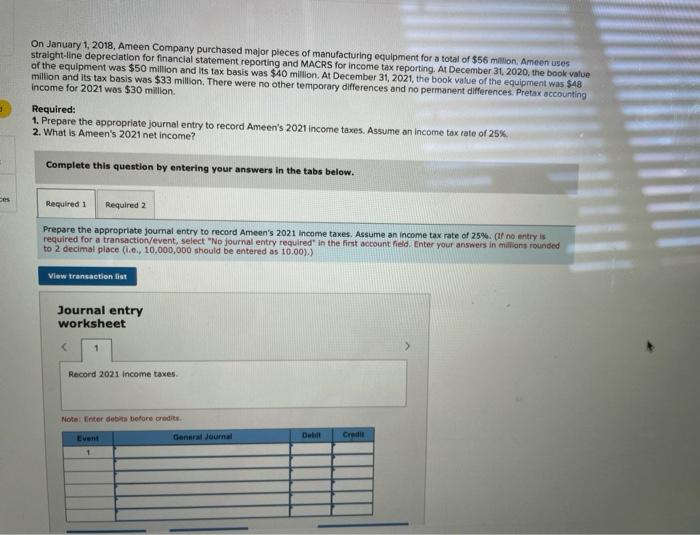

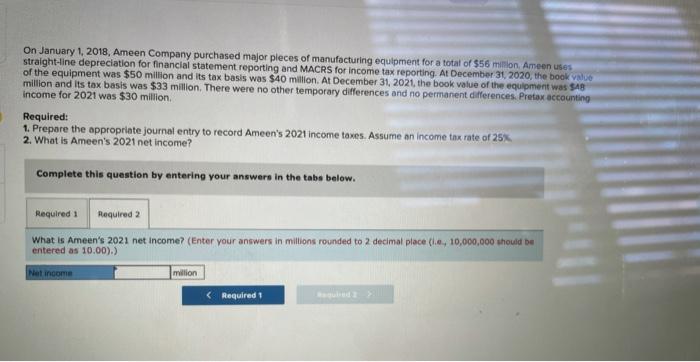

On January 1, 2018, Ameen Company purchased major pieces of manufacturing equipment for a total of $56 milion Ameen uses straight-line depreciation for financial statement reporting and MACRS for Income tax reporting, At December 31, 2020, the book value of the equipment was $50 million and its tax basis was $40 million. At December 31, 2021, the book value of the equipment was $48 million and its tax basis was $33 million. There were no other temporary differences and no permanent differences, Pretax accounting Income for 2021 was $30 million. Required: 1. Prepare the appropriate journal entry to record Ameen's 2021 income taxes. Assume an income tax rate of 25% 2. What is Ameen's 2021 net income? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare the appropriate journal entry ecord Ameen's 2021 Income taxes. Assume an income tax rate of 25% (If no entry is required for a transaction/event, select "No journal entry required in the first account Field Enter your answers in millions rounded to 2 decimal place (ie, 10,000,000 should be entered as 10.00).) View transaction lit Journal entry worksheet 1 Record 2021 Income taxes Notes Enter debit before credite General Journal Dell Cred On January 1, 2018, Ameen Company purchased major pleces of manufacturing equipment for a total of 356 min Ameen uses straight-line depreciation for financial statement reporting and MACRS for income tax reporting. At December 31 2020, the book value of the equipment was $50 million and its tax basis was $40 million. At December 31, 2021, the book value of the equipment was $48 million and its tax basis was $33 million. There were no other temporary differences and no permanent differences, Pretax accounting Income for 2021 was $30 million Required: 1. Prepare the appropriate journal entry to record Ameen's 2021 income taxes. Assume an income tax rate of 25% 2. What is Ameen's 2021 net income? Complete this question by entering your answers in the tabs below. Required 1 Required 2 What is Ameen's 2021 net income? (Enter your answers in millions rounded to 2 decimal place (l. 10,000,000 should be entered as 10.00).) Net income million