Answered step by step

Verified Expert Solution

Question

1 Approved Answer

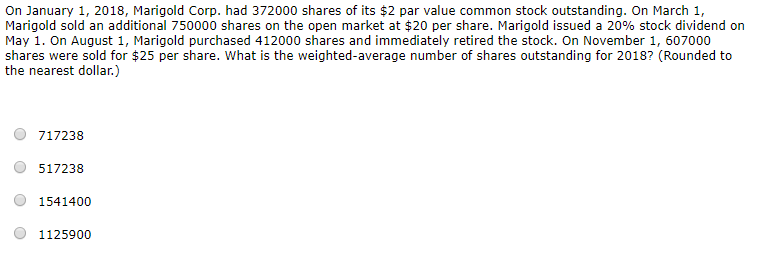

On January 1, 2018, Marigold Corp. had 372000 shares of its $2 par value common stock outstanding. On March 1, Marigold sold an additional 750000

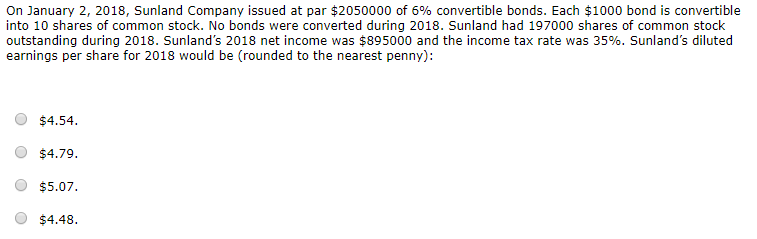

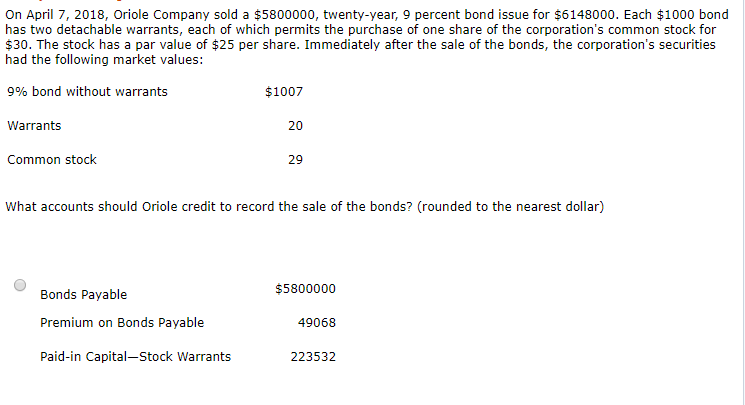

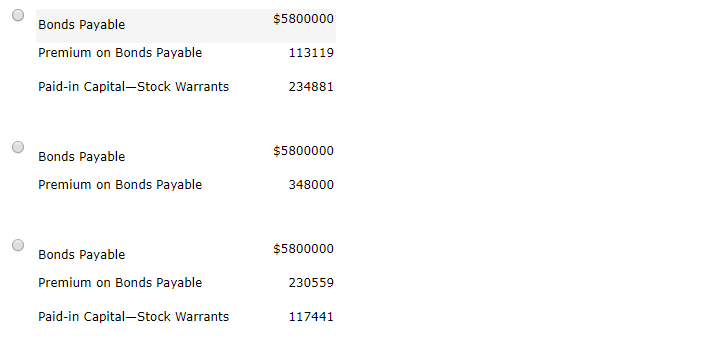

On January 1, 2018, Marigold Corp. had 372000 shares of its $2 par value common stock outstanding. On March 1, Marigold sold an additional 750000 shares on the open market at $20 per share. Marigold issued a 20% stock dividend on May 1. On August 1, Marigold purchased 4120000 shares and immediately retired the stock. On November 1, 607000 shares were sold for $25 per share. What is the weighted-average number of shares outstanding for 2018? (Rounded to the nearest dollar.) 717238 517238 1541400 1125900 On January 2, 2018, Sunland Company issued at par $2050000 of 6% convertible bonds. Each $1000 bond is convertible into 10 shares of common stock. No bonds were converted during 2018. Sunland had 197000 shares of common stock outstanding during 2018. Sunland's 2018 net income was $895000 and the income tax rate was 35%. Sunland's diluted earnings per share for 2018 would be (rounded to the nearest penny): $4.54 $4.79 $5.07. $4.48 On April 7, 2018, Oriole Company sold a $5800000, twenty-year, 9 percent bond issue for $6148000. Each $1000 bond has two detachable warrants, each of which permits the purchase of one share of the corporation's common stock for $30. The stock has a par value of $25 per share. Immediately after the sale of the bonds, the corporation's securities had the following market values: 9% bond without warrants $1007 Warrants 20 Common stock 29 What accounts should Oriole credit to record the sale of the bonds? (rounded to the nearest dollar) $5800000 Bonds Payable Premium on Bonds Payable 49068 Paid-in Capital-Stock Warrants 223532 $5800000 Bonds Payable Premium on Bonds Payable 113119 Paid-in Capital-Stock Warrants 234881 $5800000 Bonds Payable Premium on Bonds Payable 348000 $5800000 Bonds Payable Premium on Bonds Payable 230559 Paid-in Capital-Stock Warrants 117441

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started