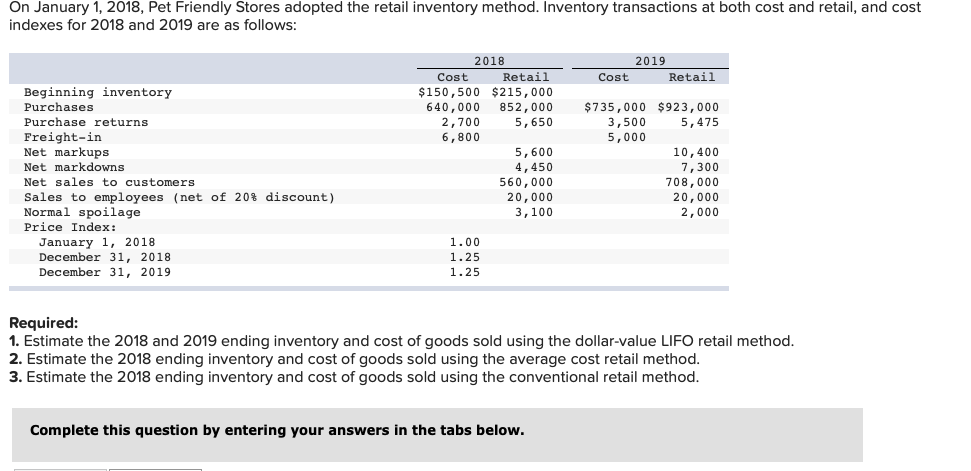

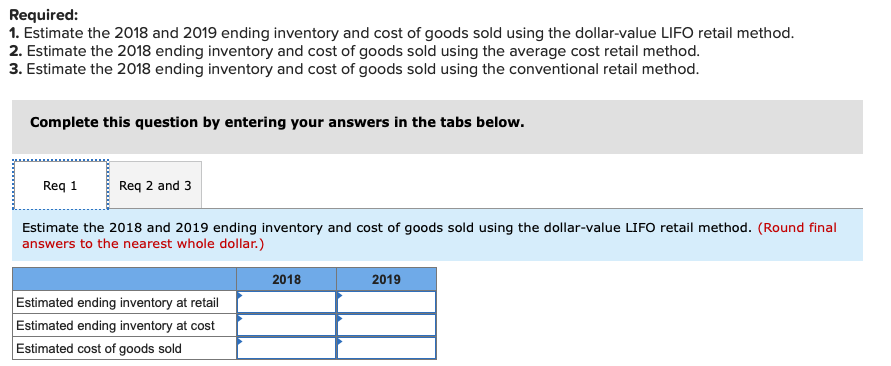

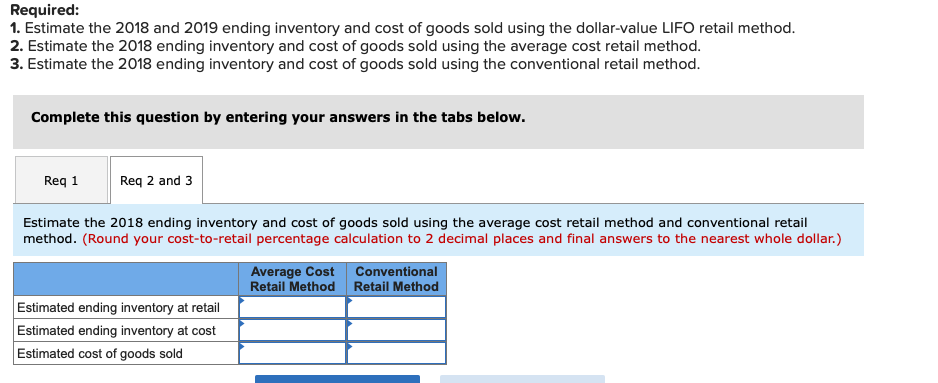

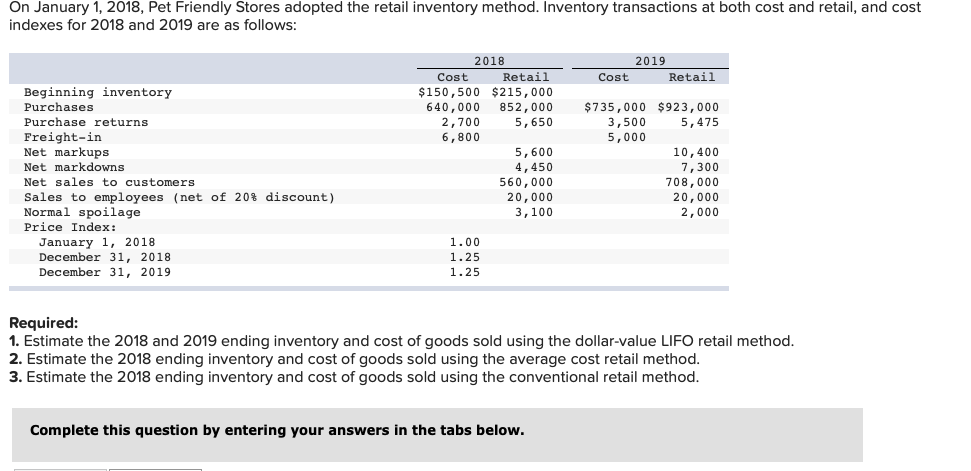

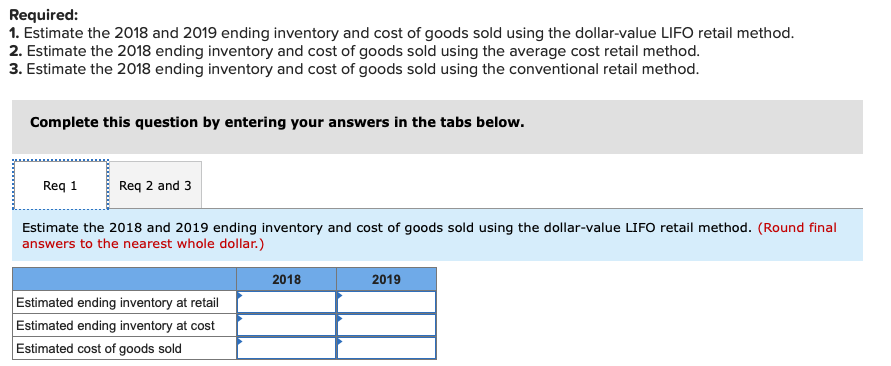

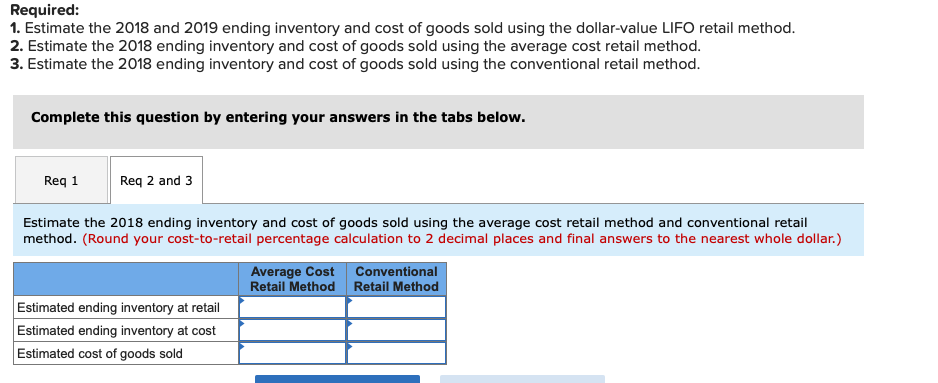

On January 1, 2018, Pet Friendly Stores adopted the retail inventory method. Inventory transactions at both cost and retail, and cost indexes for 2018 and 2019 are as follows: 2019 2018 Retail $150,500 $215,000 Cost Retail Cost Beginning inventory Purchases Purchase returns Freight-in Net markups Net markdowns Net sales to customers Sales to employees (net of 20% discount) Normal spoilage Price Index: 2,700 6 0o5 6,800 640,000 852, 000 $735,000 $923,000 5,475 3,500 5,000 5,650 10,400 7,300 708,000 20,000 2,000 5,600 4,450 560,000 20,000 3,100 1.00 1.25 1.25 January 1, 2018 December 31, 2018 December 31, 2019 Required 1. Estimate the 2018 and 2019 ending inventory and cost of goods sold using the dollar-value LIFO retail method 2. Estimate the 2018 ending inventory and cost of goods sold using the average cost retail method 3. Estimate the 2018 ending inventory and cost of goods sold using the conventional retail method Complete this question by entering your answers in the tabs below Required 1. Estimate the 2018 and 2019 ending inventory and cost of goods sold using the dollar-value LIFO retail method. 2. Estimate the 2018 ending inventory and cost of goods sold using the average cost retail method 3. Estimate the 2018 ending inventory and cost of goods sold using the conventional retail method. Complete this question by entering your answers in the tabs below. Req 1 Req 2 and 3 Estimate the 2018 and 2019 ending inventory and cost of goods sold using the dollar-value LIFO retail method. (Round final answers to the nearest whole dollar.) 2018 2019 Estimated ending inventory at retail Estimated ending inventory at cost Estimated cost of goods sold Required: 1. Estimate the 2018 and 2019 ending inventory and cost of goods sold using the dollar-value LIFO retail method. 2. Estimate the 2018 ending inventory and cost of goods sold using the average cost retail method. 3. Estimate the 2018 ending inventory and cost of goods sold using the conventional retail method Complete this question by entering your answers in the tabs below. Req 1 Req 2 and 3 Estimate the 2018 ending inventory and cost of goods sold using the average cost retail method and conventional retail method. (Round your cost-to-retail percentage calculation to 2 decimal places and final answers to the nearest whole dollar.) Average Cost Conventional Retail MethodRetail Method Estimated ending inventory at retail Estimated ending inventory at cost Estimated cost of goods sold