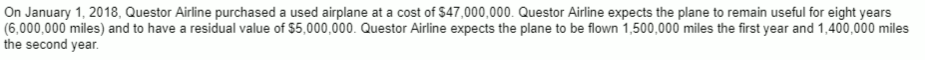

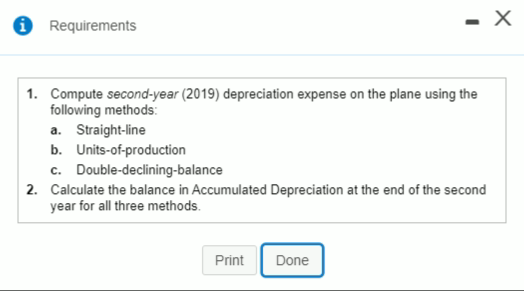

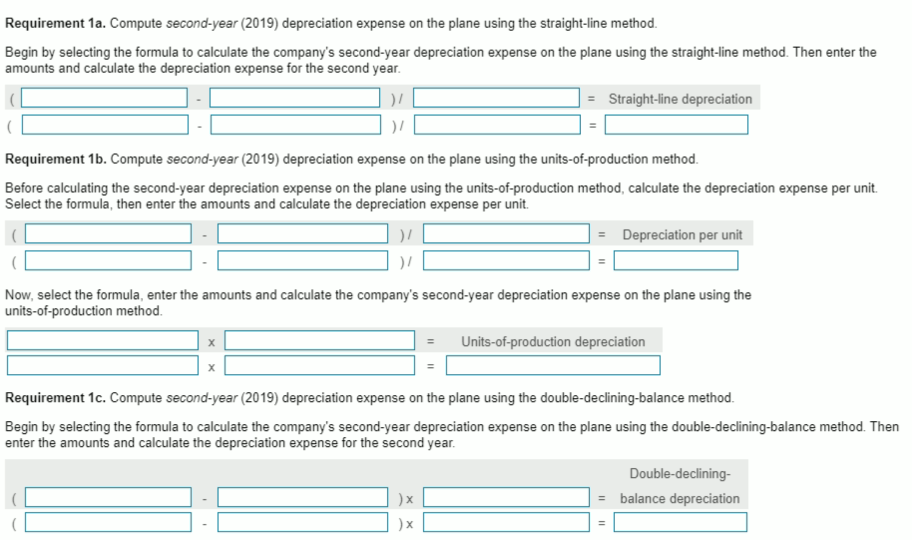

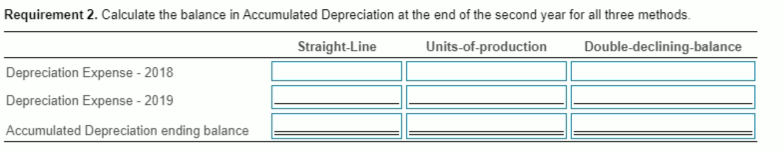

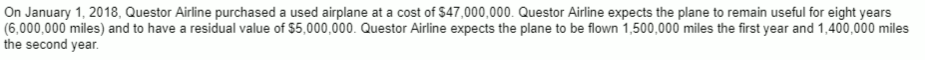

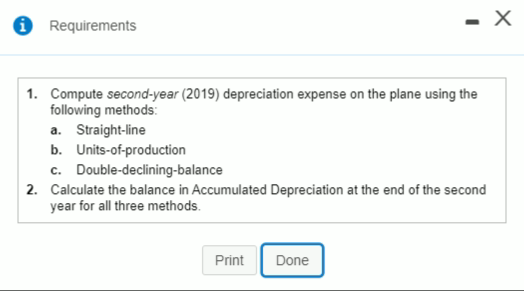

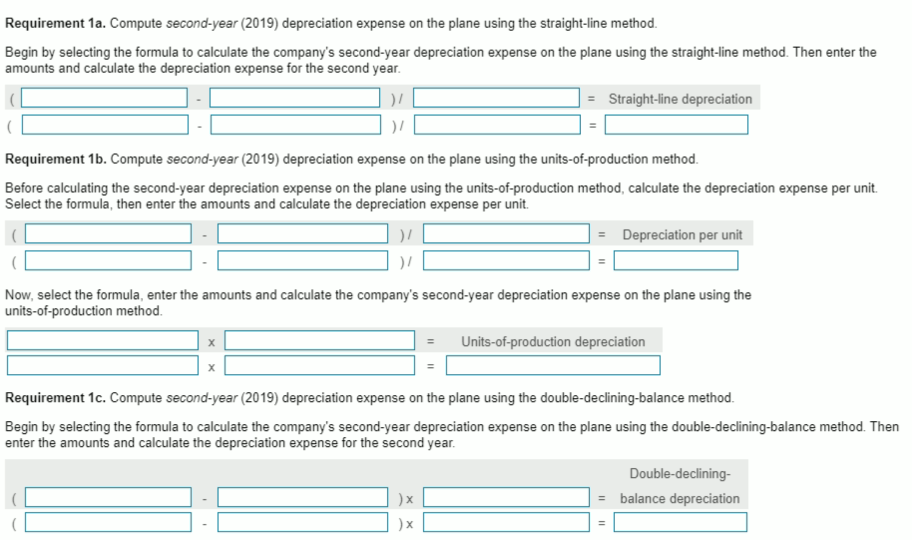

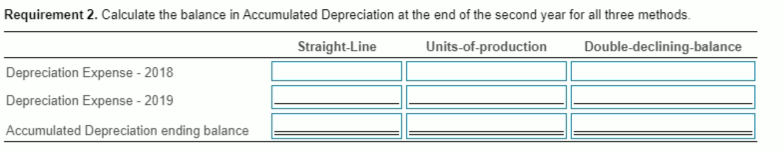

On January 1, 2018, Questor Airline purchased a used airplane at a cost of $47,000,000. Questor Airline expects the plane to remain useful for eight years (6,000,000 miles) and to have a residual value of $5,000,000. Questor Airline expects the plane to be flown 1,500,000 miles the first year and 1,400,000 miles the second year. 0 Requirements 1. Compute second-year (2019) depreciation expense on the plane using the following methods a. Straight-line b. Units-of-production c. Double-declining-balance 2. Calculate the balance in Accumulated Depreciation at the end of the second year for all three methods Print Done Requirement 1a. Compute second-year (2019) depreciation expense on the plane using the straight-line method. Begin by selecting the formula to calculate the company's second-year depreciation expense on the plane using the straight-line method. Then enter the amounts and calculate the depreciation expense for the second year. = Straight-line depreciation Requirement 1b. Compute second-year (2019) depreciation expense on the plane using the units-of-production method. Before calculating the second-year depreciation expense on the plane using the units-of-production method, calculate the depreciation expense per unit. Select the formula, then enter the amounts and calculate the depreciation expense per unit. . ) = Depreciation per unit Now, select the formula, enter the amounts and calculate the company's second-year depreciation expense on the plane using the units-of-production method. = Units-of-production depreciation Requirement 1c. Compute second-year (2019) depreciation expense on the plane using the double-declining-balance method. Begin by selecting the formula to calculate the company's second-year depreciation expense on the plane using the double-declining-balance method. Then enter the amounts and calculate the depreciation expense for the second year. Double-declining- = balance depreciation 1) Requirement 2. Calculate the balance in Accumulated Depreciation at the end of the second year for all three methods. Straight-Line Units-of-production Double-declining-balance Depreciation Expense - 2018 Depreciation Expense - 2019 Accumulated Depreciation ending balance