Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2018, the Excel Delivery Company purchased a delivery van for $30,000. At the end of its five-year service life, it is estimated

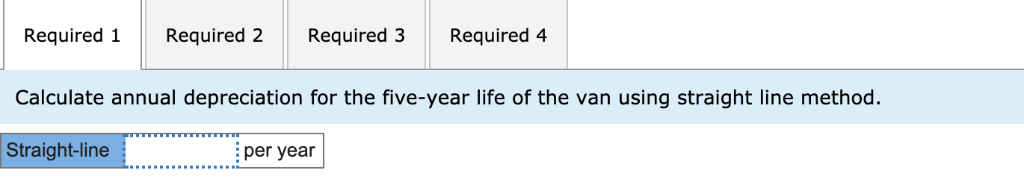

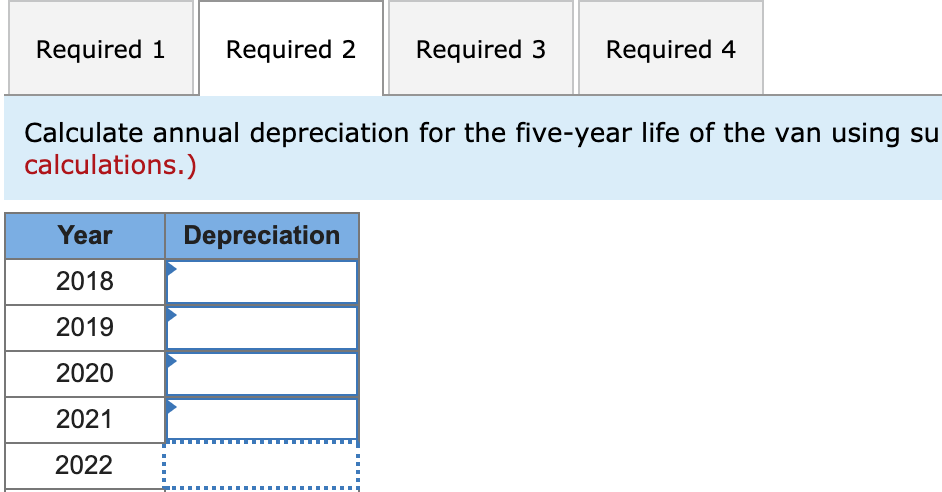

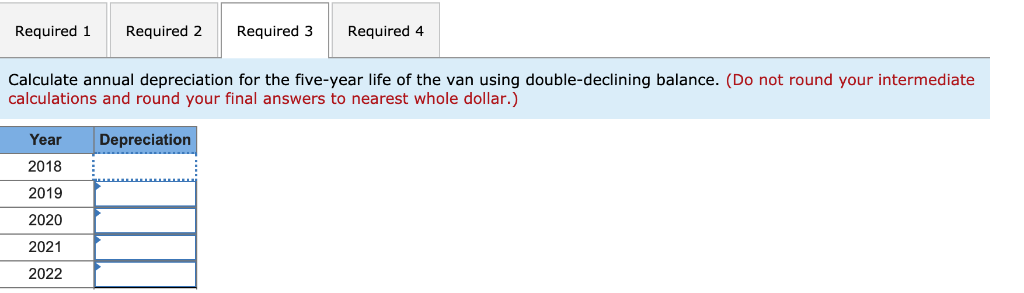

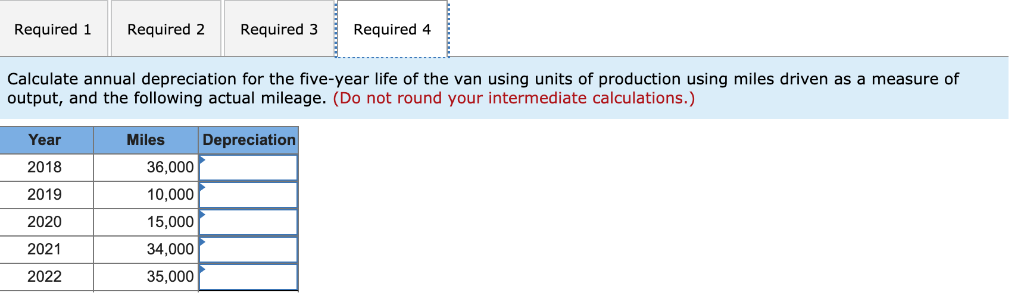

On January 1, 2018, the Excel Delivery Company purchased a delivery van for $30,000. At the end of its five-year service life, it is estimated that the van will be worth $3,000. During the five-year period, the company expects to drive the van 100,000 miles. Required: Calculate annual depreciation for the five-year life of the van using each of the following methods. 1. Straight line. 2. Sum-of-the-years-digits. 3. Double-declining balance. 4. Units of production using miles driven as a measure of output, and the following actual mileage:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started