Answered step by step

Verified Expert Solution

Question

1 Approved Answer

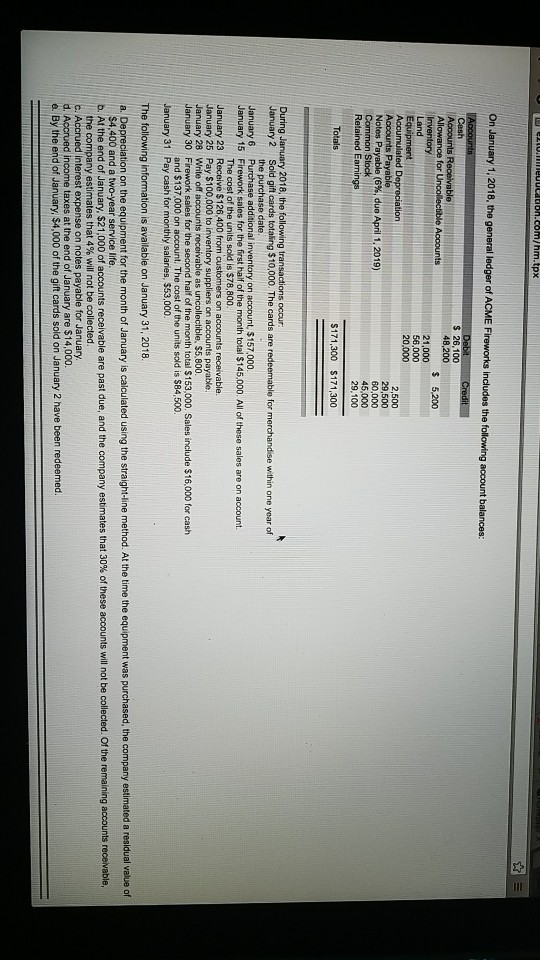

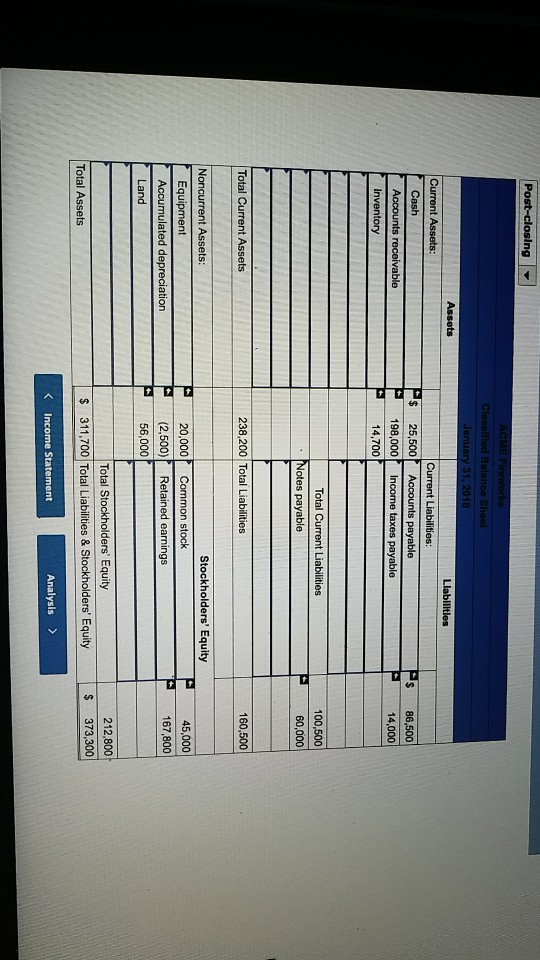

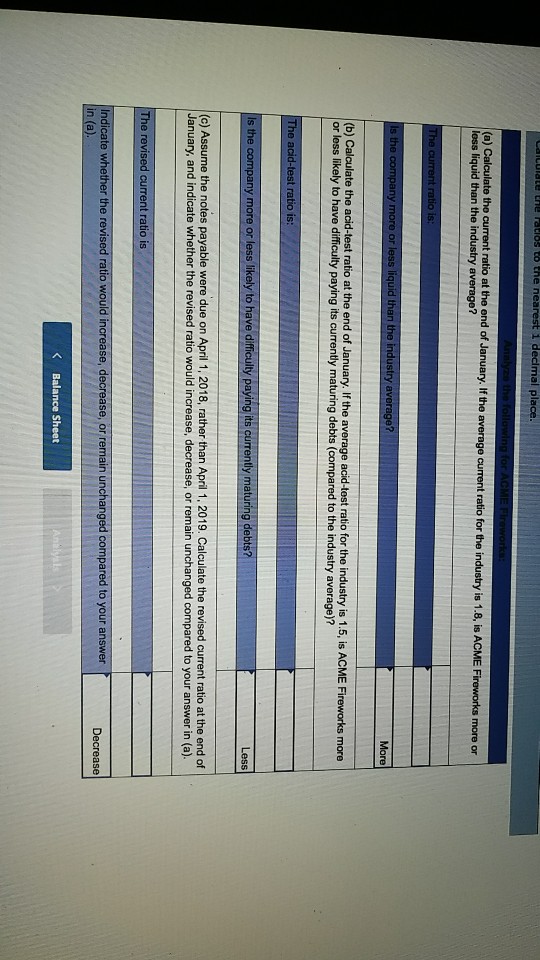

on January 1, 2018, the general ledger of acme fireworks includes the following account balances: TeuucatioH.com/hm.tpx On Janu 100 48,200 S 5,200 21,000 56,000 20,000

on January 1, 2018, the general ledger of acme fireworks includes the following account balances:

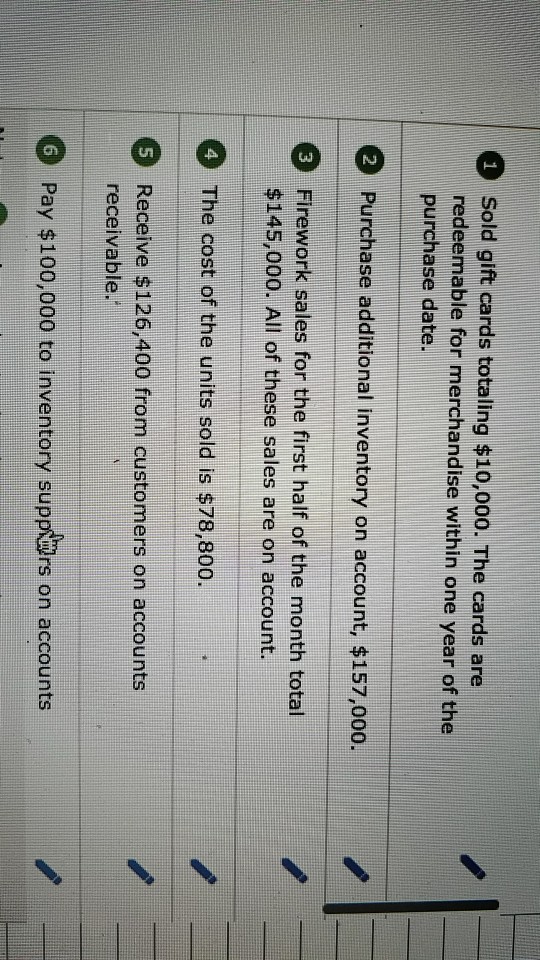

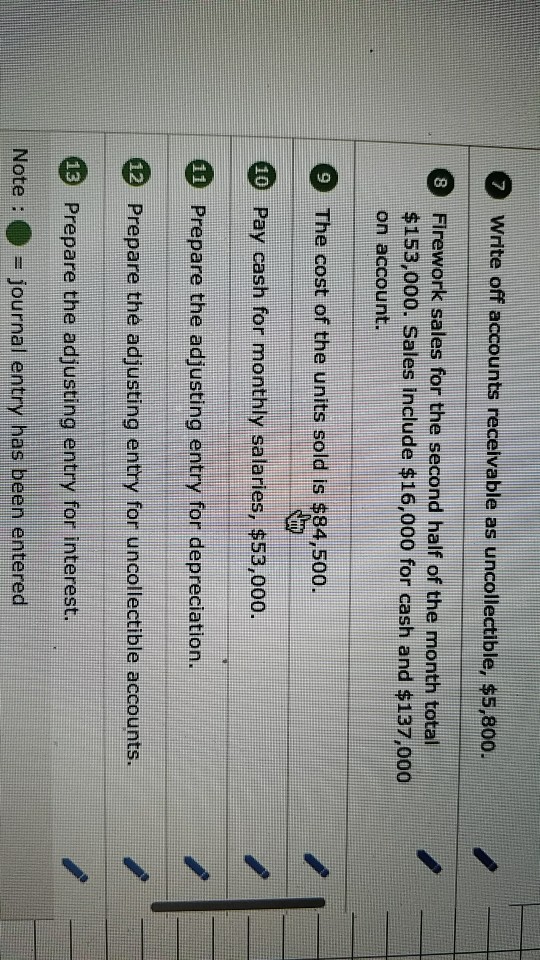

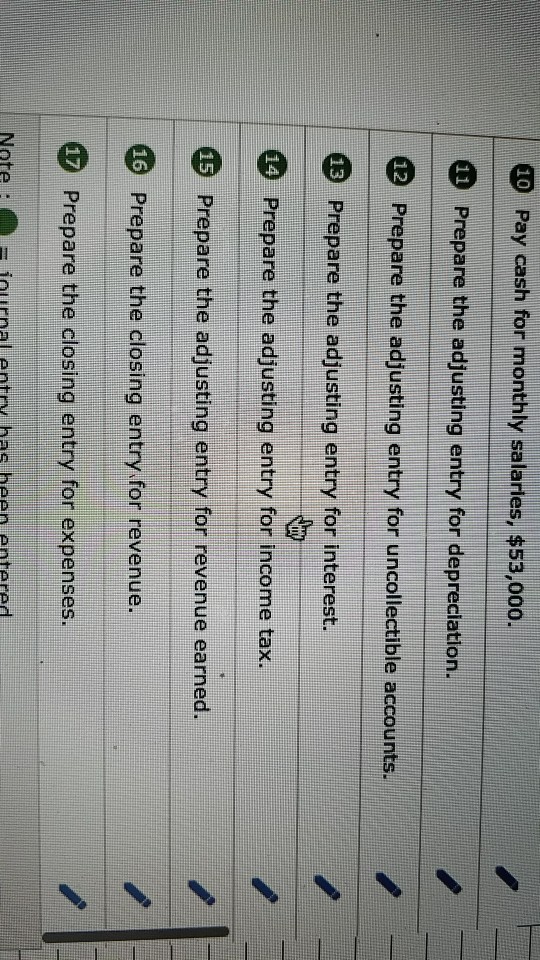

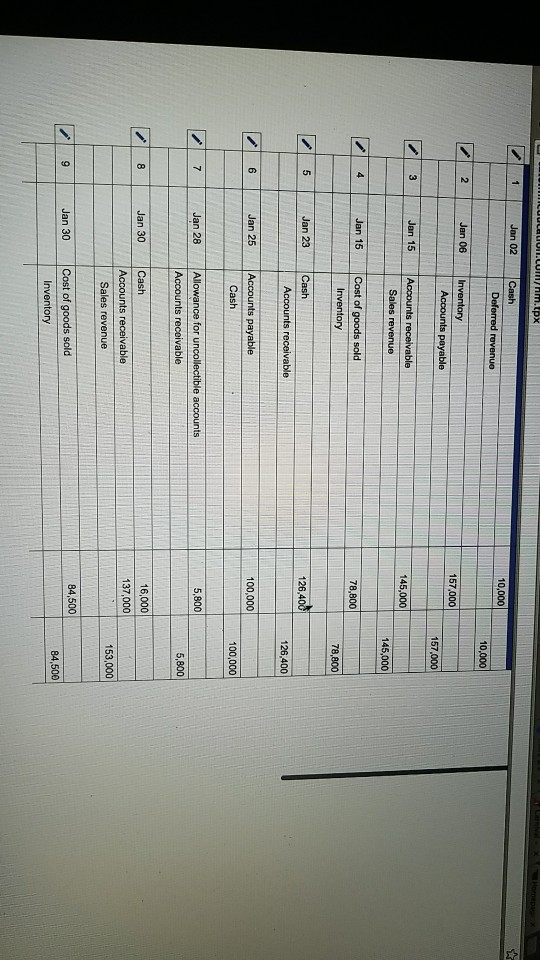

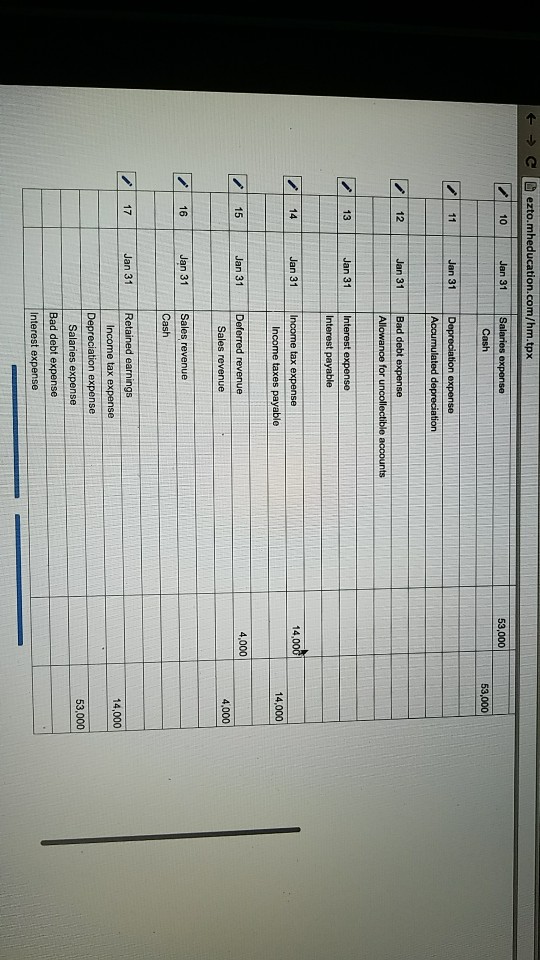

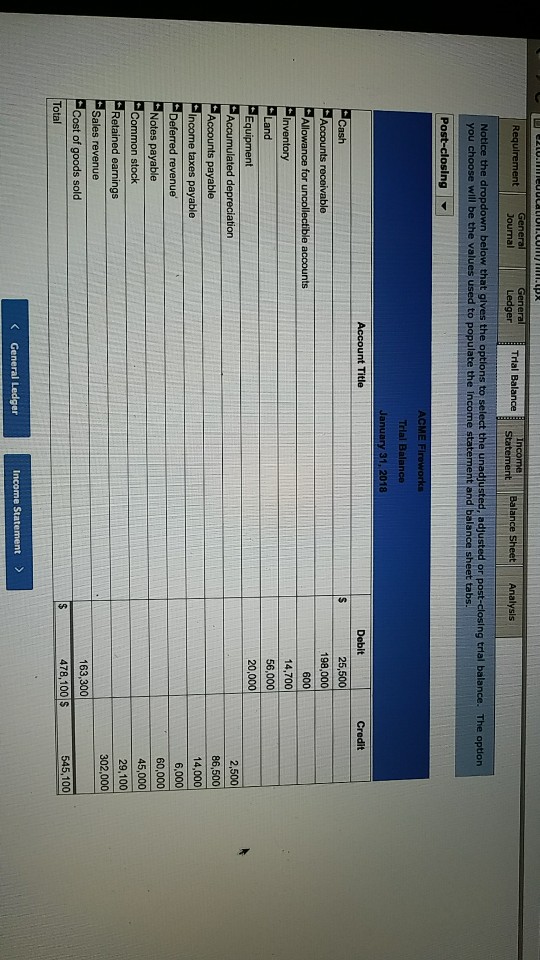

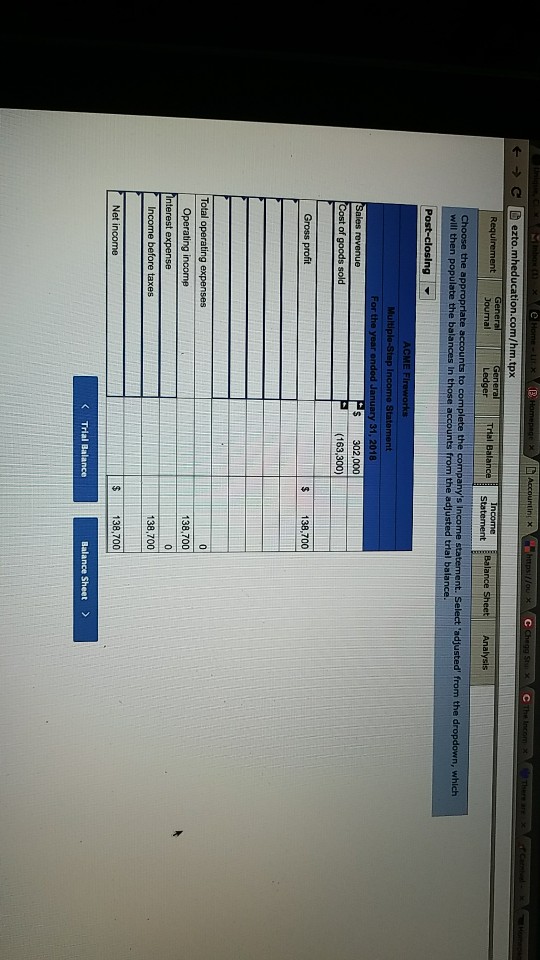

TeuucatioH.com/hm.tpx On Janu 100 48,200 S 5,200 21,000 56,000 20,000 2,500 29,500 60,000 45,000 29.100 $171,300 $171,300 During January 2018, the following transactions occur January 2 Sold gift January 6 January 15 Firework sales for the first half of the month total $145,000. All of these sales are on account e additional inventory on account, $157,000 The cost of the units sold is $78,800 January 23 Receive $126,400 from customers on accounts January 25 Pay $100,000 to inventory suppliers on a January 28 Write off receivable as u $5.800 January 30 Firework sales for the second half of the month total $153,000. Sales include $16,000 for cash January 31 Pay cash for monthly salaries, $53,000. The following information is available on January 31, 2018 a. Depreciation on the equipment for the month of January is calculated using the straight-line method. At the time the equipment was purchased, the company estimated a residual value of e a the end of a ar S21 000 o accounts recevabe are past due, and the company estimates that 30% of these accounts will not be collected O he remaning a counts receivable and $137,000 on account. The cost of the units sold is $84,500 the company estimates that 4% will not be collected c. Accrued interest expense on notes payable for January. d. Accrued income taxes at the end of January are $14,000 e. By the end of January, $4,000 of the gift cards sold on January 2 have been redeemed. TeuucatioH.com/hm.tpx On Janu 100 48,200 S 5,200 21,000 56,000 20,000 2,500 29,500 60,000 45,000 29.100 $171,300 $171,300 During January 2018, the following transactions occur January 2 Sold gift January 6 January 15 Firework sales for the first half of the month total $145,000. All of these sales are on account e additional inventory on account, $157,000 The cost of the units sold is $78,800 January 23 Receive $126,400 from customers on accounts January 25 Pay $100,000 to inventory suppliers on a January 28 Write off receivable as u $5.800 January 30 Firework sales for the second half of the month total $153,000. Sales include $16,000 for cash January 31 Pay cash for monthly salaries, $53,000. The following information is available on January 31, 2018 a. Depreciation on the equipment for the month of January is calculated using the straight-line method. At the time the equipment was purchased, the company estimated a residual value of e a the end of a ar S21 000 o accounts recevabe are past due, and the company estimates that 30% of these accounts will not be collected O he remaning a counts receivable and $137,000 on account. The cost of the units sold is $84,500 the company estimates that 4% will not be collected c. Accrued interest expense on notes payable for January. d. Accrued income taxes at the end of January are $14,000 e. By the end of January, $4,000 of the gift cards sold on January 2 have been redeemed

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started