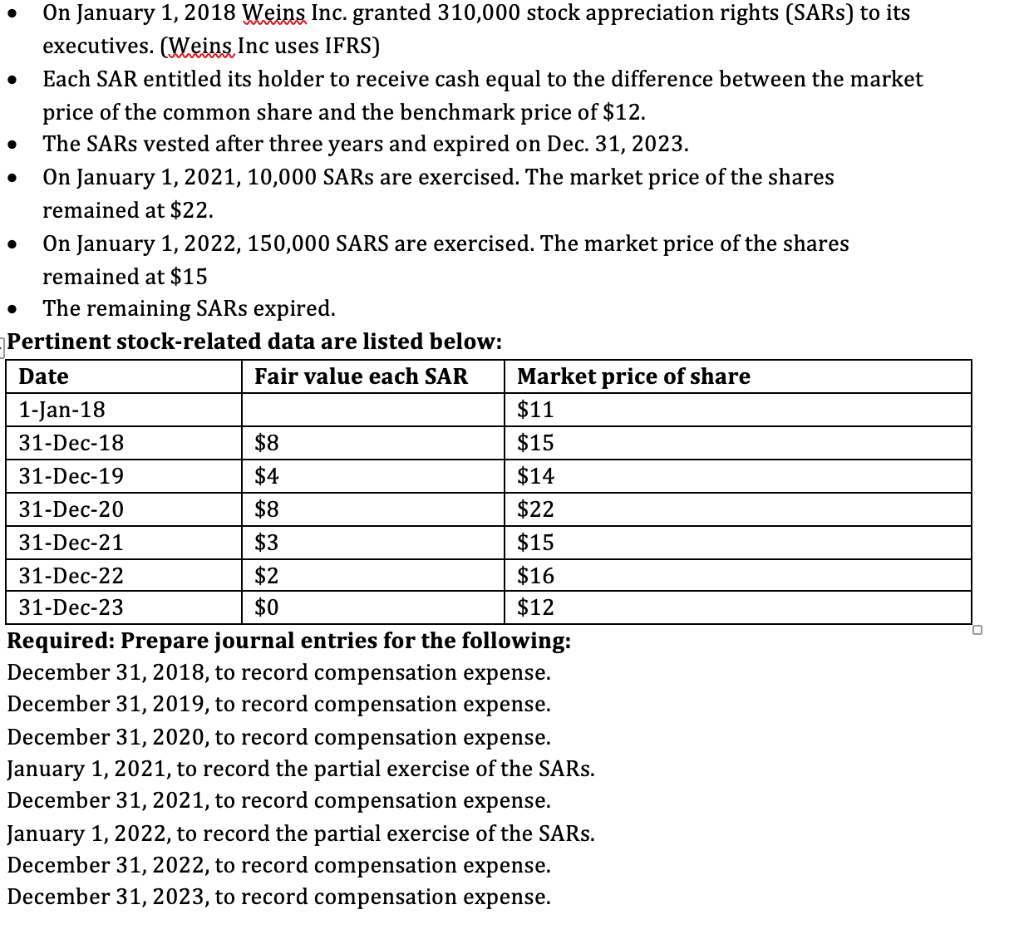

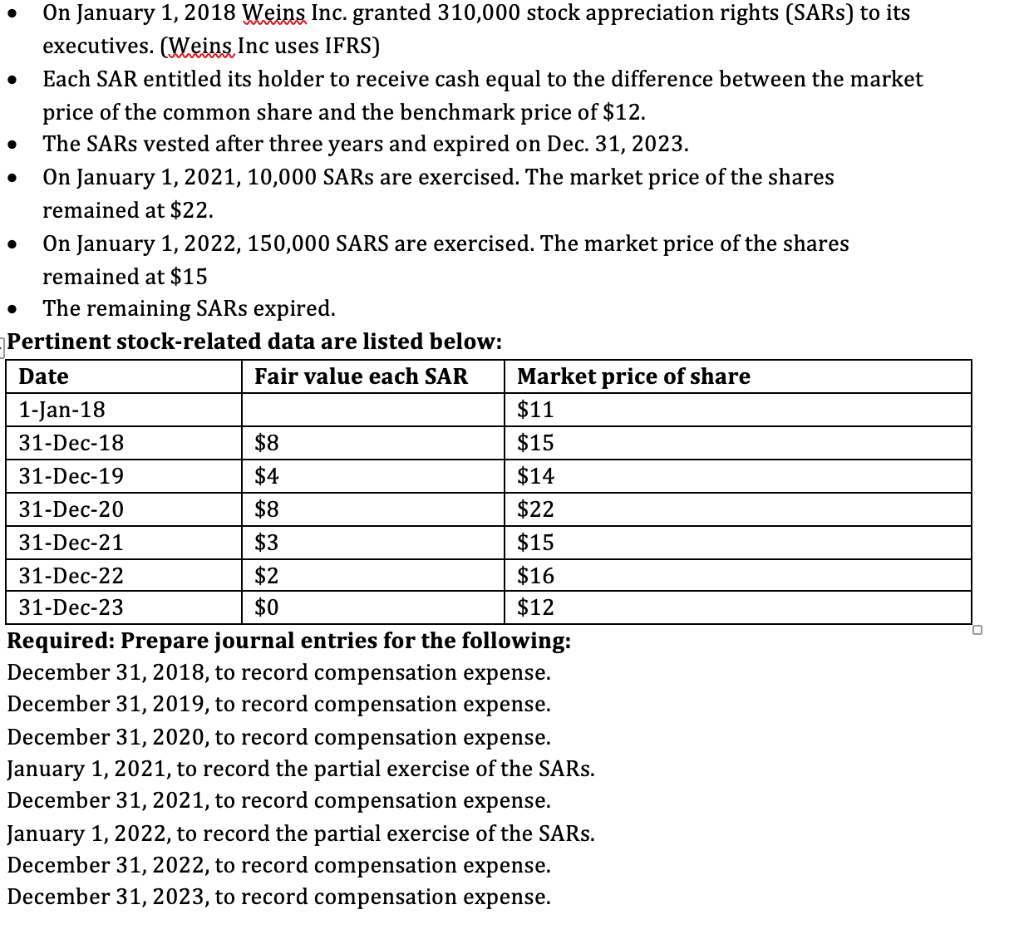

. . On January 1, 2018 Weins Inc. granted 310,000 stock appreciation rights (SARs) to its executives. (Weins, Inc uses IFRS) Each SAR entitled its holder to receive cash equal to the difference between the market price of the common share and the benchmark price of $12. The SARs vested after three years and expired on Dec. 31, 2023. On January 1, 2021, 10,000 SARs are exercised. The market price of the shares remained at $22. On January 1, 2022, 150,000 SARS are exercised. The market price of the shares remained at $15 The remaining SARs expired. Pertinent stock-related data are listed below: Date Fair value each SAR Market price of share 1-Jan-18 $11 31-Dec-18 $8 $15 31-Dec-19 $4 $14 31-Dec-20 $8 $22 31-Dec-21 $3 $15 31-Dec-22 $2 $16 31-Dec-23 $0 $12 Required: Prepare journal entries for the following: December 31, 2018, to record compensation expense. December 31, 2019, to record compensation expense. December 31, 2020, to record compensation expense. January 1, 2021, to record the partial exercise of the SARs. December 31, 2021, to record compensation expense. January 1, 2022, to record the partial exercise of the SARs. December 31, 2022, to record compensation expense. December 31, 2023, to record compensation expense. . . On January 1, 2018 Weins Inc. granted 310,000 stock appreciation rights (SARs) to its executives. (Weins, Inc uses IFRS) Each SAR entitled its holder to receive cash equal to the difference between the market price of the common share and the benchmark price of $12. The SARs vested after three years and expired on Dec. 31, 2023. On January 1, 2021, 10,000 SARs are exercised. The market price of the shares remained at $22. On January 1, 2022, 150,000 SARS are exercised. The market price of the shares remained at $15 The remaining SARs expired. Pertinent stock-related data are listed below: Date Fair value each SAR Market price of share 1-Jan-18 $11 31-Dec-18 $8 $15 31-Dec-19 $4 $14 31-Dec-20 $8 $22 31-Dec-21 $3 $15 31-Dec-22 $2 $16 31-Dec-23 $0 $12 Required: Prepare journal entries for the following: December 31, 2018, to record compensation expense. December 31, 2019, to record compensation expense. December 31, 2020, to record compensation expense. January 1, 2021, to record the partial exercise of the SARs. December 31, 2021, to record compensation expense. January 1, 2022, to record the partial exercise of the SARs. December 31, 2022, to record compensation expense. December 31, 2023, to record compensation expense