Question

On January 1, 2018, White Corporation signed a $200,000, five-year, 4% note. The loan required White to make payments annually on December 31 of

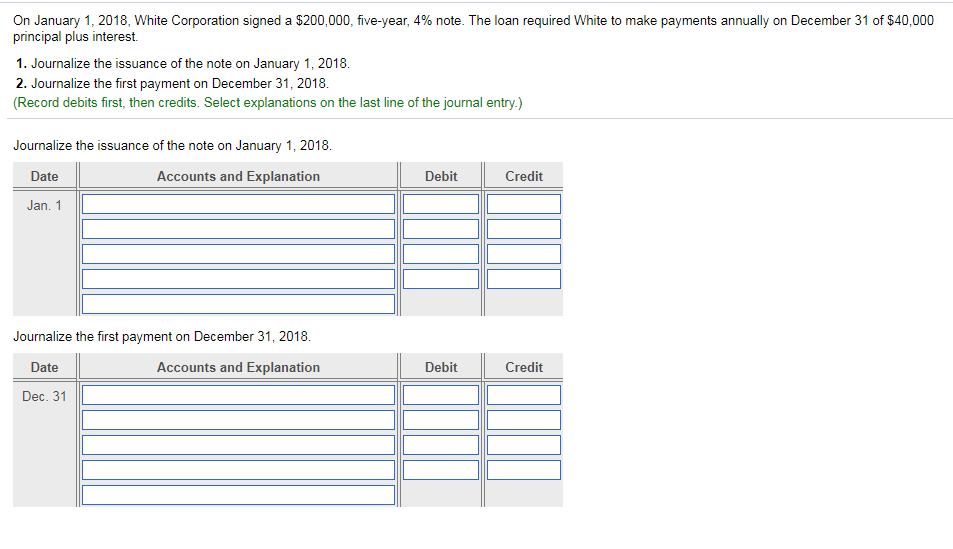

On January 1, 2018, White Corporation signed a $200,000, five-year, 4% note. The loan required White to make payments annually on December 31 of $40,000 principal plus interest. 1. Journalize the issuance of the note on January 1, 2018. 2. Journalize the first payment on December 31, 2018. (Record debits first, then credits. Select explanations on the last line of the journal entry.) Journalize the issuance of the note on January 1, 2018. Date Accounts and Explanation Debit Credit Jan. 1 Journalize the first payment on December 31, 2018. Date Accounts and Explanation Debit Credit Dec. 31

Step by Step Solution

3.33 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Jan 1 Cash 200000 Notes Payable 200...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting

Authors: David Spiceland, Wayne Thomas, Don Herrmann

4th edition

1259307956, 978-1259307959

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App