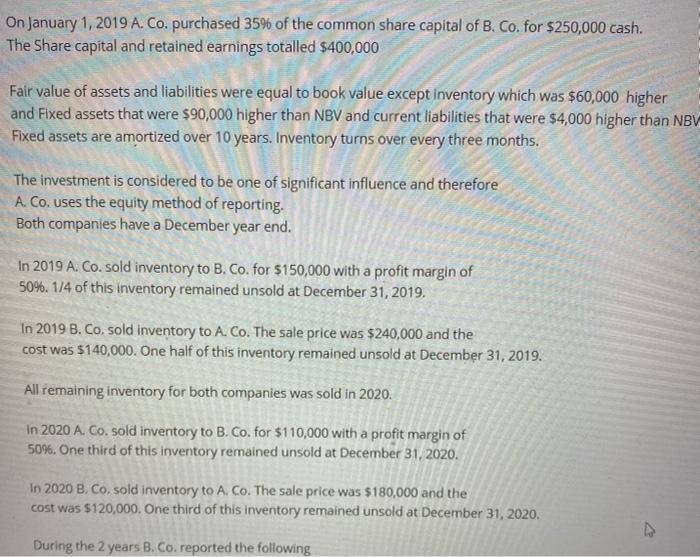

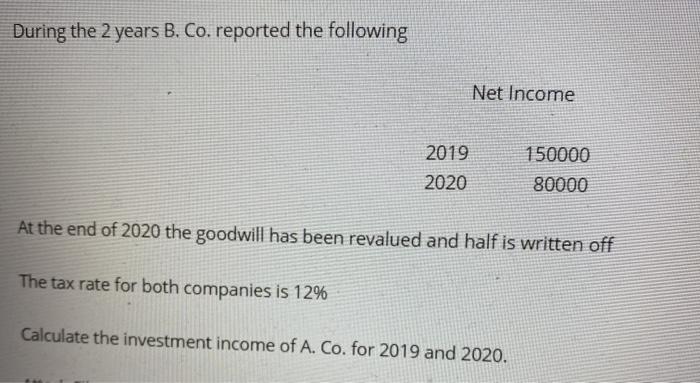

On January 1, 2019 A. Co. purchased 35% of the common share capital of B. Co. for $250,000 cash. The Share capital and retained earnings totalled $400,000 Fair value of assets and liabilities were equal to book value except inventory which was $60,000 higher and Fixed assets that were $90,000 higher than NBV and current liabilities that were $4,000 higher than NBV Fixed assets are amortized over 10 years. Inventory turns over every three months. The investment is considered to be one of significant influence and therefore A. Co. uses the equity method of reporting. Both companies have a December year end. In 2019 A. Co. sold inventory to B. Co. for $150,000 with a profit margin of 50%. 1/4 of this inventory remained unsold at December 31, 2019. In 2019 B.Co. sold inventory to A. Co. The sale price was $240,000 and the cost was $140,000. One half of this inventory remained unsold at December 31, 2019. All remaining inventory for both companies was sold in 2020. In 2020 A. Co. sold inventory to B. Co. for $110,000 with a profit margin of 50%. One third of this inventory remained unsold at December 31, 2020. In 2020 B. Co. sold inventory to A. Co. The sale price was $180,000 and the cost was $120,000. One third of this inventory remained unsold at December 31, 2020, During the 2 years B. Co. reported the following During the 2 years B. Co. reported the following Net Income 2019 2020 150000 80000 At the end of 2020 the goodwill has been revalued and half is written off The tax rate for both companies is 12% Calculate the investment income of A. Co. for 2019 and 2020. On January 1, 2019 A. Co. purchased 35% of the common share capital of B. Co. for $250,000 cash. The Share capital and retained earnings totalled $400,000 Fair value of assets and liabilities were equal to book value except inventory which was $60,000 higher and Fixed assets that were $90,000 higher than NBV and current liabilities that were $4,000 higher than NBV Fixed assets are amortized over 10 years. Inventory turns over every three months. The investment is considered to be one of significant influence and therefore A. Co. uses the equity method of reporting. Both companies have a December year end. In 2019 A. Co. sold inventory to B. Co. for $150,000 with a profit margin of 50%. 1/4 of this inventory remained unsold at December 31, 2019. In 2019 B.Co. sold inventory to A. Co. The sale price was $240,000 and the cost was $140,000. One half of this inventory remained unsold at December 31, 2019. All remaining inventory for both companies was sold in 2020. In 2020 A. Co. sold inventory to B. Co. for $110,000 with a profit margin of 50%. One third of this inventory remained unsold at December 31, 2020. In 2020 B. Co. sold inventory to A. Co. The sale price was $180,000 and the cost was $120,000. One third of this inventory remained unsold at December 31, 2020, During the 2 years B. Co. reported the following During the 2 years B. Co. reported the following Net Income 2019 2020 150000 80000 At the end of 2020 the goodwill has been revalued and half is written off The tax rate for both companies is 12% Calculate the investment income of A. Co. for 2019 and 2020