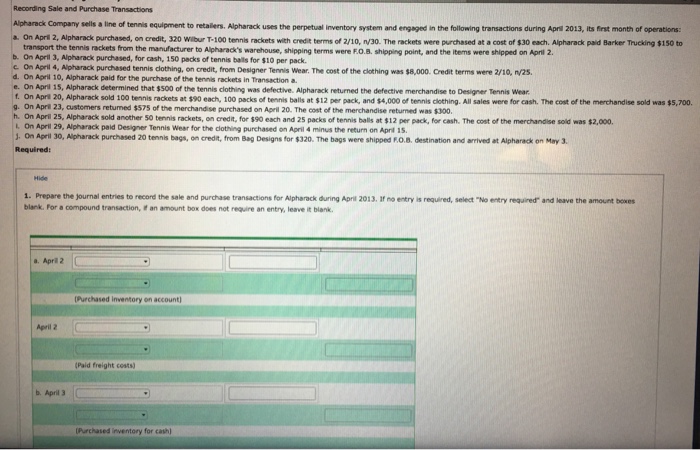

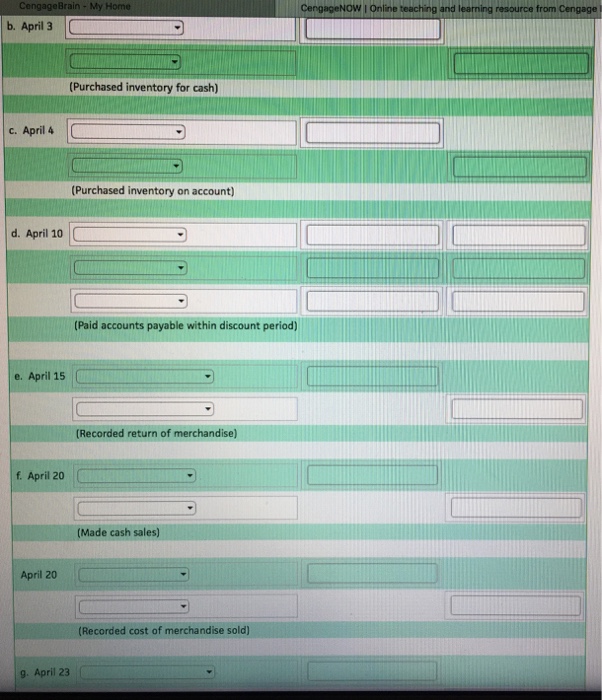

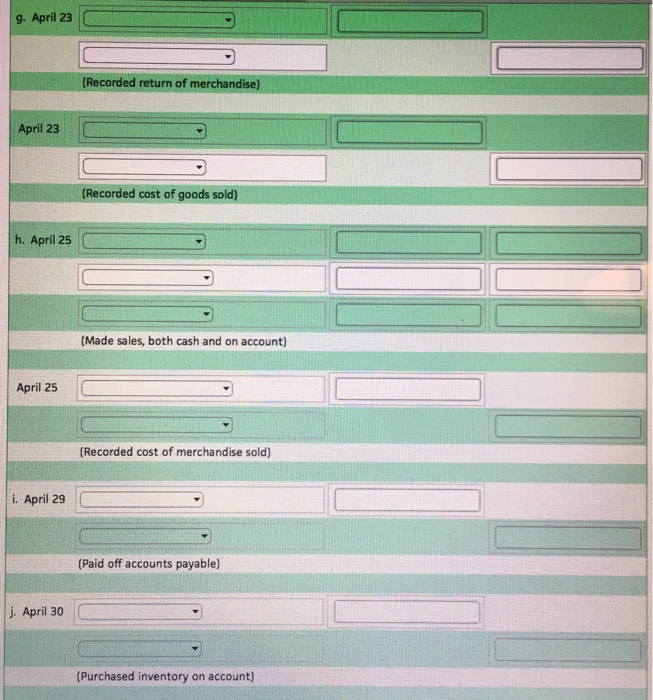

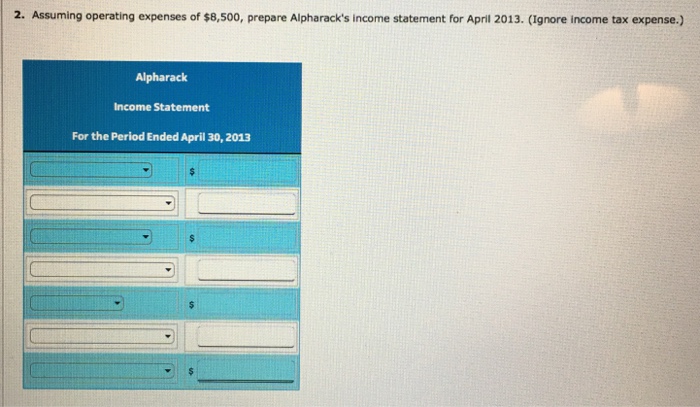

Recording sale and Purchase Transactions Alpharack Company sells a line of tennis equipment to retailers. Alpharack uses the perpetual inventory system and engaged in the following transactions during Apr 2013, its ntmonth of operations: a. On Apr 2, Alpharack purchased, on credit, 320 wibur T.100 tennis rackets with credit terms of 2/ at a cost of s30 each. Alpharack paid Barker Thucking $150 to transport the tennis rackets from the manufacturer to Alpharack's warehouse, shipping terms were Fo B. shipping point, and the items were shipped on Apr 2. c on Apri 3, Alpharack purchased, for cash, 150 packs of tennis bals for s10 per pack. The cost of the cothing was s credit terms were 2/10, n/2s. On April 4, Alpharack purchased tennis on credit, from Designer Tennis wear. d, on April 10, Alpharack paid for the purchase of the tennis rackets in Transaction e. On April 15 Alpharack determined that ssoo of the tennis clothing was defective. Alpharack returned the defective merchandise to Designer Tennis wear f on April 20, Alpharack sold 100 tennis rackets at each, packs of tennis balls at s12 per pack, and s4.000 of tennis cothing. All sales were for cash. The cost of the menchandise sold was $5,700. g. On Apr 23, austomers retumed ss75 of the merchandise purchased on April 20. The cost of the merchandise returned was s300 h. On April 25, sold another 50 tennis rackets, on aedit, for sgo each and 25 packs oftennis balls at s12 per pack for cash. The cost of the merchandise sold was s2,000. L On April 29, Alpharack paid Designer Tennis Wear for the dothing purchased on April 4 minus the return on Apr 15 On April 30, Alpharack purchased 20 tennis bags, on credit, from Bag Designs for s320. The bags were shipped Fo.B, destination and arrived at Alpharack on May 3. Required 1. Prepare the Journal entries to record the sale and purchase transactions for Alpharack during Apr 2013. ir no entry is required, select "No entry required and leave the amount bowes blank. For a compound transaction, ran amount box does not require an entry, leave it blank. a, April 2 (Purchased inventory on account Paid freight costs) April 3 [Purchased inventory for cash