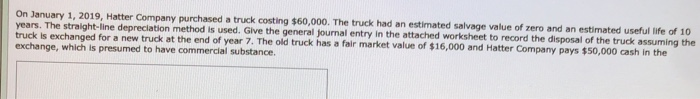

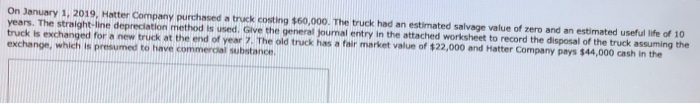

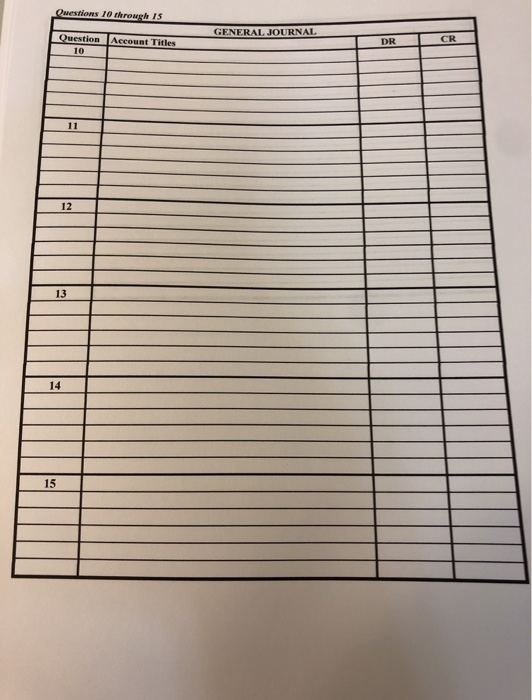

On January 1, 2019, Hatter Company purchased a truck costing $60,000. The truck had an estimated salvage value of zero and an estimated useful life of 10 years. The straight-line depreciation method is used. Give the general Journal entry in the attached worksheet to record the disposal of the truck assuming the truck is discarded at the end of year 10. On January 1, 2019, Hatter Company purchased a truck costing $60,000. The truck had an estimated salvage value of zero and an estimated useful life of 10 years. The straight-line depreciation method is used. Give the general journal entry in the attached worksheet to record the disposal of the truck assuming the truck is discarded at the end of year 8. On January 1, 2019, Hatter Company purchased a truck costing $60,000. The truck had an estimated salvage value of zero and an estimated useful life of 10 years. The straight-line depreciation method is used. Give the general journal entry in the attached worksheet to record the disposal of the truck assuming the truck is sold for $23,000 cash on July 1 of year 6. On January 1, 2019, Hatter Company purchased a truck costing $60,000. The truck had an estimated salvage value of zero and an estimated useful life of 10 years. The straight-line depreciation method is used. Give the general journal entry in the attached worksheet to record the disposal of the truck assuming the truck is exchanged for a new truck at the end of year 7. The old truck has a fair market value of $16,000 and Hatter Company pays $50,000 cash in the exchange, which is presumed to have commercial substance. On January 1, 2019, Hatter Company purchased a truck costing $60,000. The truck had an estimated salvage value of zero and an estimated useful life of 10 years. The straight-line depreciation method is used. Give the general journal entry in the attached worksheet to record the disposal of the truck assuming the truck is exchanged for a new truck at the end of year 7. The old truck has a fair market value of $22,000 and Hatter Company pays $44,000 cash in the exchange, which is presumed to have commercial substance Questions 10 through 15 GENERAL JOURNAL Question Account Titles 12 13 15 L T