Answered step by step

Verified Expert Solution

Question

1 Approved Answer

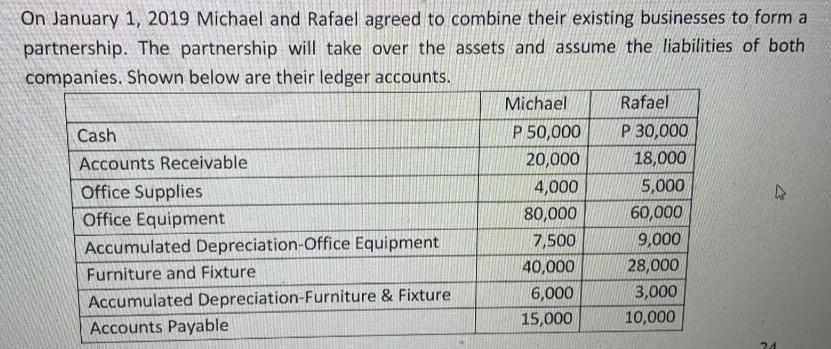

On January 1, 2019 Michael and Rafael agreed to combine their existing businesses to form a partnership. The partnership will take over the assets

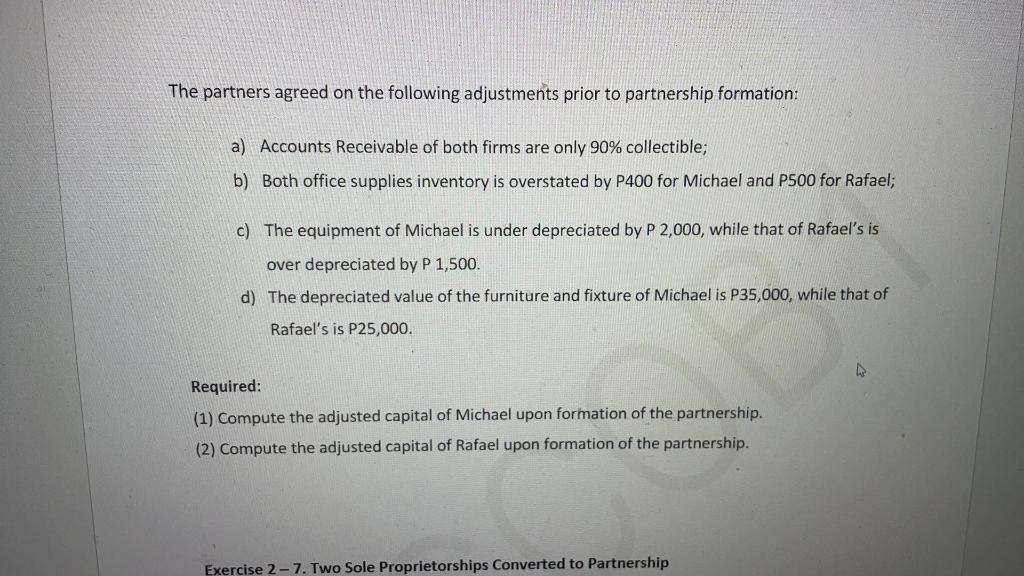

On January 1, 2019 Michael and Rafael agreed to combine their existing businesses to form a partnership. The partnership will take over the assets and assume the liabilities of both companies. Shown below are their ledger accounts. Cash Accounts Receivable Office Supplies Office Equipment Accumulated Depreciation-Office Equipment Furniture and Fixture Accumulated Depreciation-Furniture & Fixture Accounts Payable Michael P 50,000 20,000 4,000 80,000 7,500 40,000 6,000 15,000 Rafael P 30,000 18,000 5,000 60,000 9,000 28,000 3,000 10,000 24 The partners agreed on the following adjustments prior to partnership formation: a) Accounts Receivable of both firms are only 90% collectible; b) Both office supplies inventory is overstated by P400 for Michael and P500 for Rafael; c) The equipment of Michael is under depreciated by P 2,000, while that of Rafael's is over depreciated by P 1,500. d) The depreciated value of the furniture and fixture of Michael is P35,000, while that of Rafael's is P25,000. Required: (1) Compute the adjusted capital of Michael upon formation of the partnership. (2) Compute the adjusted capital of Rafael upon formation of the partnership. Exercise 2-7. Two Sole Proprietorships Converted to Partnership

Step by Step Solution

★★★★★

3.36 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Backs of Michael Capelac Particulare To Reduration Arc Reclination ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started