Answered step by step

Verified Expert Solution

Question

1 Approved Answer

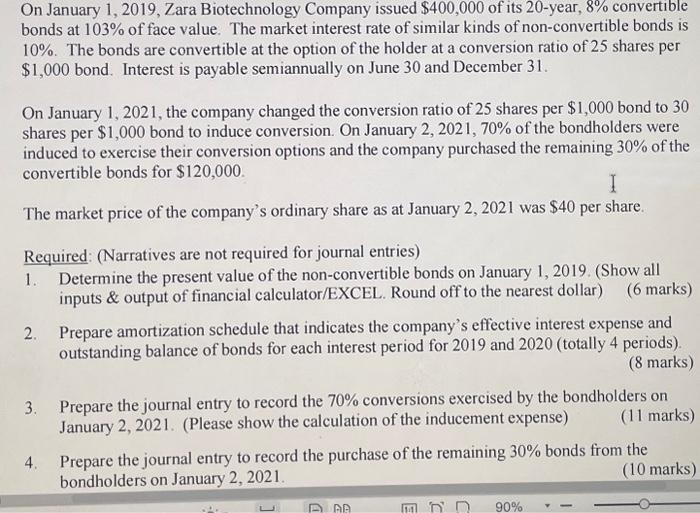

On January 1, 2019, Zara Biotechnology Company issued $400,000 of its 20-year, 8% convertible bonds at 103% of face value. The market interest rate of

On January 1, 2019, Zara Biotechnology Company issued $400,000 of its 20-year, 8% convertible bonds at 103% of face value. The market interest rate of similar kinds of non-convertible bonds is 10%. The bonds are convertible at the option of the holder at a conversion ratio of 25 shares per $1,000 bond. Interest is payable semiannually on June 30 and December 31. On January 1, 2021, the company changed the conversion ratio of 25 shares per $1,000 bond to 30 shares per $1,000 bond to induce conversion. On January 2, 2021, 70% of the bondholders were induced to exercise their conversion options and the company purchased the remaining 30% of the convertible bonds for $120,000. I The market price of the company's ordinary share as at January 2, 2021 was $40 per share. Required: (Narratives are not required for journal entries) 1. Determine the present value of the non-convertible bonds on January 1, 2019. (Show all inputs & output of financial calculator/EXCEL. Round off to the nearest dollar) (6 marks) 2. Prepare amortization schedule that indicates the company's effective interest expense and outstanding balance of bonds for each interest period for 2019 and 2020 (totally 4 periods). (8 marks) 3. Prepare the journal entry to record the 70% conversions exercised by the bondholders on January 2, 2021. (Please show the calculation of the inducement expense) (11 marks) 4. Prepare the journal entry to record the purchase of the remaining 30% bonds from the bondholders on January 2, 2021. (10 marks) AD 90%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started