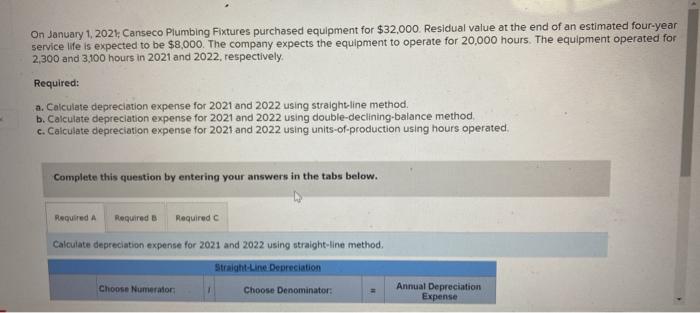

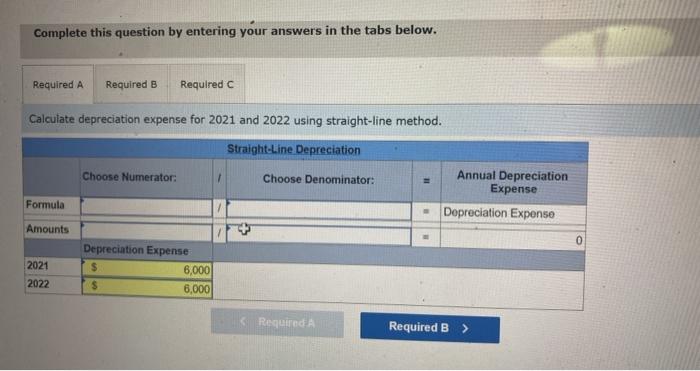

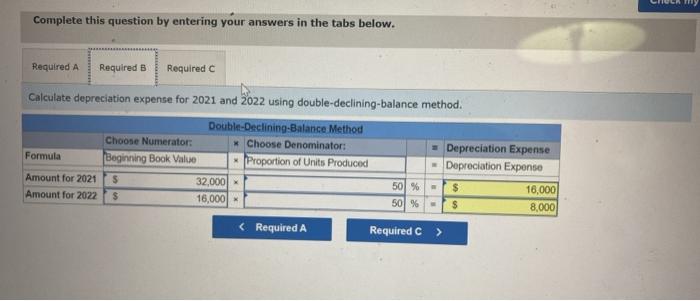

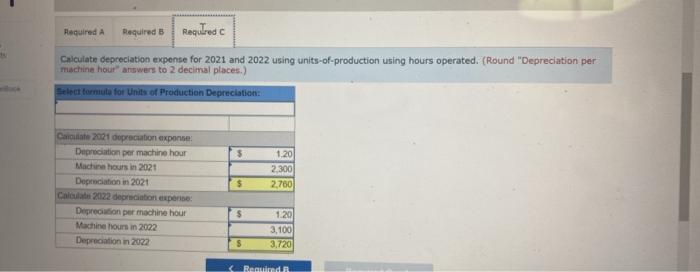

On January 1, 202, Canseco Plumbing Fixtures purchased equipment for $32,000. Residual value at the end of an estimated four-year service life is expected to be $8,000. The company expects the equipment to operate for 20,000 hours. The equipment operated for 2,300 and 3,100 hours in 2021 and 2022, respectively Required: a. Calculate depreciation expense for 2021 and 2022 using straight-line method. b. Calculate depreciation expense for 2021 and 2022 using double-declining balance method c. Calculate depreciation expense for 2021 and 2022 using units-of-production using hours operated, Complete this question by entering your answers in the tabs below. Required A Required B Required Calculate depreciation expense for 2021 and 2022 using straight-line method. Straight-Line Depreciation Choose Numerator Choose Denominator: Annual Depreciation Expense Complete this question by entering your answers in the tabs below. Required A Required B Required c Calculate depreciation expense for 2021 and 2022 using straight-line method. Straight-Line Depreciation Choose Numerator: Choose Denominator: Annual Depreciation Expense Depreciation Expense Formula Amounts 0 2021 2022 Depreciation Expense $ 6,000 $ 6,000 Required a Required B > Ry Complete this question by entering your answers in the tabs below. Required A Required B Required Calculate depreciation expense for 2021 and 2022 using double-declining-balance method. Double-Declining-Balance Method Choose Numerator: * Choose Denominator: Depreciation Expense Formula Beginning Book Value Proportion of Units Produced Depreciation Exponse Amount for 2021 $ 32,000 50 % $ 16,000 Amount for 2022 $ 16,000 50% - $ 8,000 Required Required B Requlredc Calculate depreciation expense for 2021 and 2022 using units-of-production using hours operated. (Round "Depreciation per machine hour answers to 2 decimal places.) Select formula for Units of Production Depreciation $ Calculate 2021 deprecation expose Depreciation per machine hour Machine hours in 2021 Depreciation in 2021 Calculate 2022 depreciation experie: Depreciation per machine hour Machine hours in 2022 Depreciation in 2022 1.20 2.300 2,760 $ $ 1.20 3,100 3.720 s