On January 1, 2020, A, B & C agree to the formation of a general partnership (ABC) in which each will have the same

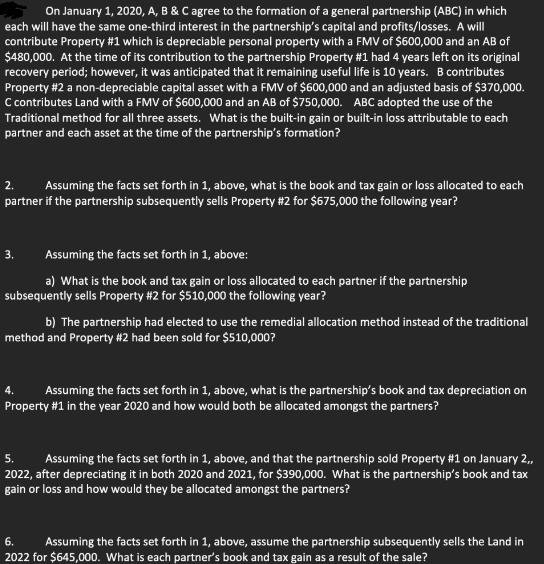

On January 1, 2020, A, B & C agree to the formation of a general partnership (ABC) in which each will have the same one-third interest in the partnership's capital and profits/losses. A will contribute Property #1 which is depreciable personal property with a FMV of $600,000 and an AB of $480,000. At the time of its contribution to the partnership Property #1 had 4 years left on its original recovery period; however, it was anticipated that it remaining useful life is 10 years. B contributes Property #2 a non-depreciable capital asset with a FMV of $600,000 and an adjusted basis of $370,000. C contributes Land with a FMV of $600,000 and an AB of $750,000. ABC adopted the use of the Traditional method for all three assets. What is the built-in gain or built-in loss attributable to each partner and each asset at the time of the partnership's formation? 2. Assuming the facts set forth in 1, above, what is the book and tax gain or loss allocated to each partner if the partnership subsequently sells Property #2 for $675,000 the following year? Assuming the facts set forth in 1, above: a) What is the book and tax gain or loss allocated to each partner if the partnership subsequently sells Property #2 for $510,000 the following year? 3. b) The partnership had elected to use the remedial allocation method instead of the traditional method and Property #2 had been sold for $510,000? 4. Assuming the facts set forth in 1, above, what is the partnership's book and tax depreciation on Property #1 in the year 2020 and how would both be allocated amongst the partners? 5. Assuming the facts set forth in 1, above, and that the partnership sold Property #1 on January 2,, 2022, after depreciating it in both 2020 and 2021, for $390,000. What is the partnership's book and tax gain or loss and how would they be allocated amongst the partners? 6. Assuming the facts set forth in 1, above, assume the partnership subsequently sells the Land in 2022 for $645,000. What is each partner's book and tax gain as a result of the sale?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the builtin gain or builtin loss attributable to each partner and each asset at the time of the partnerships formation as well as the subsequent gain or loss on the sale of Property 2 the ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started