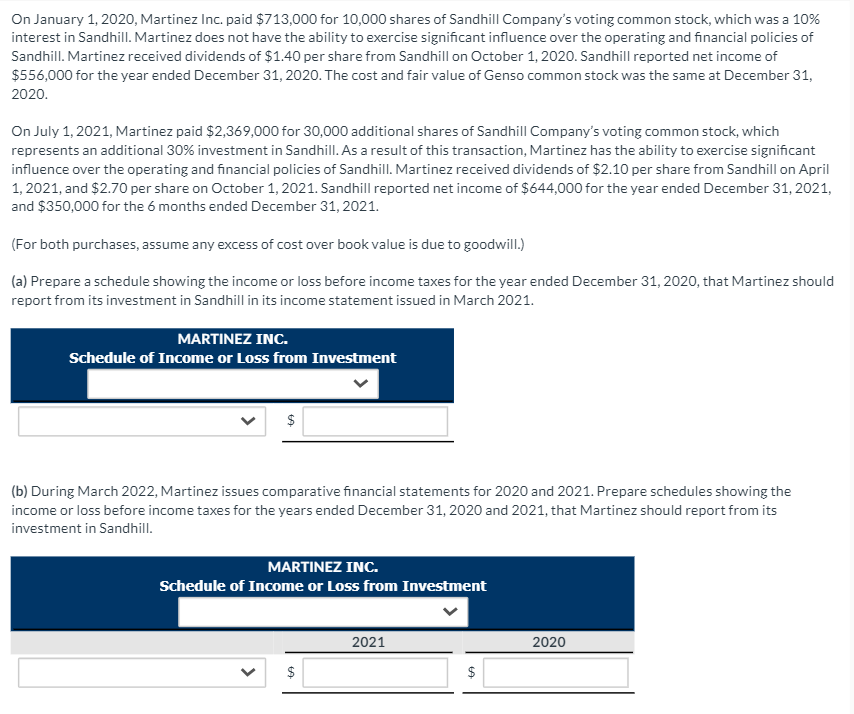

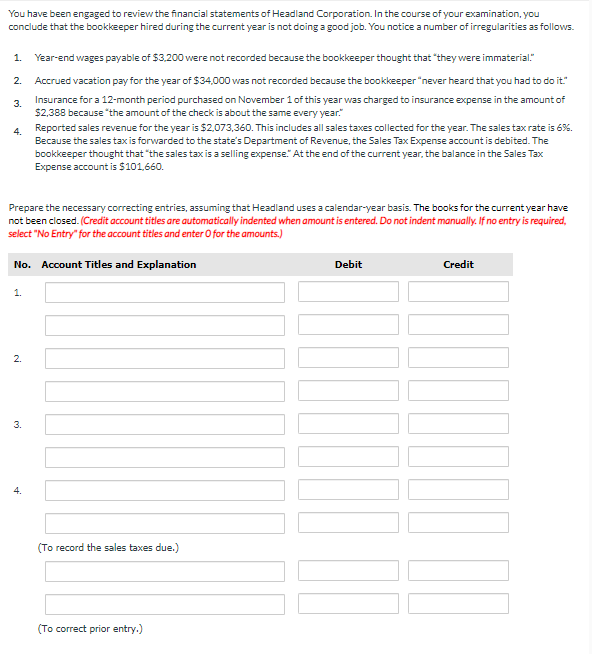

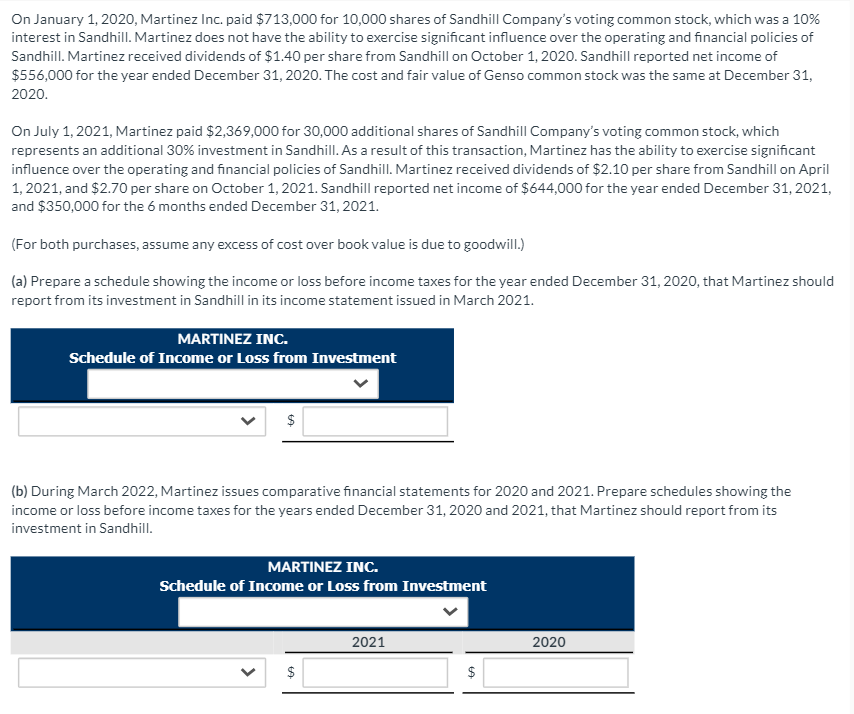

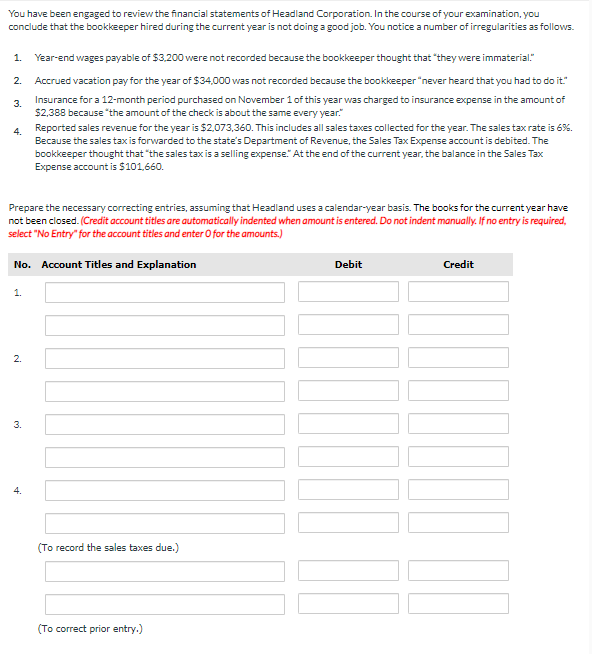

On January 1, 2020, Martinez Inc. paid $713,000 for 10,000 shares of Sandhill Company's voting common stock, which was a 10% interest in Sandhill. Martinez does not have the ability to exercise significant influence over the operating and financial policies of Sandhill. Martinez received dividends of $1.40 per share from Sandhill on October 1, 2020. Sandhill reported net income of $556,000 for the year ended December 31, 2020. The cost and fair value of Genso common stock was the same at December 31, 2020. On July 1, 2021, Martinez paid $2,369,000 for 30,000 additional shares of Sandhill Company's voting common stock, which represents an additional 30% investment in Sandhill. As a result of this transaction, Martinez has the ability to exercise significant influence over the operating and financial policies of Sandhill. Martinez received dividends of $2.10 per share from Sandhill on April 1, 2021, and $2.70 per share on October 1, 2021. Sandhill reported net income of $644,000 for the year ended December 31, 2021, and $350,000 for the 6 months ended December 31, 2021. (For both purchases, assume any excess of cost over book value is due to goodwill.) (a) Prepare a schedule showing the income or loss before income taxes for the year ended December 31, 2020, that Martinez should report from its investment in Sandhill in its income statement issued in March 2021. MARTINEZ INC. Schedule of Income or Loss from Investment $ (b) During March 2022, Martinez issues comparative financial statements for 2020 and 2021. Prepare schedules showing the income or loss before income taxes for the years ended December 31, 2020 and 2021, that Martinez should report from its investment in Sandhill. MARTINEZ INC. Schedule of Income or Loss from Investment 2021 2020 $ $ $ You have been engaged to review the financial statements of Headland Corporation. In the course of your examination, you conclude that the bookkeeper hired during the current year is not doing a good job. You notice a number of irregularities as follows. 1. 2. 3. Year-end wages payable of $3,200 were not recorded because the bookkeeper thought that they were immaterial." Accrued vacation pay for the year of $34,000 was not recorded because the bookkeeper "never heard that you had to do it Insurance for a 12-month period purchased on November 1 of this year was charged to insurance expense in the amount of $2,388 because the amount of the check is about the same every year." Reported sales revenue for the year is $2,073,360. This includes all sales taxes collected for the year. The sales tax rate is 6%. Because the sales tax is forwarded to the state's Department of Revenue, the Sales Tax Expense account is debited. The bookkeeper thought that the sales tax is a selling expense." At the end of the current year, the balance in the Sales Tax Expense account is $101.660. 4. Prepare the necessary correcting entries, assuming that Headland uses a calendar-year basis. The books for the current year have not been closed. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts.) No. Account Titles and Explanation Debit Credit 1. 2. 3. 4. (To record the sales taxes due.) (To correct prior entry.) On January 1, 2020, Martinez Inc. paid $713,000 for 10,000 shares of Sandhill Company's voting common stock, which was a 10% interest in Sandhill. Martinez does not have the ability to exercise significant influence over the operating and financial policies of Sandhill. Martinez received dividends of $1.40 per share from Sandhill on October 1, 2020. Sandhill reported net income of $556,000 for the year ended December 31, 2020. The cost and fair value of Genso common stock was the same at December 31, 2020. On July 1, 2021, Martinez paid $2,369,000 for 30,000 additional shares of Sandhill Company's voting common stock, which represents an additional 30% investment in Sandhill. As a result of this transaction, Martinez has the ability to exercise significant influence over the operating and financial policies of Sandhill. Martinez received dividends of $2.10 per share from Sandhill on April 1, 2021, and $2.70 per share on October 1, 2021. Sandhill reported net income of $644,000 for the year ended December 31, 2021, and $350,000 for the 6 months ended December 31, 2021. (For both purchases, assume any excess of cost over book value is due to goodwill.) (a) Prepare a schedule showing the income or loss before income taxes for the year ended December 31, 2020, that Martinez should report from its investment in Sandhill in its income statement issued in March 2021. MARTINEZ INC. Schedule of Income or Loss from Investment $ (b) During March 2022, Martinez issues comparative financial statements for 2020 and 2021. Prepare schedules showing the income or loss before income taxes for the years ended December 31, 2020 and 2021, that Martinez should report from its investment in Sandhill. MARTINEZ INC. Schedule of Income or Loss from Investment 2021 2020 $ $ $ You have been engaged to review the financial statements of Headland Corporation. In the course of your examination, you conclude that the bookkeeper hired during the current year is not doing a good job. You notice a number of irregularities as follows. 1. 2. 3. Year-end wages payable of $3,200 were not recorded because the bookkeeper thought that they were immaterial." Accrued vacation pay for the year of $34,000 was not recorded because the bookkeeper "never heard that you had to do it Insurance for a 12-month period purchased on November 1 of this year was charged to insurance expense in the amount of $2,388 because the amount of the check is about the same every year." Reported sales revenue for the year is $2,073,360. This includes all sales taxes collected for the year. The sales tax rate is 6%. Because the sales tax is forwarded to the state's Department of Revenue, the Sales Tax Expense account is debited. The bookkeeper thought that the sales tax is a selling expense." At the end of the current year, the balance in the Sales Tax Expense account is $101.660. 4. Prepare the necessary correcting entries, assuming that Headland uses a calendar-year basis. The books for the current year have not been closed. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts.) No. Account Titles and Explanation Debit Credit 1. 2. 3. 4. (To record the sales taxes due.) (To correct prior entry.)