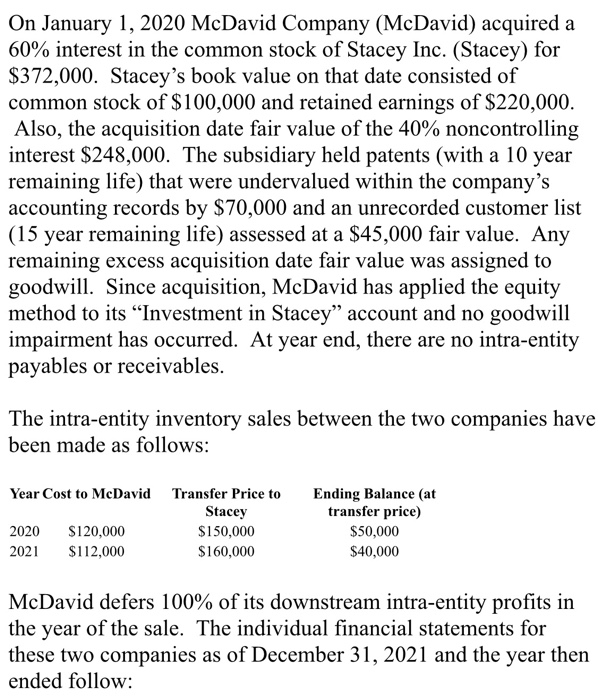

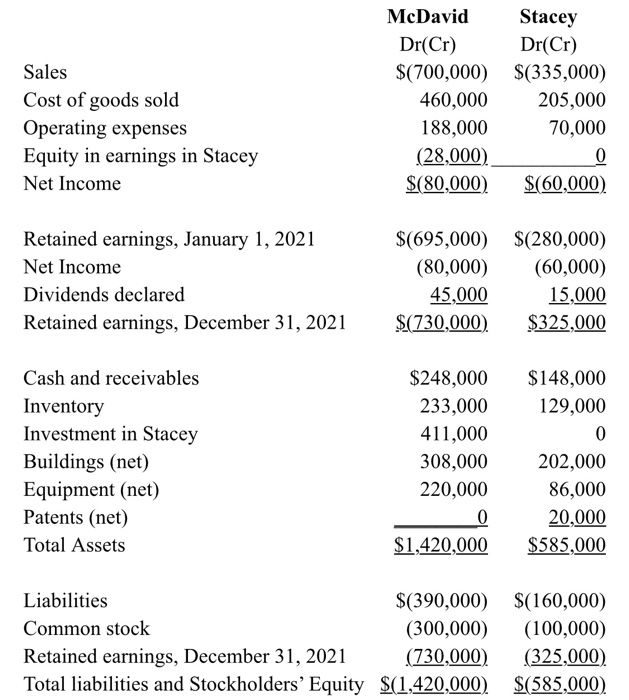

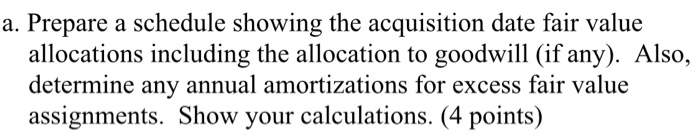

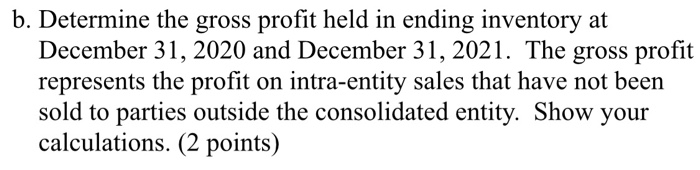

On January 1, 2020 McDavid Company (McDavid) acquired a 60% interest in the common stock of Stacey Inc. (Stacey) for $372,000. Stacey's book value on that date consisted of common stock of $100,000 and retained earnings of $220,000. Also, the acquisition date fair value of the 40% noncontrolling interest $248,000. The subsidiary held patents (with a 10 year remaining life) that were undervalued within the company's accounting records by $70,000 and an unrecorded customer list (15 year remaining life) assessed at a $45,000 fair value. Any remaining excess acquisition date fair value was assigned to goodwill. Since acquisition, McDavid has applied the equity method to its Investment in Stacey account and no goodwill impairment has occurred. At year end, there are no intra-entity payables or receivables. The intra-entity inventory sales between the two companies have been made as follows: Year Cost to McDavid Transfer Price to Stacey 2020 $120,000 $150,000 2021 $112,000 $160,000 Ending Balance (at transfer price) $50,000 $40,000 McDavid defers 100% of its downstream intra-entity profits in the year of the sale. The individual financial statements for these two companies as of December 31, 2021 and the year then ended follow: Sales Cost of goods sold Operating expenses Equity in earnings in Stacey Net Income McDavid Stacey Dr(Cr) Dr(Cr) $(700,000) $(335,000) 460,000 205,000 188,000 70,000 (28,000) 0 $(80,000) $(60,000) Retained earnings, January 1, 2021 Net Income Dividends declared Retained earnings, December 31, 2021 $(695,000) $(280,000) (80,000) (60,000) 45,000 15,000 $(730,000) $325,000 Cash and receivables Inventory Investment in Stacey Buildings (net) Equipment (net) Patents (net) Total Assets $248,000 233,000 411,000 308,000 220,000 0 $1,420,000 $148,000 129,000 0 202,000 86,000 20,000 $585,000 Liabilities $(390,000) $(160,000) Common stock (300,000) (100,000) Retained earnings, December 31, 2021 (730,000) (325,000) Total liabilities and Stockholders' Equity $(1,420,000) $(585,000) a. Prepare a schedule showing the acquisition date fair value allocations including the allocation to goodwill (if any). Also, determine any annual amortizations for excess fair value assignments. Show your calculations. (4 points) b. Determine the gross profit held in ending inventory at December 31, 2020 and December 31, 2021. The gross profit represents the profit on intra-entity sales that have not been sold to parties outside the consolidated entity. Show your calculations. (2 points) c. McDavid's Investment in Stacey balance is $411,000 at the end of 2021. Prepare a reconciliation from the date of acquisition to December 31, 2021 that explains this balance. d. Prepare the worksheet journal entries that would be used to prepare the consolidated balance sheet as of December 31, 2021. Each journal entry should be labelled either by a letter or number to cross reference on the worksheet. Provide a short description for each journal entry. (5 points) e. Prepare a consolidated worksheet to determine appropriate balances for the consolidated balance sheet as of December 31, 2021. Be sure to cross reference each journal entry on the worksheet. (10 points)