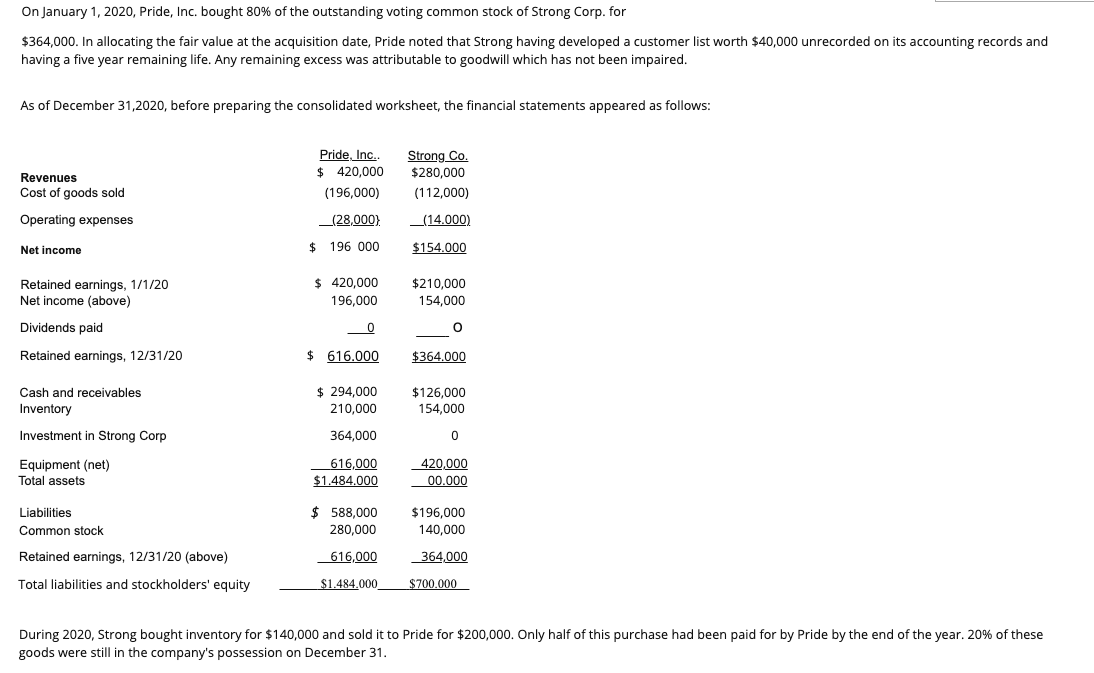

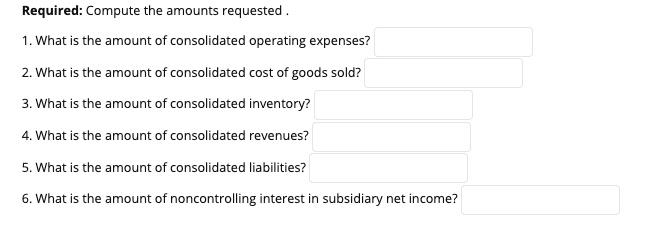

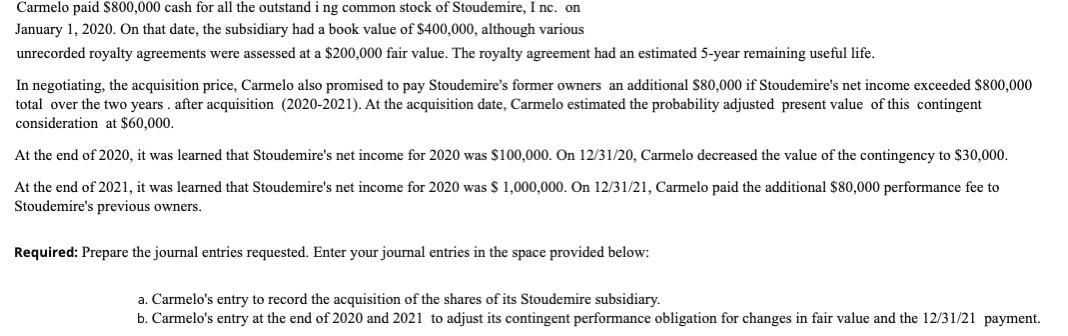

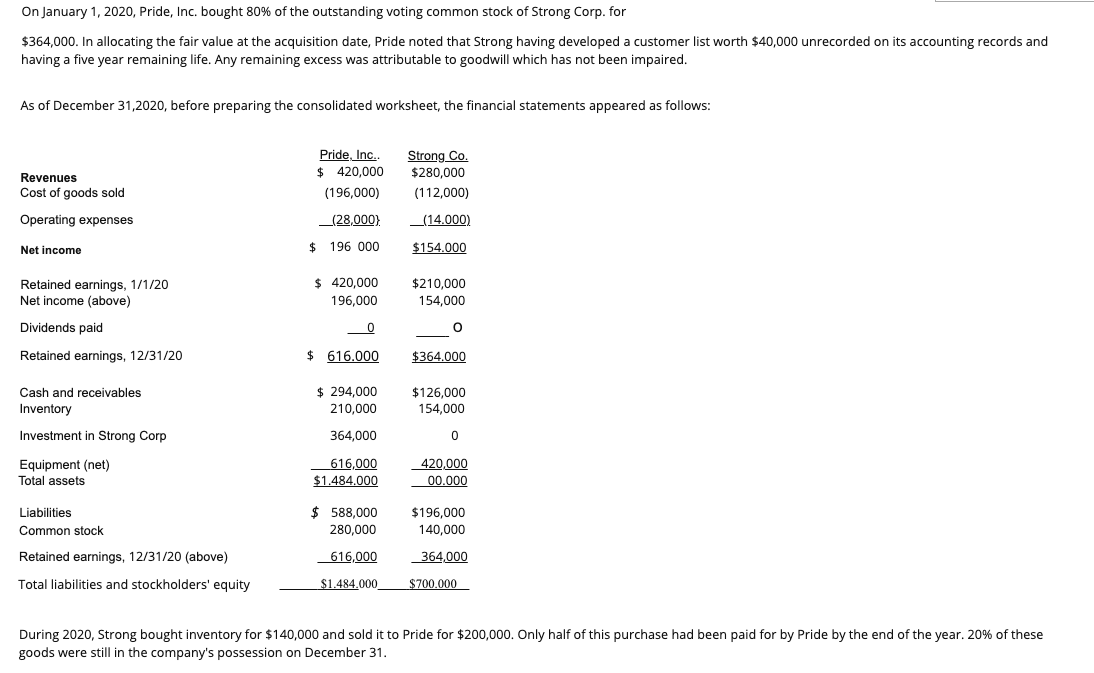

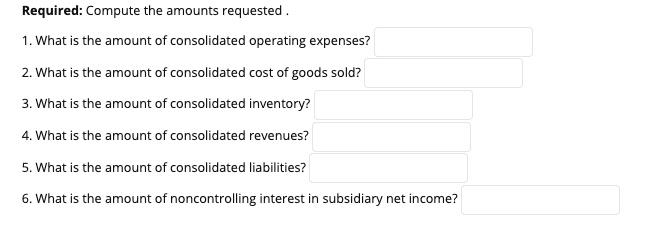

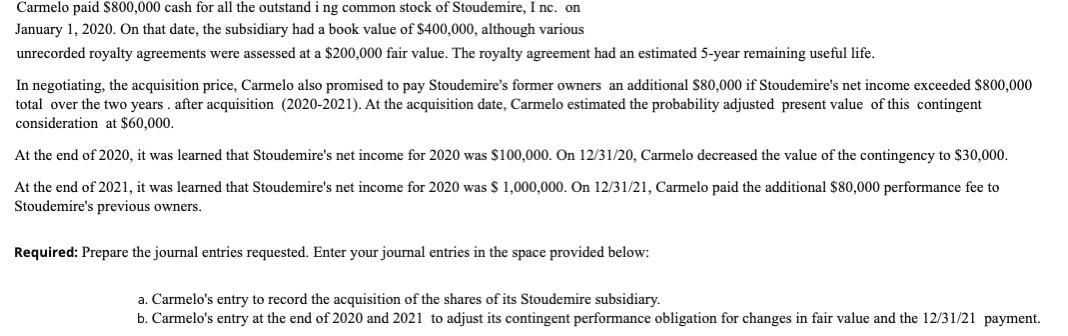

On January 1, 2020, Pride, Inc. bought 80% of the outstanding voting common stock of Strong Corp. for $364,000. In allocating the fair value at the acquisition date, Pride noted that Strong having developed a customer list worth $40,000 unrecorded on its accounting records and having a five year remaining life. Any remaining excess was attributable to goodwill which has not been impaired. As of December 31,2020, before preparing the consolidated worksheet, the financial statements appeared as follows: Revenues Cost of goods sold Pride, Inc. $ 420,000 (196,000) _(28,000) Strong Co. $280,000 (112,000) Operating expenses _(14.000) Net income $ 196 000 $154.000 Retained earnings, 1/1/20 Net income (above) $ 420,000 196,000 $210,000 154,000 Dividends paid 0 Retained earnings, 12/31/20 $ 616.000 $364.000 Cash and receivables Inventory $ 294,000 210,000 $126,000 154,000 Investment in Strong Corp 364,000 0 Equipment (net) Total assets 616,000 $1.484.000 420.000 00.000 Liabilities Common stock $ 588,000 280,000 $196,000 140,000 Retained earnings, 12/31/20 (above) 616,000 364,000 Total liabilities and stockholders' equity $1.484.000 $700.000 During 2020, Strong bought inventory for $140,000 and sold it to Pride for $200,000. Only half of this purchase had been paid for by Pride by the end of the year. 20% of these goods were still in the company's possession on December 31. Required: Compute the amounts requested. 1. What is the amount of consolidated operating expenses? 2. What is the amount of consolidated cost of goods sold? 3. What is the amount of consolidated inventory? 4. What is the amount of consolidated revenues? 5. What is the amount of consolidated liabilities? 6. What is the amount of noncontrolling interest in subsidiary net income? Carmelo paid $800,000 cash for all the outstand i ng common stock of Stoudemire, I nc. on January 1, 2020. On that date, the subsidiary had a book value of $400,000, although various unrecorded royalty agreements were assessed at a $200,000 fair value. The royalty agreement had an estimated 5-year remaining useful life. In negotiating, the acquisition price, Carmelo also promised to pay Stoudemire's former owners an additional $80,000 if Stoudemire's net income exceeded $800,000 total over the two years after acquisition (2020-2021). At the acquisition date, Carmelo estimated the probability adjusted present value of this contingent consideration at $60,000. At the end of 2020, it was learned that Stoudemire's net income for 2020 was $100,000. On 12/31/20, Carmelo decreased the value of the contingency to $30,000. At the end of 2021, it was learned that Stoudemire's net income for 2020 was $ 1,000,000. On 12/31/21, Carmelo paid the additional $80,000 performance fee to Stoudemire's previous owners. Required: Prepare the journal entries requested. Enter your journal entries in the space provided below: a. Carmelo's entry to record the acquisition of the shares of its Stoudemire subsidiary. b. Carmelo's entry at the end of 2020 and 2021 to adjust its contingent performance obligation for changes in fair value and the 12/31/21 payment