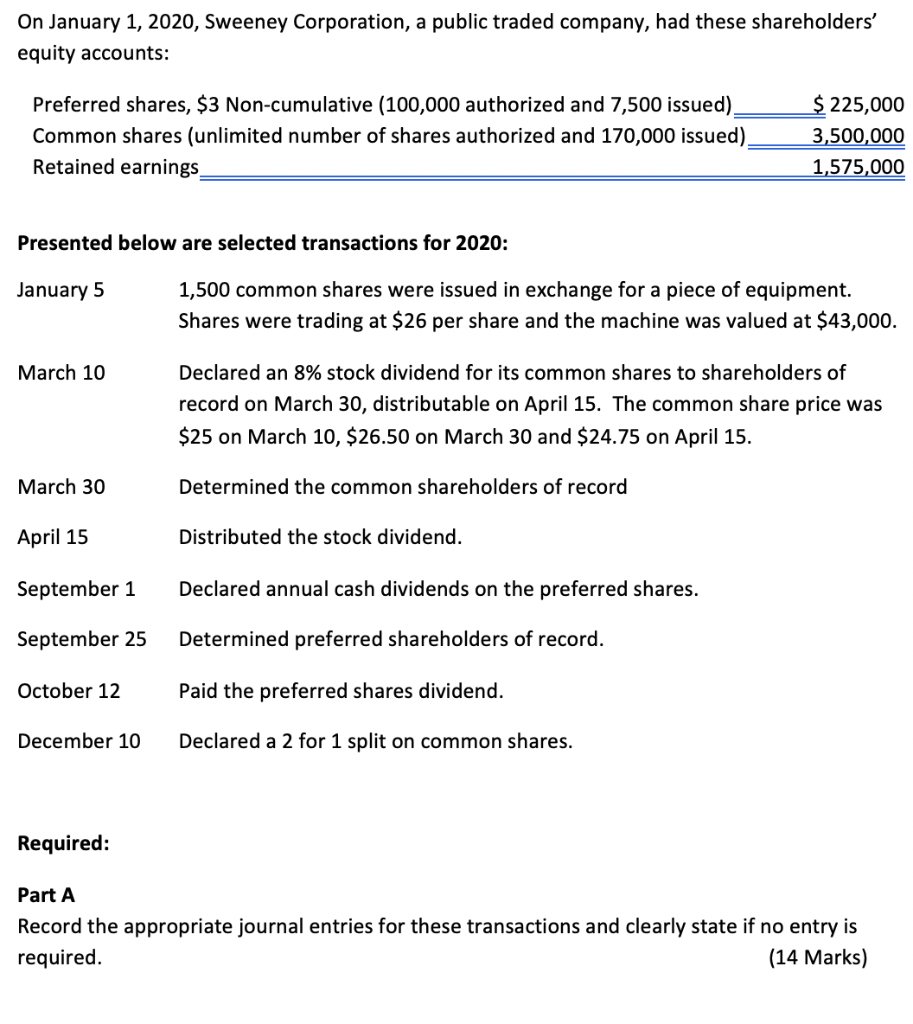

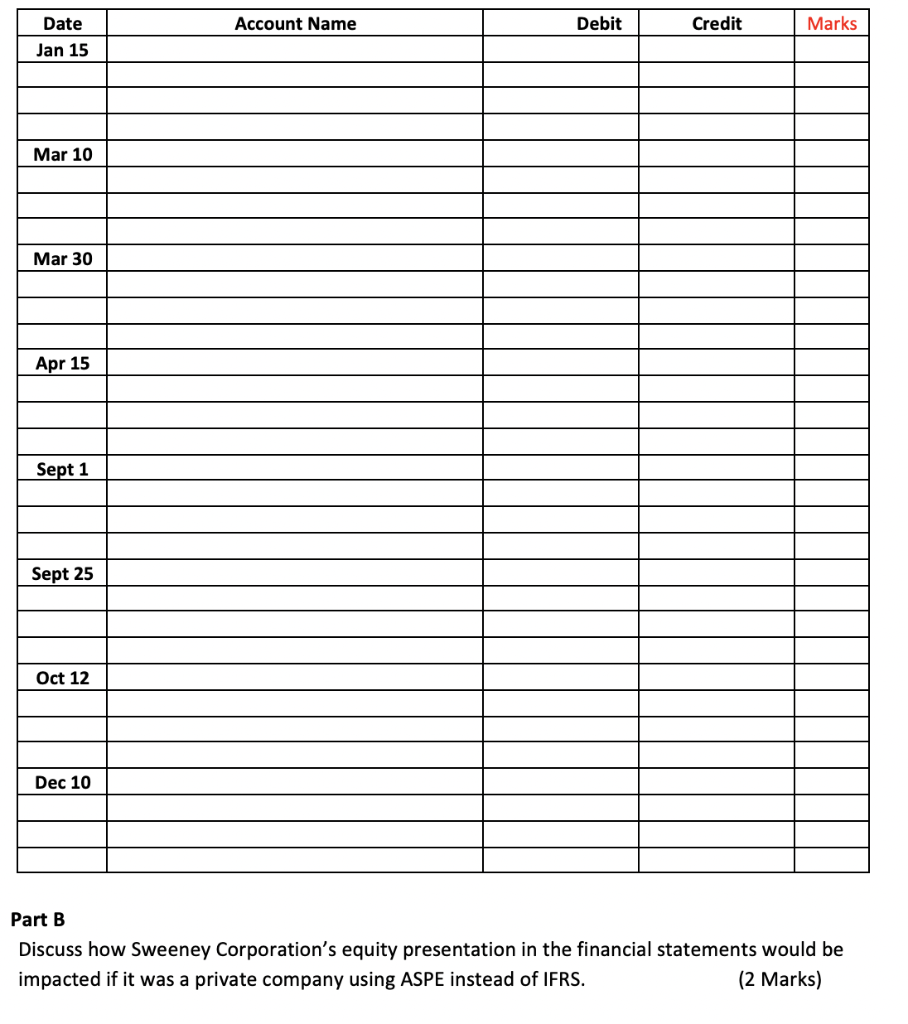

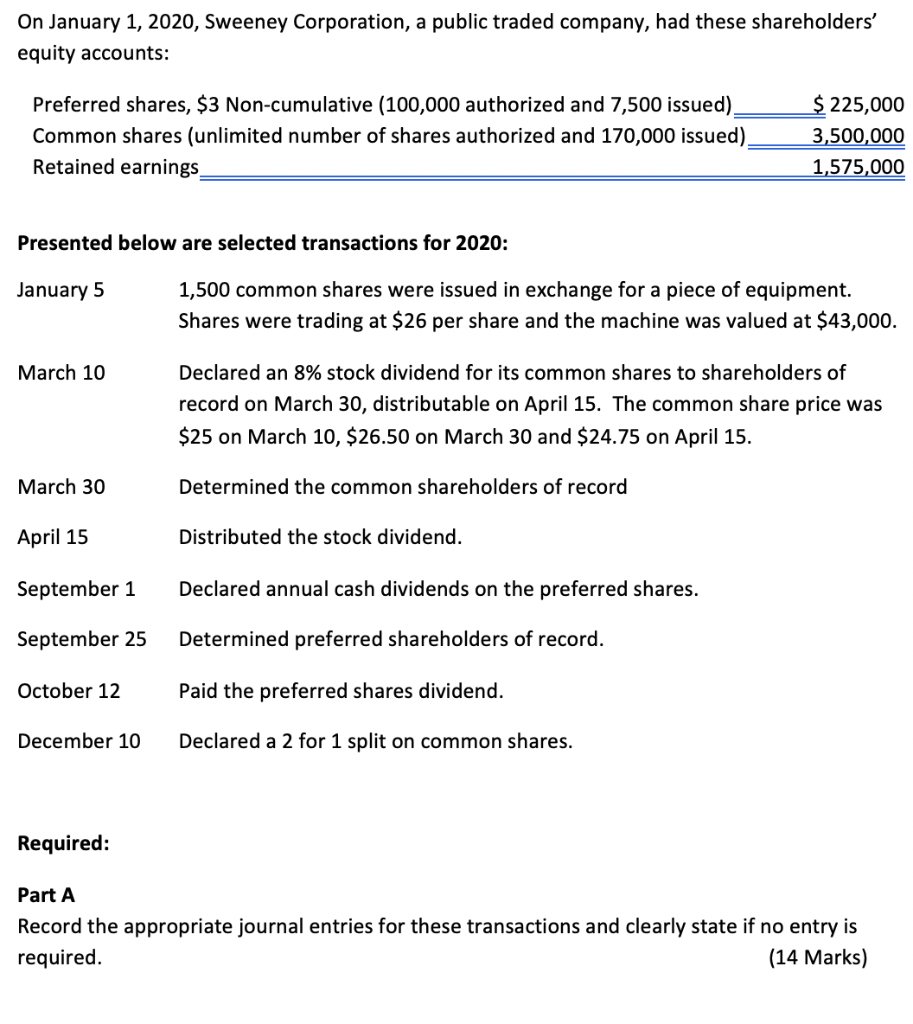

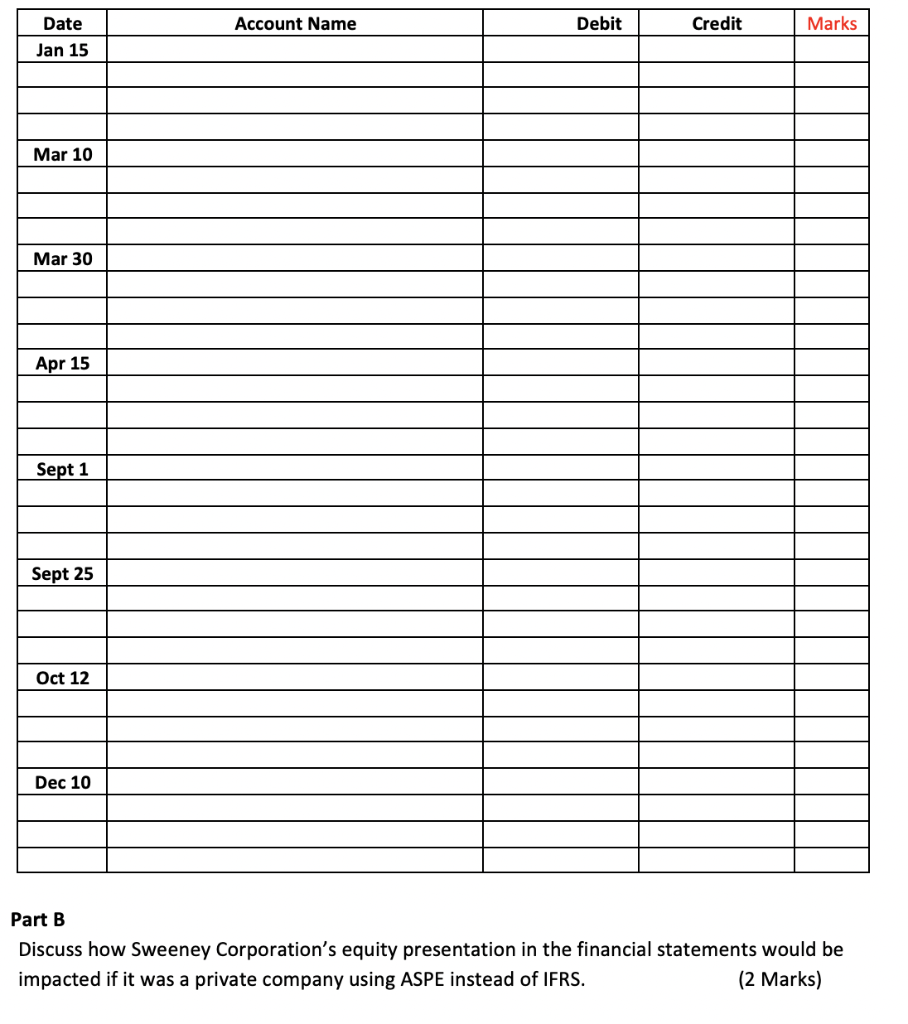

On January 1, 2020, Sweeney Corporation, a public traded company, had these shareholders' equity accounts: Preferred shares, $3 Non-cumulative (100,000 authorized and 7,500 issued). Common shares (unlimited number of shares authorized and 170,000 issued) Retained earnings $ 225,000 3,500,000 1,575,000 Presented below are selected transactions for 2020: January 5 1,500 common shares were issued in exchange for a piece of equipment. Shares were trading at $26 per share and the machine was valued at $43,000. March 10 Declared an 8% stock dividend for its common shares to shareholders of record on March 30, distributable on April 15. The common share price was $25 on March 10, $26.50 on March 30 and $24.75 on April 15. March 30 Determined the common shareholders of record April 15 Distributed the stock dividend. September 1 Declared annual cash dividends on the preferred shares. September 25 Determined preferred shareholders of record. October 12 Paid the preferred shares dividend. December 10 Declared a 2 for 1 split on common shares. Required: Part A Record the appropriate journal entries for these transactions and clearly state if no entry is required. (14 Marks) Account Name Debit Credit Marks Date Jan 15 Mar 10 Mar 30 Apr 15 Sept 1 Sept 25 Oct 12 Dec 10 Part B Discuss how Sweeney Corporation's equity presentation in the financial statements would be impacted if it was a private company using ASPE instead of IFRS. (2 Marks) On January 1, 2020, Sweeney Corporation, a public traded company, had these shareholders' equity accounts: Preferred shares, $3 Non-cumulative (100,000 authorized and 7,500 issued). Common shares (unlimited number of shares authorized and 170,000 issued) Retained earnings $ 225,000 3,500,000 1,575,000 Presented below are selected transactions for 2020: January 5 1,500 common shares were issued in exchange for a piece of equipment. Shares were trading at $26 per share and the machine was valued at $43,000. March 10 Declared an 8% stock dividend for its common shares to shareholders of record on March 30, distributable on April 15. The common share price was $25 on March 10, $26.50 on March 30 and $24.75 on April 15. March 30 Determined the common shareholders of record April 15 Distributed the stock dividend. September 1 Declared annual cash dividends on the preferred shares. September 25 Determined preferred shareholders of record. October 12 Paid the preferred shares dividend. December 10 Declared a 2 for 1 split on common shares. Required: Part A Record the appropriate journal entries for these transactions and clearly state if no entry is required. (14 Marks) Account Name Debit Credit Marks Date Jan 15 Mar 10 Mar 30 Apr 15 Sept 1 Sept 25 Oct 12 Dec 10 Part B Discuss how Sweeney Corporation's equity presentation in the financial statements would be impacted if it was a private company using ASPE instead of IFRS. (2 Marks)