Question

On January 1, 2020, the dental partnership of Angela, Diaz, and Krause was formed when the partners contributed $42,000, $65,000, and $72,000, respectively. Over the

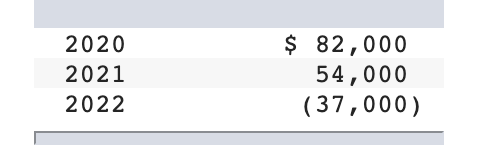

On January 1, 2020, the dental partnership of Angela, Diaz, and Krause was formed when the partners contributed $42,000, $65,000, and $72,000, respectively. Over the next three years, the business reported net income and (loss) as follows

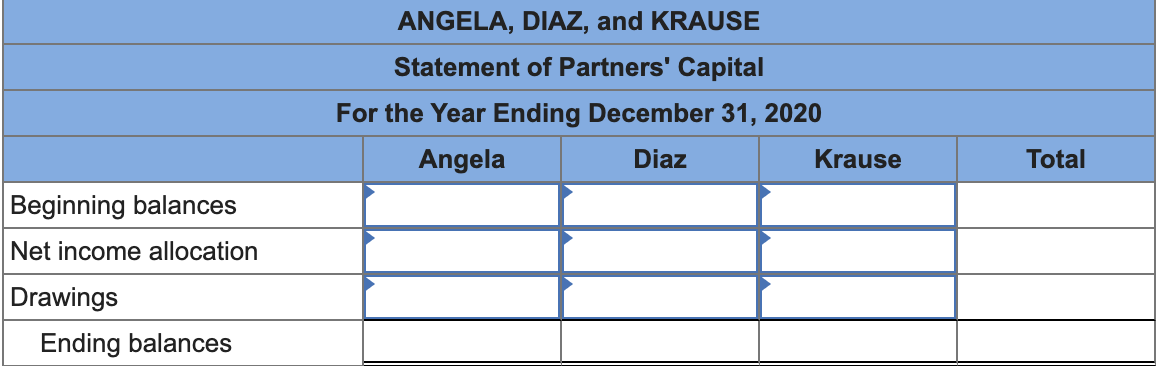

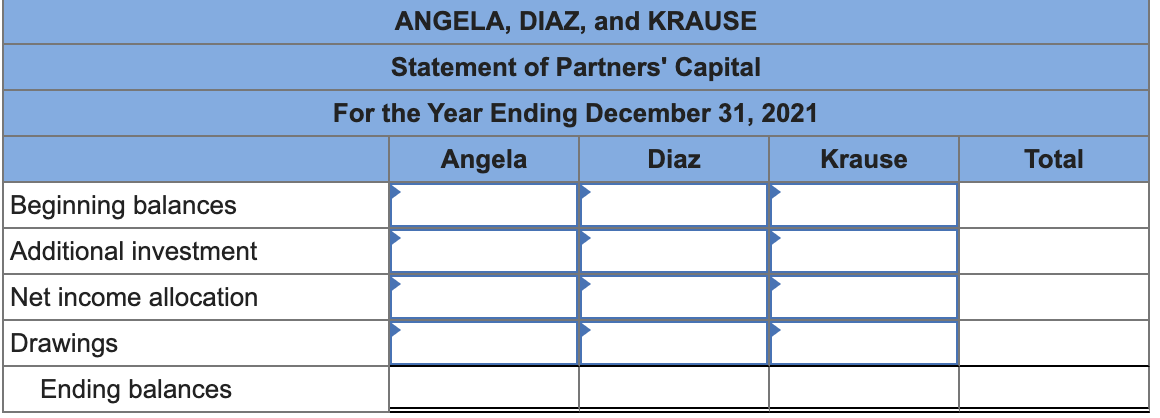

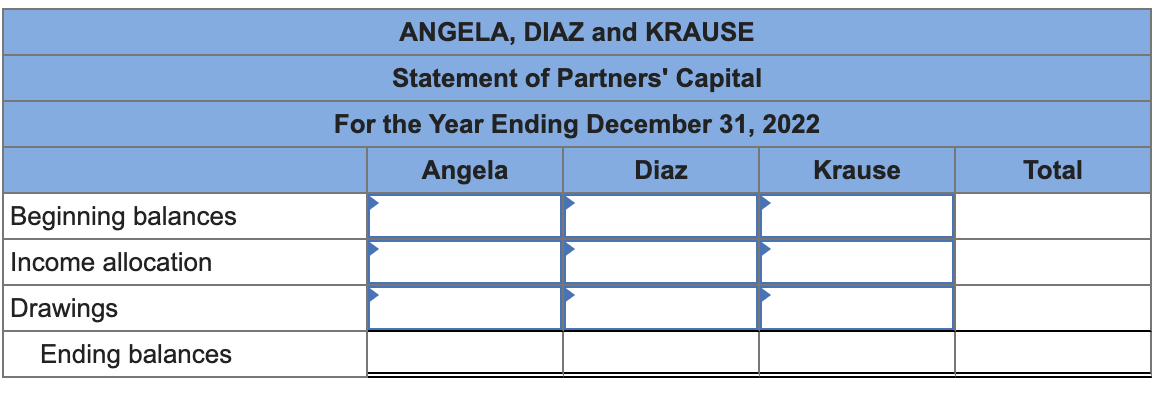

During this period, each partner withdrew cash of $14,000 per year. Krause invested an additional $4,000 in cash on February 9, 2021.

At the time that the partnership was created, the three partners agreed to allocate all profits and losses according to a specified plan written as follows:

- Each partner is entitled to interest computed at the rate of 10 percent per year based on the individual capital balances at the beginning of that year.

- Because of prior work experience, Angela is entitled to an annual salary allowance of $11,500 per year, and Diaz is entitled to an annual salary allowance of $10,200 per year.

- Any remaining profit will be split as follows: Angela, 20 percent; Diaz, 35 percent; and Krause, 45 percent. If a net loss remains after the initial allocations to the partners, the balance will be allocated: Angela, 30 percent; Diaz, 45 percent; and Krause, 25 percent.

Prepare a schedule that determines the ending capital balance for each partner as of the end of each of these three years.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started