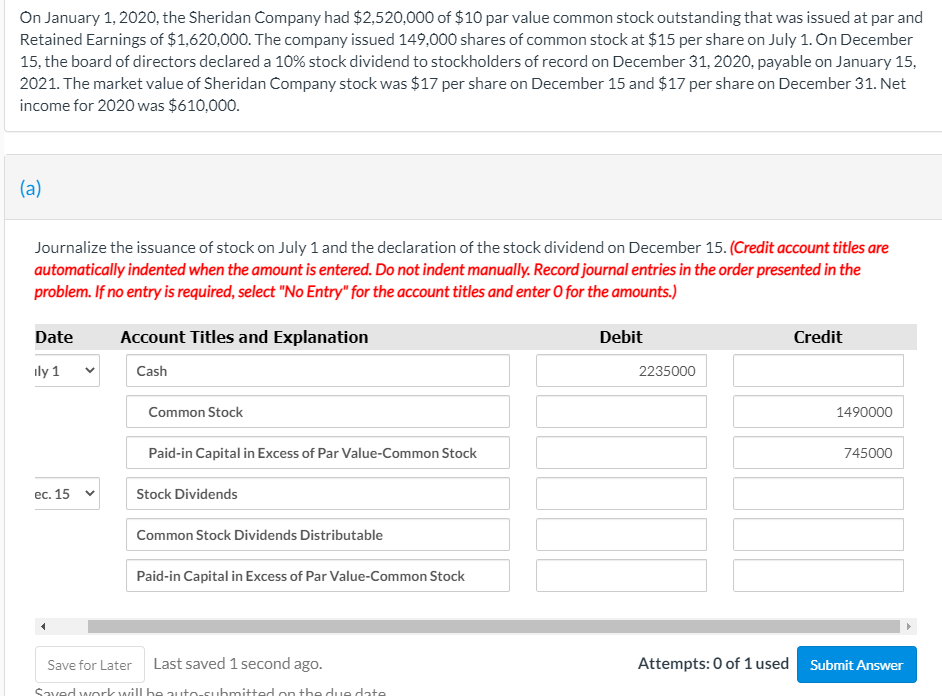

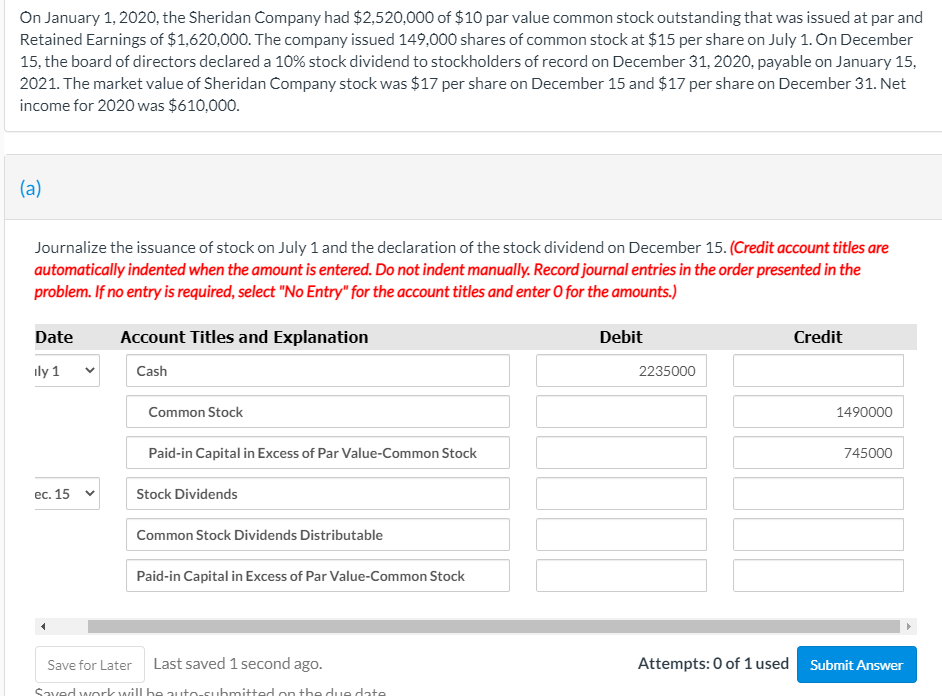

On January 1, 2020, the Sheridan Company had $2,520,000 of $10 par value common stock outstanding that was issued at par and Retained Earnings of $1,620,000. The company issued 149,000 shares of common stock at $15 per share on July 1. On December 15, the board of directors declared a 10% stock dividend to stockholders of record on December 31, 2020, payable on January 15, 2021. The market value of Sheridan Company stock was $17 per share on December 15 and $17 per share on December 31. Net income for 2020 was $610,000. (a) Journalize the issuance of stock on July 1 and the declaration of the stock dividend on December 15. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. Record journal entries in the order presented in the problem. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Date Debit Credit Account Titles and Explanation Cash ily 1 2235000 Common Stock 1490000 Paid-in Capital in Excess of Par Value-Common Stock 745000 ec. 15 Stock Dividends Common Stock Dividends Distributable Paid-in Capital in Excess of Par Value-Common Stock Save for Later Last saved 1 second ago. Attempts: 0 of 1 used Submit Answer Saved work will be auto-cubmitted on the due date On January 1, 2020, the Sheridan Company had $2,520,000 of $10 par value common stock outstanding that was issued at par and Retained Earnings of $1,620,000. The company issued 149,000 shares of common stock at $15 per share on July 1. On December 15, the board of directors declared a 10% stock dividend to stockholders of record on December 31, 2020, payable on January 15, 2021. The market value of Sheridan Company stock was $17 per share on December 15 and $17 per share on December 31. Net income for 2020 was $610,000. (a) Journalize the issuance of stock on July 1 and the declaration of the stock dividend on December 15. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. Record journal entries in the order presented in the problem. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Date Debit Credit Account Titles and Explanation Cash ily 1 2235000 Common Stock 1490000 Paid-in Capital in Excess of Par Value-Common Stock 745000 ec. 15 Stock Dividends Common Stock Dividends Distributable Paid-in Capital in Excess of Par Value-Common Stock Save for Later Last saved 1 second ago. Attempts: 0 of 1 used Submit Answer Saved work will be auto-cubmitted on the due date