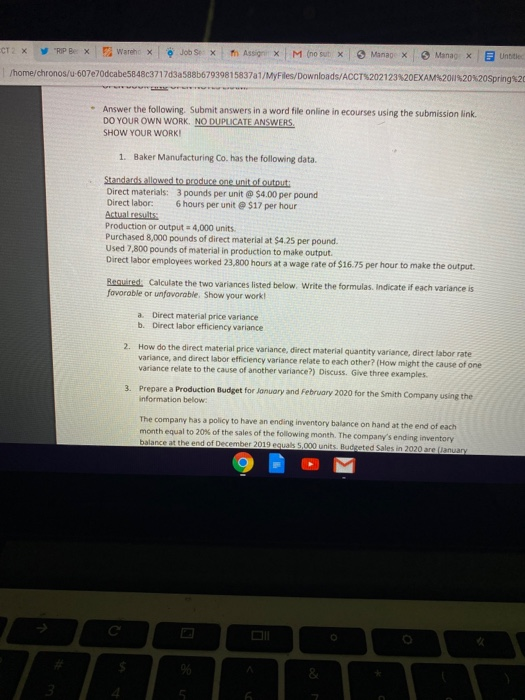

CT2 X "RIP Bex Warehe Job Sex Assign X M (no sut x 3 Manage Manag X Untitle /home/chronos/u-607e70dcabe5848c3717d3a588b67939815837a1/MyFiles/Downloads/ACCT202123%20EXAM%201%20%20Spring 20 Answer the following Submit answers in a word file online in ecourses using the submission link. DO YOUR OWN WORK. NO DUPLICATE ANSWERS SHOW YOUR WORK! 1. Baker Manufacturing Co. has the following data. Standards allowed to produce one unit of outout: Direct materials: 3 pounds per unit @ $4.00 per pound Direct labor: 6 hours per unit @ $17 per hour Actual results Production or output = 4,000 units. Purchased 8,000 pounds of direct material at $4.25 per pound. Used 7,800 pounds of material in production to make output. Direct labor employees worked 23,800 hours at a wage rate of $16.75 per hour to make the output. Required. Calculate the two variances listed below. Write the formulas. Indicate if each variance is favorable or unfavorable. Show your work! a Direct material price variance b. Direct labor efficiency variance 2. How do the direct material price variance, direct material quantity variance, direct labor rate variance, and direct labor efficiency variance relate to each other? (How might the cause of one variance relate to the cause of another variance?) Discuss Give three examples. 3. Prepare a Production Budget for January and February 2020 for the Smith Company using the information below: The company has a policy to have an ending inventory balance on hand at the end of each month equal to 20% of the sales of the following month. The company's ending inventory balance at the end of December 2019 equals 5,000 units Budgeted Sales in 2020 are anuary CT2 X "RIP Bex Warehe Job Sex Assign X M (no sut x 3 Manage Manag X Untitle /home/chronos/u-607e70dcabe5848c3717d3a588b67939815837a1/MyFiles/Downloads/ACCT202123%20EXAM%201%20%20Spring 20 Answer the following Submit answers in a word file online in ecourses using the submission link. DO YOUR OWN WORK. NO DUPLICATE ANSWERS SHOW YOUR WORK! 1. Baker Manufacturing Co. has the following data. Standards allowed to produce one unit of outout: Direct materials: 3 pounds per unit @ $4.00 per pound Direct labor: 6 hours per unit @ $17 per hour Actual results Production or output = 4,000 units. Purchased 8,000 pounds of direct material at $4.25 per pound. Used 7,800 pounds of material in production to make output. Direct labor employees worked 23,800 hours at a wage rate of $16.75 per hour to make the output. Required. Calculate the two variances listed below. Write the formulas. Indicate if each variance is favorable or unfavorable. Show your work! a Direct material price variance b. Direct labor efficiency variance 2. How do the direct material price variance, direct material quantity variance, direct labor rate variance, and direct labor efficiency variance relate to each other? (How might the cause of one variance relate to the cause of another variance?) Discuss Give three examples. 3. Prepare a Production Budget for January and February 2020 for the Smith Company using the information below: The company has a policy to have an ending inventory balance on hand at the end of each month equal to 20% of the sales of the following month. The company's ending inventory balance at the end of December 2019 equals 5,000 units Budgeted Sales in 2020 are anuary