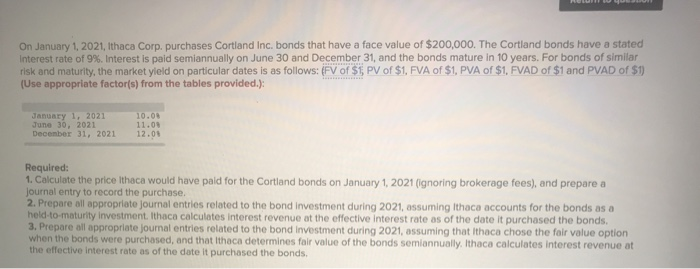

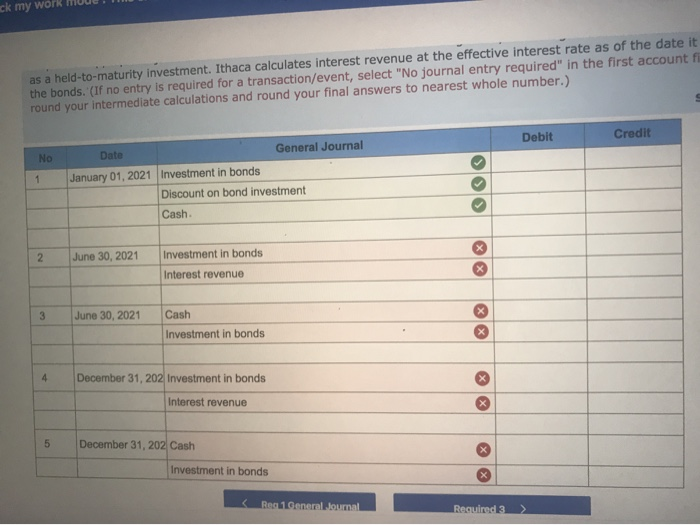

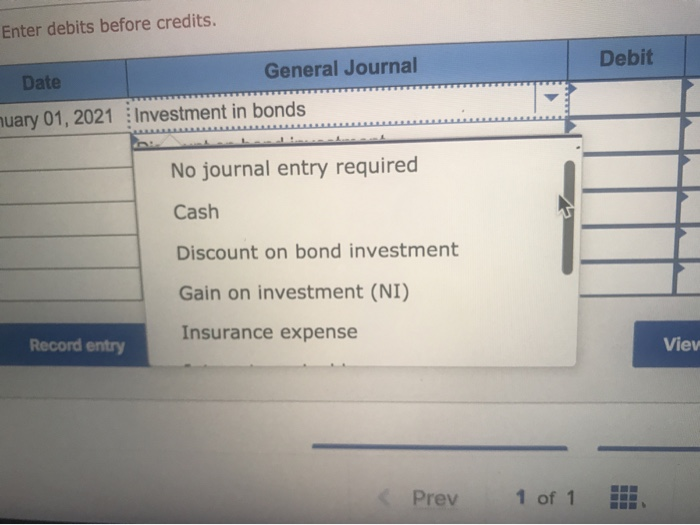

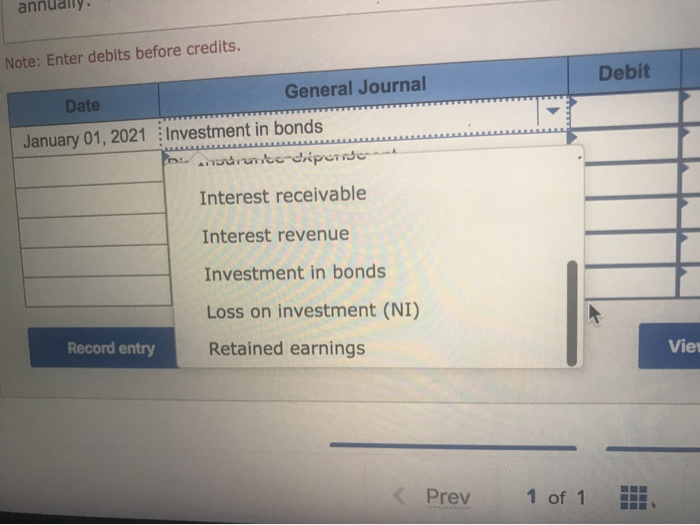

On January 1, 2021, Ithaca Corp. purchases Cortland Inc, bonds that have a face value of $200,000. The Cortland bonds have a stated Interest rate of 9%. Interest is paid semiannually on June 30 and December 31, and the bonds mature in 10 years. For bonds of similar risk and maturity, the market yield on particular dates is as follows: (FV of $f PV of $1. FVA of $1, PVA of $1. FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.): January 1, 2021 June 30, 2021 December 31, 2021 10.08 11.09 12.05 Required: 1. Calculate the price Ithaca would have paid for the Cortland bonds on January 1, 2021 (ignoring brokerage fees), and prepare a Journal entry to record the purchase. 2. Prepare all appropriate journal entries related to the bond Investment during 2021, assuming Ithaca accounts for the bonds as a held-to-maturity Investment. Ithaca calculates interest revenue at the effective interest rate as of the date it purchased the bonds. 3. Prepare all appropriate journal entries related to the bond Investment during 2021, assuming that Ithaca chose the fair value option when the bonds were purchased, and that Ithaca determines fair value of the bonds semiannually. Ithaca calculates interest revenue at the effective interest rate as of the date it purchased the bonds. ck my work Me.Me as a held-to-maturity investment. Ithaca calculates interest revenue at the effective interest rate as of the date it the bonds. (If no entry is required for a transaction/event, select "No journal entry required" in the first account fi round your intermediate calculations and round your final answers to nearest whole number.) Debit Credit No 1 Date General Journal January 01, 2021 Investment in bonds Discount on bond investment Cash 2 June 30, 2021 Investment in bonds Interest revenue 3 June 30, 2021 Cash Investment in bonds December 31, 202 Investment in bonds Interest revenue 5 December 31, 202 Cash Investment in bonds Enter debits before credits. Debit Date General Journal nuary 01, 2021 : Investment in bonds No journal entry required Cash Discount on bond investment Gain on investment (NI) Insurance expense Record entry Viev Prev 1 of 1 ! annually. Note: Enter debits before credits. Debit Date General Journal January 01, 2021 : Investment in bonds u drumice-crpetrder- Interest receivable Interest revenue Investment in bonds Loss on investment (NI) Record entry Retained earnings Viet Prev 1 of 1 HH