Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2021, Kingbird Co. started its merchandising business and at the end of the year had accounts receivable of $600,000. On January

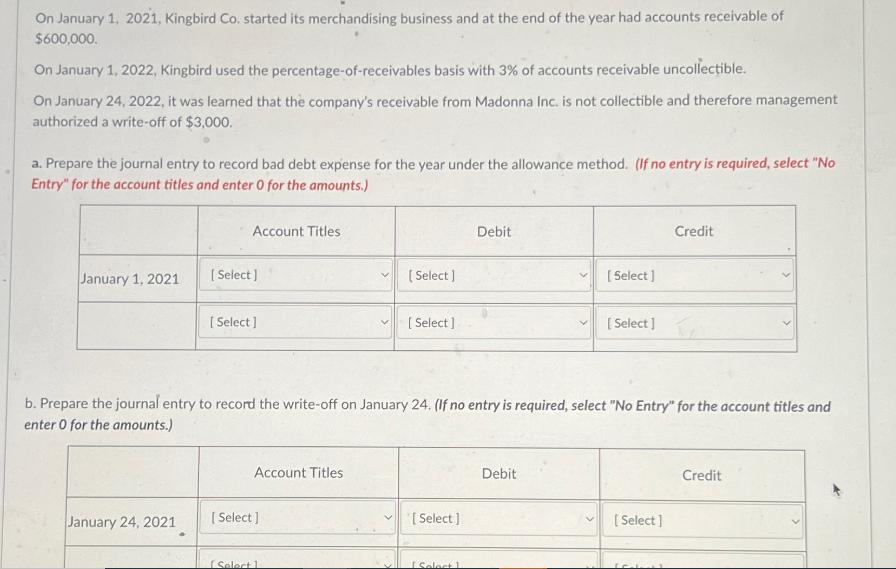

On January 1, 2021, Kingbird Co. started its merchandising business and at the end of the year had accounts receivable of $600,000. On January 1, 2022, Kingbird used the percentage-of-receivables basis with 3% of accounts receivable uncollectible. On January 24, 2022, it was learned that the company's receivable from Madonna Inc. is not collectible and therefore management authorized a write-off of $3,000. a. Prepare the journal entry to record bad debt expense for the year under the allowance method. (If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Account Titles January 1, 2021 [Select] [Select] [Select] [Select] Debit [Select] [Select] Credit b. Prepare the journal entry to record the write-off on January 24. (If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) January 24, 2021 [Select] [Select] Account Titles [Select] Select 1 Debit [Select] Credit

Step by Step Solution

★★★★★

3.48 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Answer a The journal entry to record bad debt expense for the year unde...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663dfaa69533d_960693.pdf

180 KBs PDF File

663dfaa69533d_960693.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started