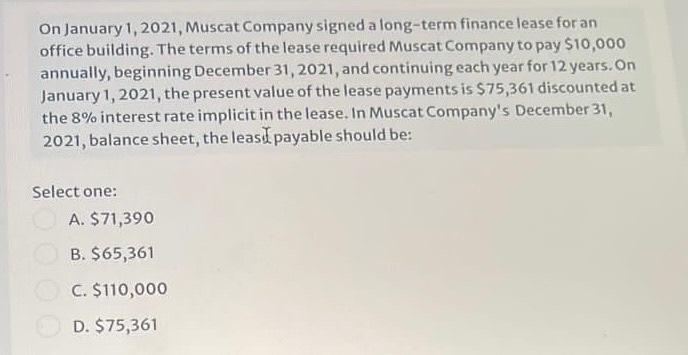

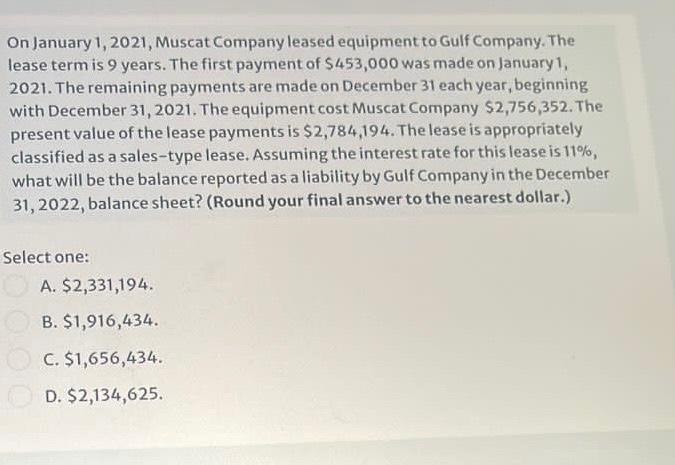

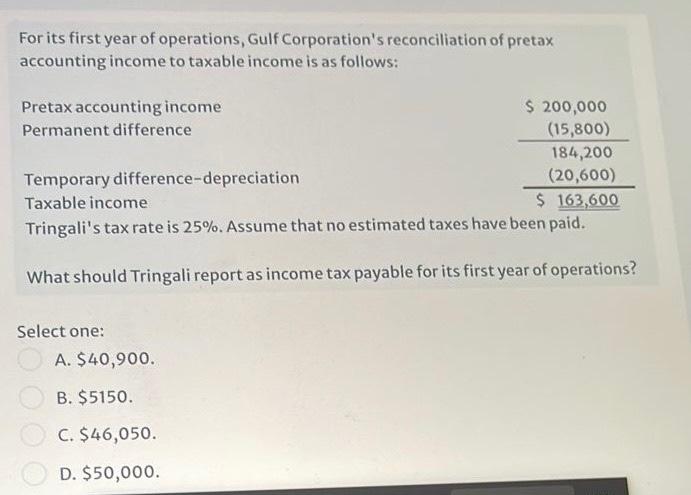

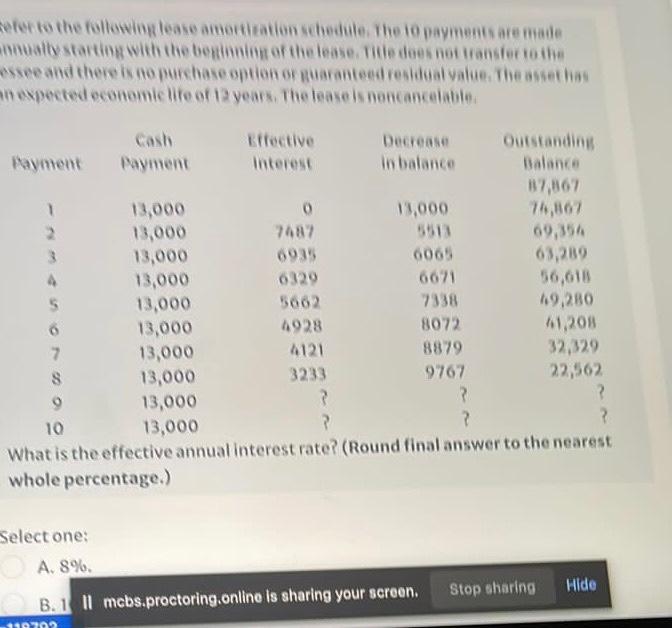

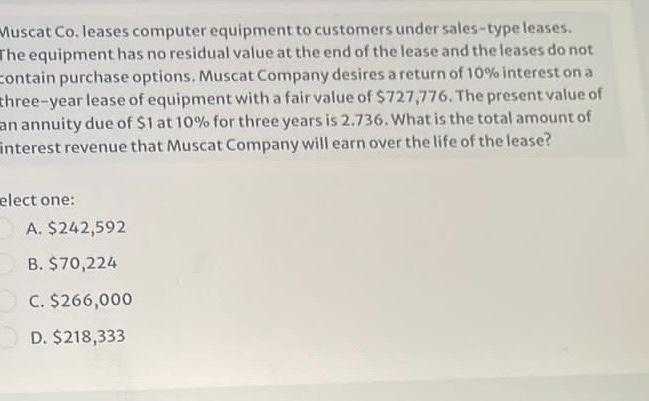

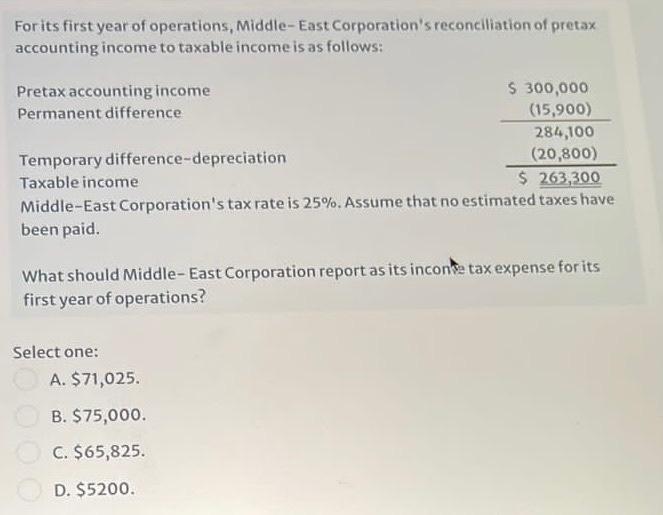

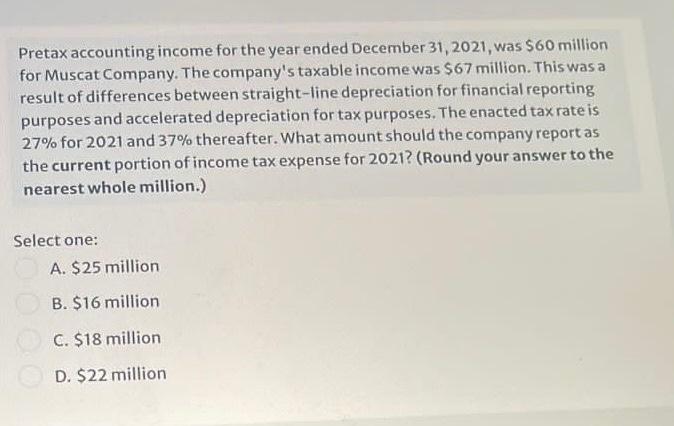

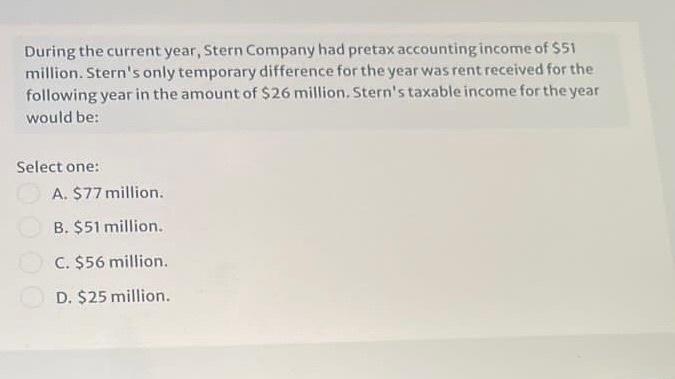

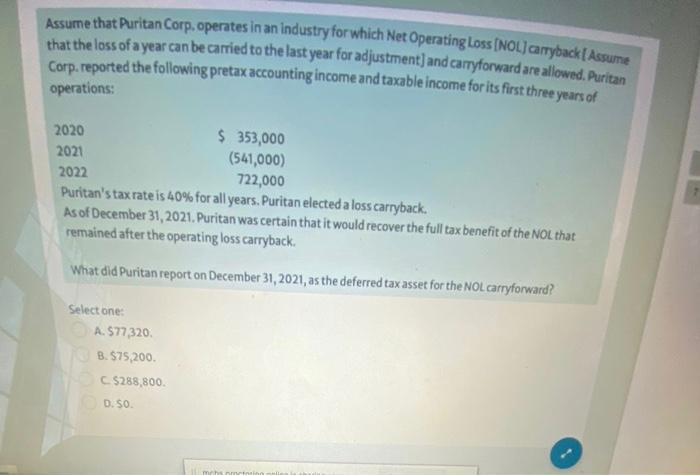

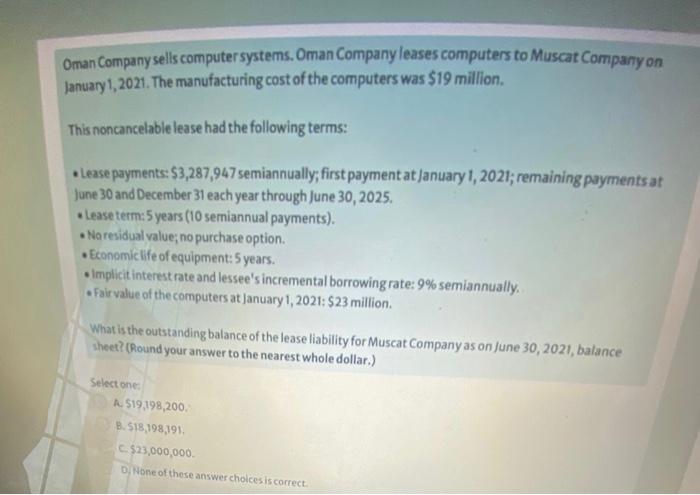

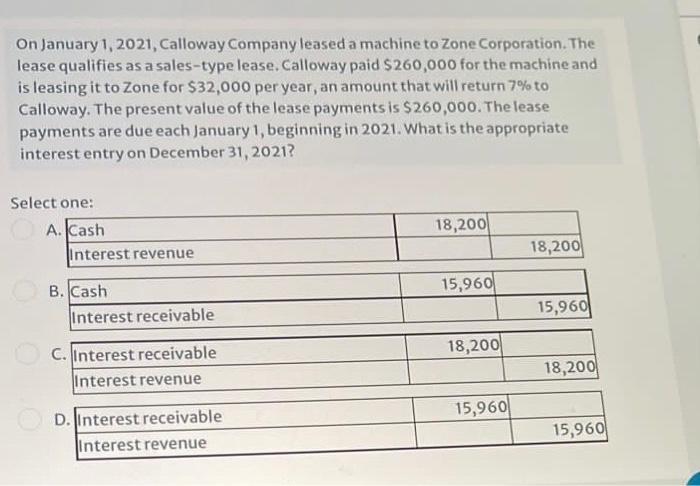

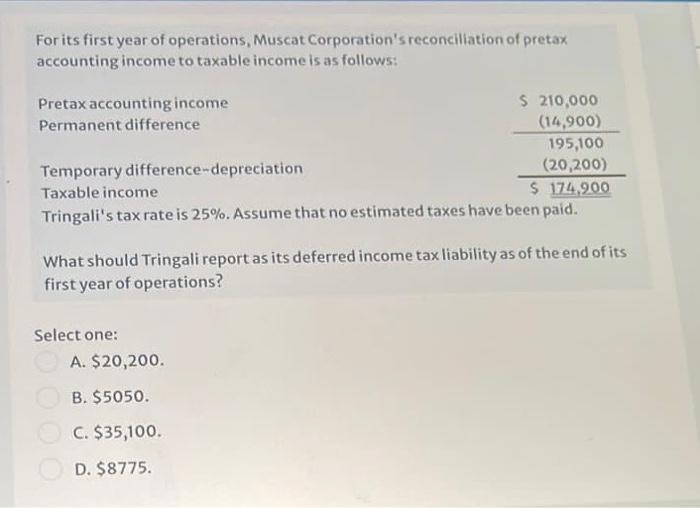

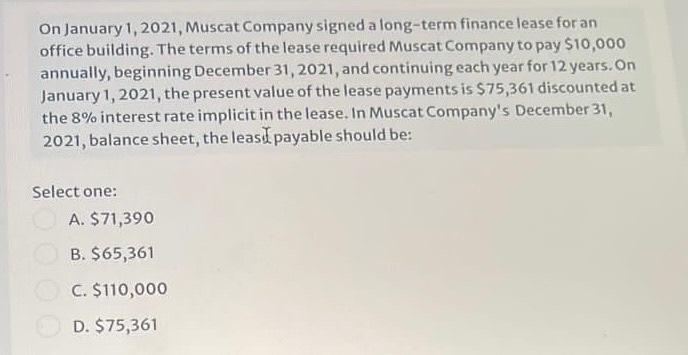

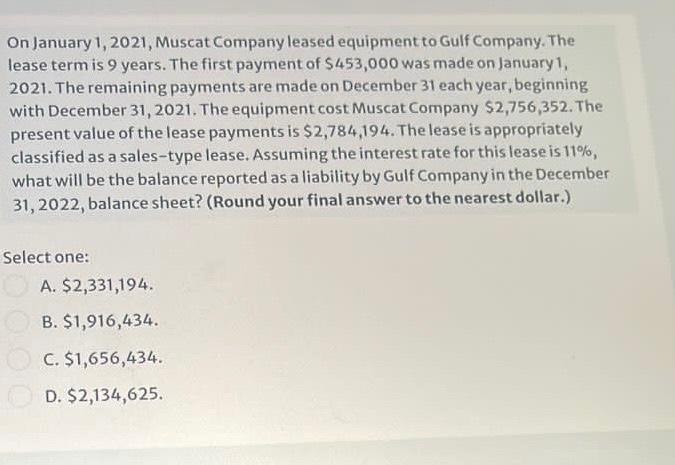

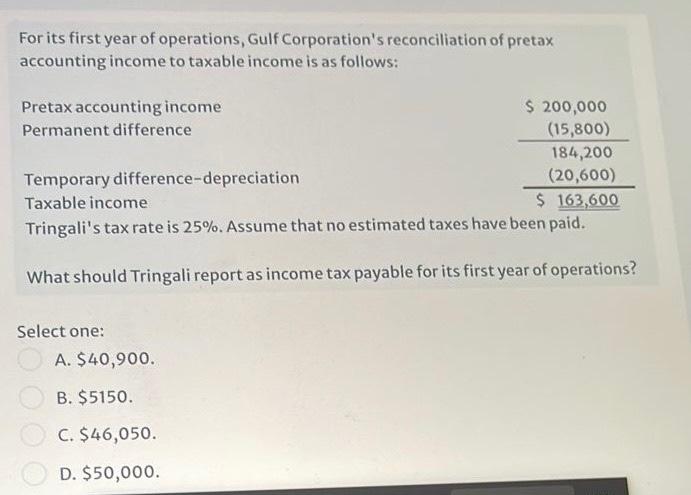

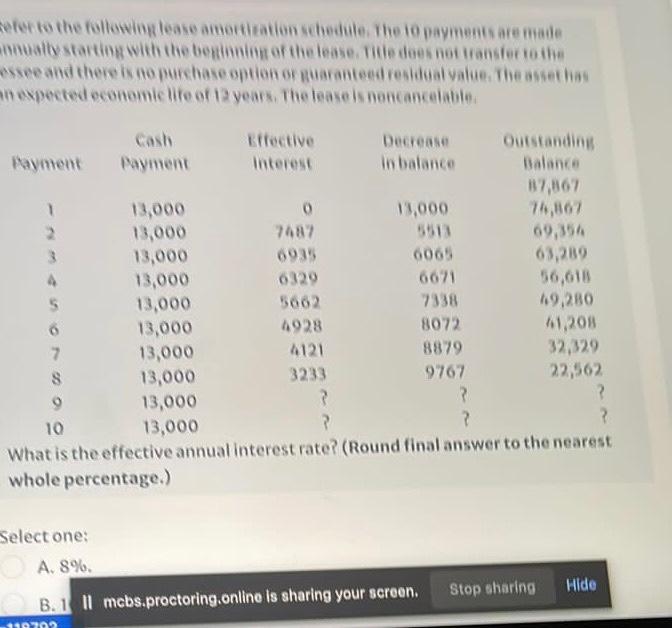

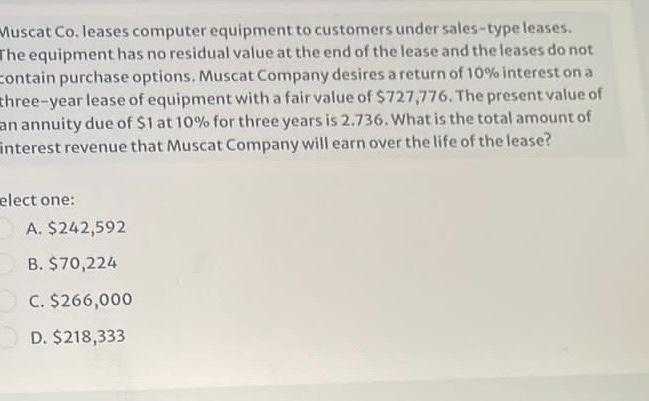

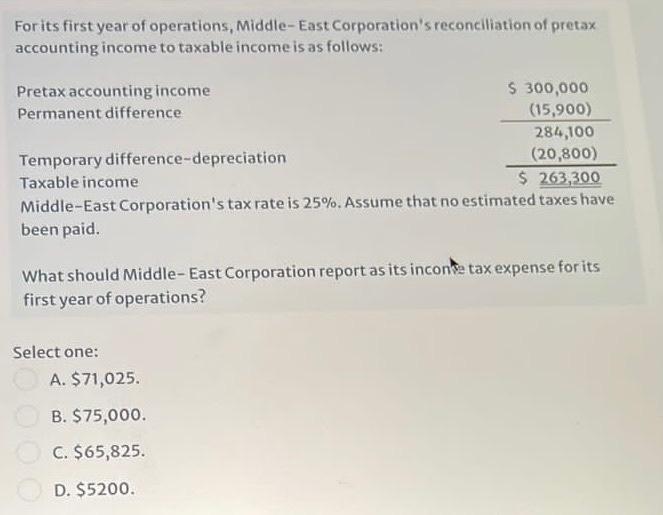

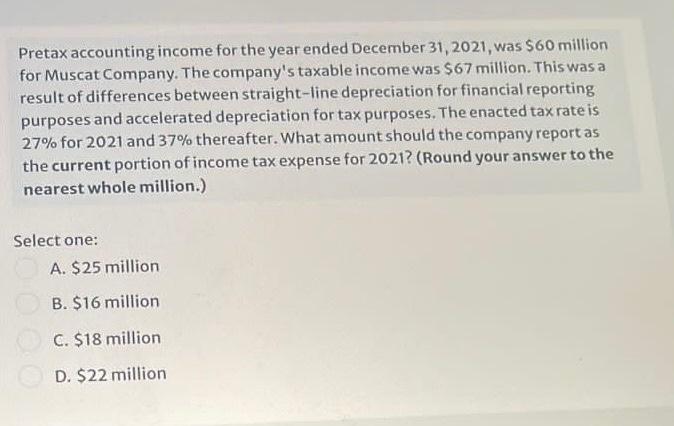

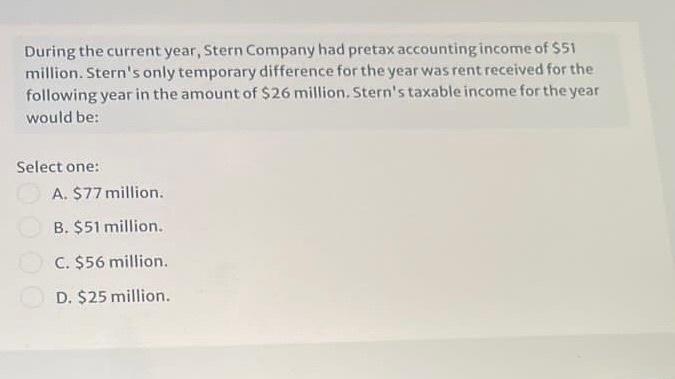

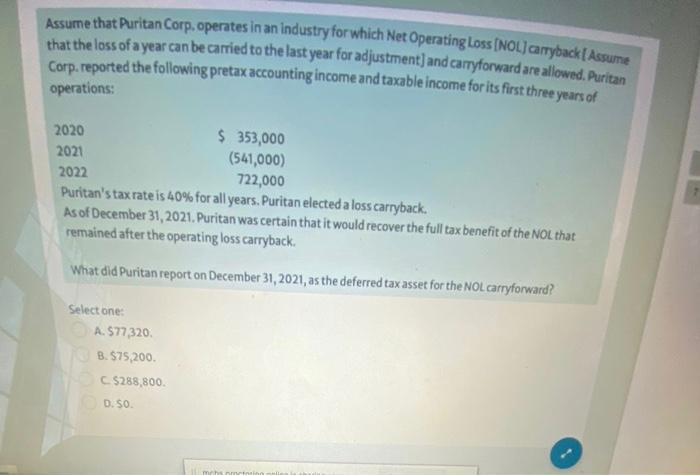

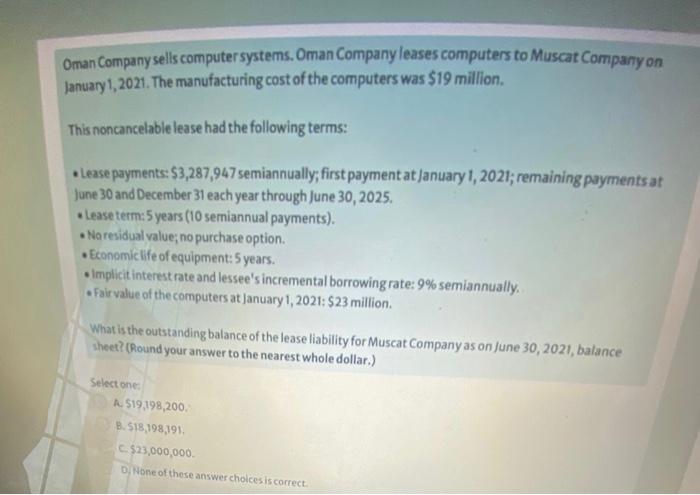

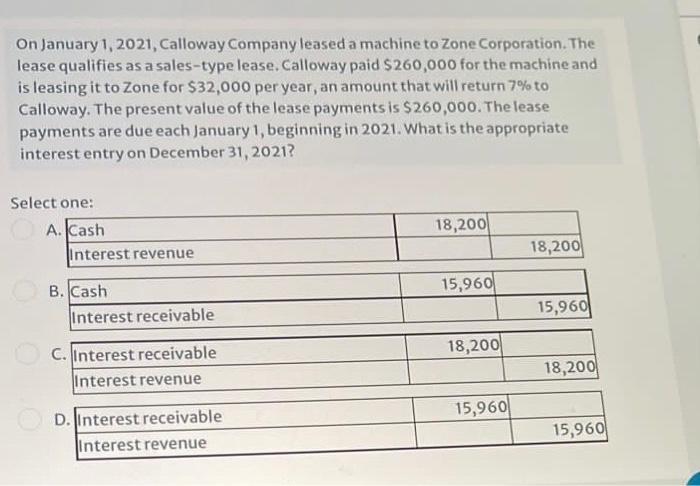

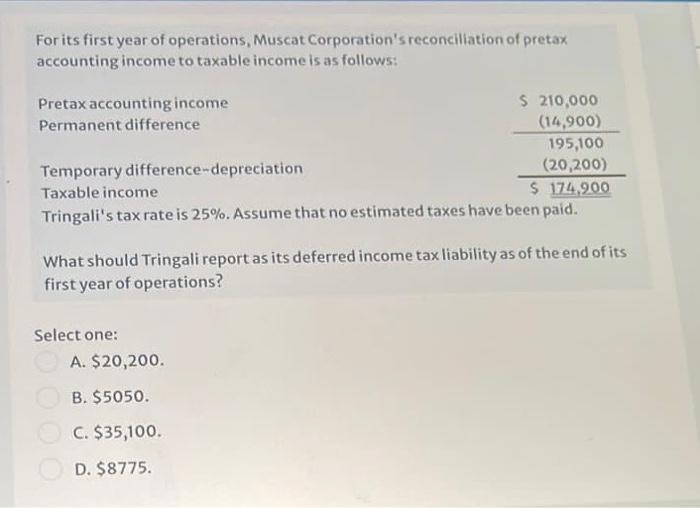

On January 1, 2021, Muscat Company signed a long-term finance lease foran office building. The terms of the lease required Muscat Company to pay $10,000 annually, beginning December 31, 2021, and continuing each year for 12 years. On January 1, 2021, the present value of the lease payments is $75,361 discounted at the 8% interest rate implicit in the lease. In Muscat Company's December 31, 2021, balance sheet, the least payable should be: Select one: A. $71,390 B. $65,361 C. $110,000 D. $75,361 On January 1, 2021, Muscat Company leased equipment to Gulf Company. The lease term is 9 years. The first payment of $453,000 was made on January 1, 2021. The remaining payments are made on December 31 each year, beginning with December 31, 2021. The equipment cost Muscat Company $2,756,352. The present value of the lease payments is $2,784,194. The lease is appropriately classified as a sales-type lease. Assuming the interest rate for this lease is 11%, what will be the balance reported as a liability by Gulf Company in the December 31, 2022, balance sheet? (Round your final answer to the nearest dollar.) Select one: A. $2,331,194. B. $1,916,434. C. $1,656,434. D. $2,134,625. For its first year of operations, Gulf Corporation's reconciliation of pretax accounting income to taxable income is as follows: Pretax accounting income $ 200,000 Permanent difference (15,800) 184,200 Temporary difference-depreciation (20,600) Taxable income $ 163,600 Tringali's tax rate is 25%. Assume that no estimated taxes have been paid. What should Tringali report as income tax payable for its first year of operations? Select one: A. $40,900. B. $5150. C. $46,050. D. $50,000. refer to the following lease amortization schedule. The to payments are made anually starting with the besinning of the lease. The does not transfer to the see and there is no purchase option or suaranteed residual value. The assethas nexpected economielite om 12 years. The tease is no cancelable Cash Effective Decrease Outstanding Payment Payment Interest Balance 87,867 13,000 0 13,000 74,867 2 13,000 7487 69,354 3 13,000 6935 6065 63,209 4 13,000 6329 6071 56,018 5 13,000 5662 19,280 6 13,000 4928 8072 41208 7 13,000 4121 8879 32,329 S 13,000 3233 9767 22,562 13,000 2 2 2 10 13,000 ? 2 2 What is the effective annual interest rate? (Round final answer to the nearest whole percentage.) Select one: A. 8%. Stop sharing Hide B.1 Il mcbs.proctoring online is sharing your screen. 99202 Muscat Co,leases computer equipment to customers under sales-type leases. The equipment has no residual value at the end of the lease and the leases do not contain purchase options. Muscat Company desires a return of 10% interest on a three-year lease of equipment with a fair value of $727,776. The present value of an annuity due of S1 at 10% for three years is 2.736. What is the total amount of interest revenue that Muscat Company will earn over the life of the lease? elect one: A. $242,592 B. $70,224 C. $266,000 D. $218,333 For its first year of operations, Middle-East Corporation's reconciliation of pretax accounting income to taxable income is as follows: Pretax accounting income S 300,000 Permanent difference (15,900) 284,100 Temporary difference-depreciation (20,800) Taxable income $ 263,300 Middle-East Corporation's tax rate is 25%. Assume that no estimated taxes have been paid. What should Middle-East Corporation report as its inconte tax expense for its first year of operations? Select one: A. $71,025. B. $75,000 C. $65,825. D. $5200. Pretax accounting income for the year ended December 31, 2021, was $60 million for Muscat Company. The company's taxable income was $67 million. This was a result of differences between straight-line depreciation for financial reporting purposes and accelerated depreciation for tax purposes. The enacted tax rate is 27% for 2021 and 37% thereafter. What amount should the company report as the current portion of income tax expense for 2021? (Round your answer to the nearest whole million.) Select one: A. $25 million B. $16 million C. $18 million D. $22 million During the current year, Stern Company had pretax accounting income of $51 million. Stern's only temporary difference for the year was rent received for the following year in the amount of $26 million. Stern's taxable income for the year would be: Select one: A. $77 million. B. $51 million. C. $56 million D. $25 million. Assume that Puritan Corp. operates in an industry for which Net Operating loss [NOL) carryback[ Assume that the loss of a year can be carried to the last year for adjustment) and carryforward are allowed. Puritan Corp. reported the following pretax accounting income and taxable income for its first three years of operations: 2020 $ 353,000 2021 (541,000) 2022 722,000 Puritan's tax rate is 40% for all years. Puritan elected a loss carryback. As of December 31, 2021. Puritan was certain that it would recover the full tax benefit of the NOL that remained after the operating loss carryback. What did Puritan report on December 31, 2021, as the deferred tax asset for the NOL carryforward? Select one: A. $77320 B. 575,200 C$288,800. D. SO Oman Company sells computer systems. Oman Company leases computers to Muscat Company on January 1, 2021. The manufacturing cost of the computers was $19 million This noncancelable lease had the following terms: Lease payments: $3,287,947 semiannually; first payment at January 1, 2021; remaining payments at June 30 and December 31 each year through June 30, 2025. Lease term: 5 years (10 semiannual payments). No residual value; no purchase option. Economic life of equipment: 5 years. Implicit interest rate and lessee's incremental borrowing rate: 9% semiannually, Fair value of the computers at January 1, 2021: $23 million. What is the outstanding balance of the lease liability for Muscat Company as on June 30, 2021, balance sheet? (Round your answer to the nearest whole dollar) Select one A. 519,198,200. B.518,198,191 C$23,000,000 None of these answer choices is correct. On January 1, 2021, Calloway Company leased a machine to Zone Corporation. The lease qualifies as a sales-type lease. Calloway paid $260,000 for the machine and is leasing it to Zone for $32,000 per year, an amount that will return 7% to Calloway. The present value of the lease payments is $260,000. The lease payments are due each January 1, beginning in 2021. What is the appropriate interest entry on December 31, 2021? Select one: A. Cash Interest revenue 18,200 18,200 15,960 B. Cash Interest receivable 15,960 18,200 C. Interest receivable Interest revenue 18,200 15,960 D. Interest receivable interest revenue 15,960 For its first year of operations, Muscat Corporation's reconciliation of pretax accounting income to taxable income is as follows: Pretax accounting income $ 210,000 Permanent difference (14,900) 195,100 Temporary difference-depreciation (20,200) Taxable income $ 174,200 Tringali's tax rate is 25%. Assume that no estimated taxes have been paid. What should Tringali reportas its deferred income tax liability as of the end of its first year of operations? Select one: A. $20,200. B. $5050. C. $35,100. D. $8775