Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please to help me solve and check all questions. 1 5 On July 20th Green Company received a $40 payment from a customer. Green made

Please to help me solve and check all questions.

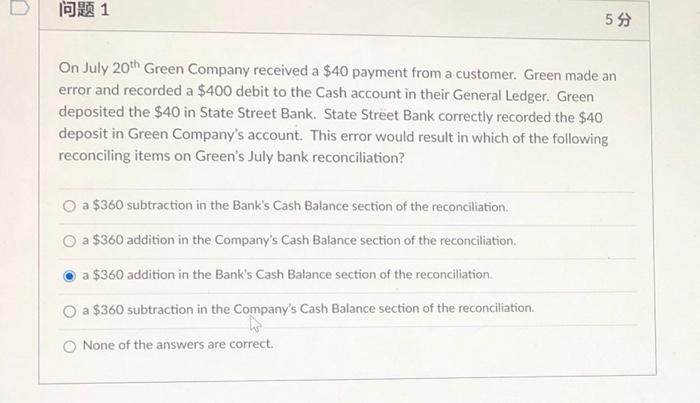

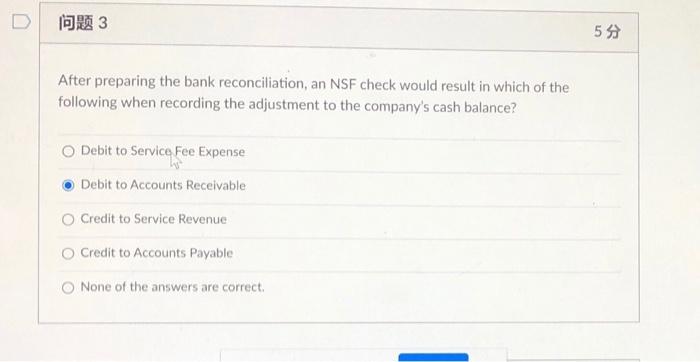

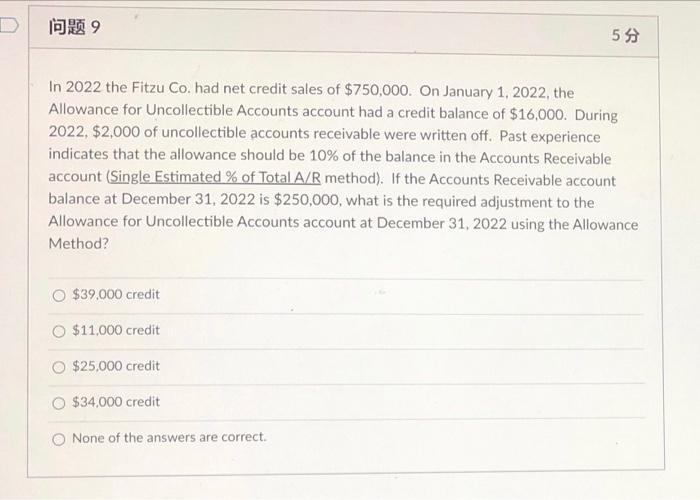

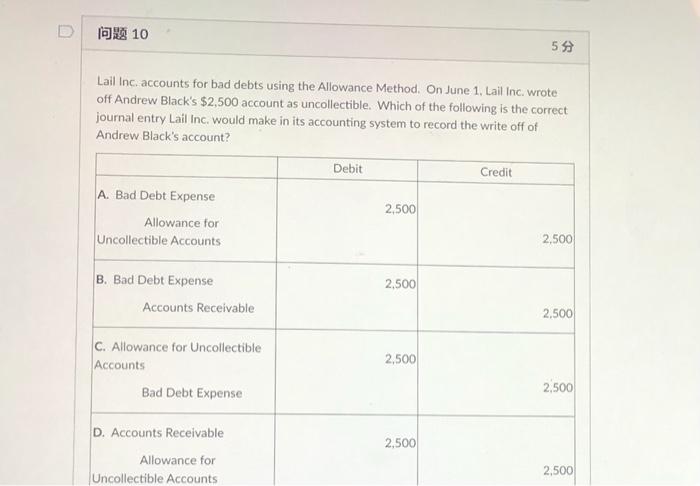

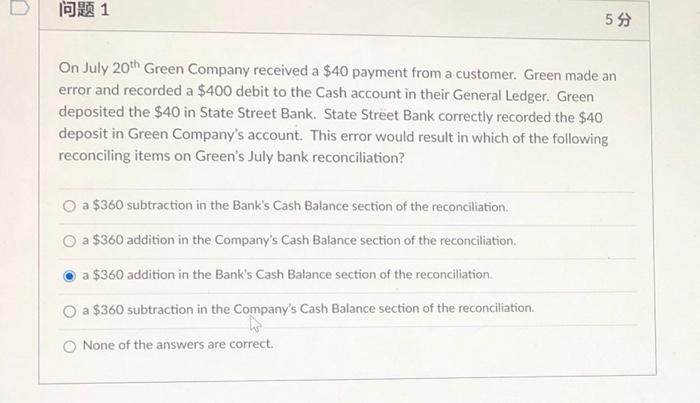

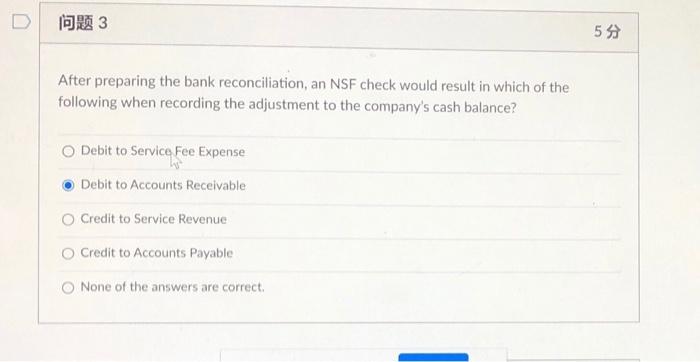

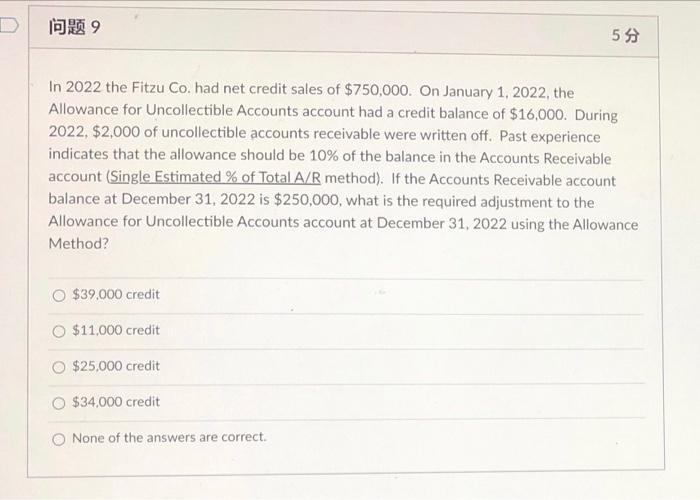

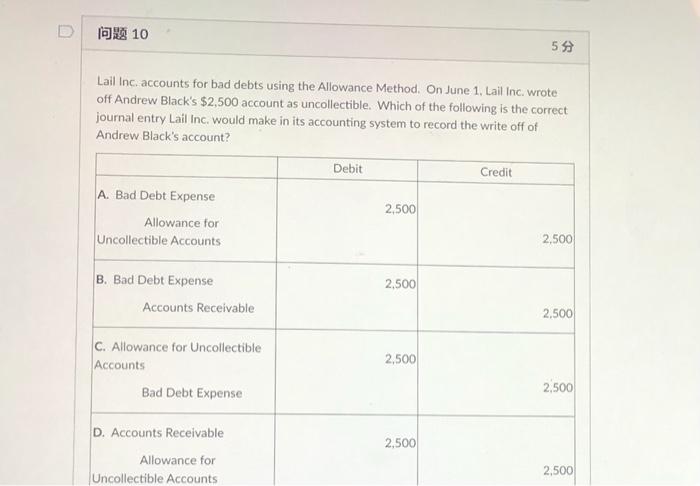

1 5 On July 20th Green Company received a $40 payment from a customer. Green made an error and recorded a $400 debit to the Cash account in their General Ledger. Green deposited the $40 in State Street Bank. State Street Bank correctly recorded the $40 deposit in Green Company's account. This error would result in which of the following reconciling items on Green's July bank reconciliation? O a $360 subtraction in the Bank's Cash Balance section of the reconciliation. a $360 addition in the Company's Cash Balance section of the reconciliation. a $360 addition in the Bank's Cash Balance section of the reconciliation. O a $360 subtraction in the Company's Cash Balance section of the reconciliation. None of the answers are correct. 3 5 After preparing the bank reconciliation, an NSF check would result in which of the following when recording the adjustment to the company's cash balance? O Debit to Service Fee Expense Debit to Accounts Receivable Credit to Service Revenue O Credit to Accounts Payable None of the answers are correct. D 9 55 In 2022 the Fitzu Co. had net credit sales of $750,000. On January 1, 2022, the Allowance for Uncollectible Accounts account had a credit balance of $16,000. During 2022, $2,000 of uncollectible accounts receivable were written off. Past experience indicates that the allowance should be 10% of the balance in the Accounts Receivable account (Single Estimated % of Total A/R method). If the Accounts Receivable account balance at December 31, 2022 is $250,000, what is the required adjustment to the Allowance for Uncollectible Accounts account at December 31, 2022 using the Allowance Method? O $39,000 credit O $11,000 credit $25,000 credit O $34,000 credit None of the answers are correct. 10 59 Lail Inc. accounts for bad debts using the Allowance Method. On June 1, Lail Inc. wrote off Andrew Black's $2,500 account as uncollectible. Which of the following is the correct journal entry Lail Inc. would make in its accounting system to record the write off of Andrew Black's account? Debit Credit A. Bad Debt Expense 2,500 Allowance for Uncollectible Accounts B. Bad Debt Expense 2,500 Accounts Receivable C. Allowance for Uncollectible Accounts 2,500 Bad Debt Expense D. Accounts Receivable 2,500 Allowance for Uncollectible Accounts 2,500 2,500 2,500 2,500

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started