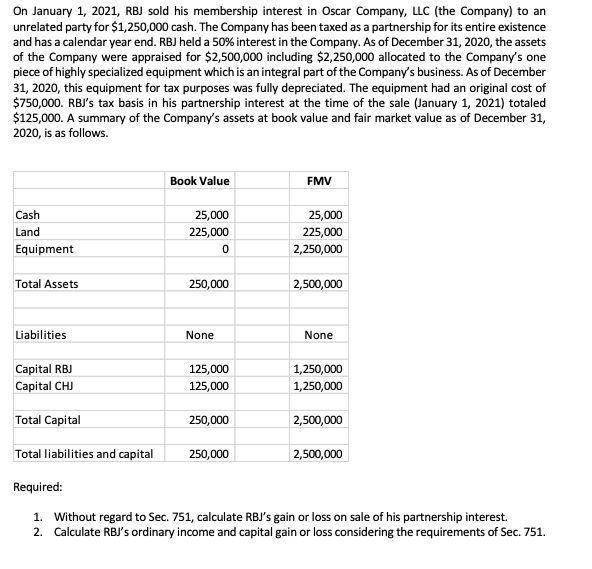

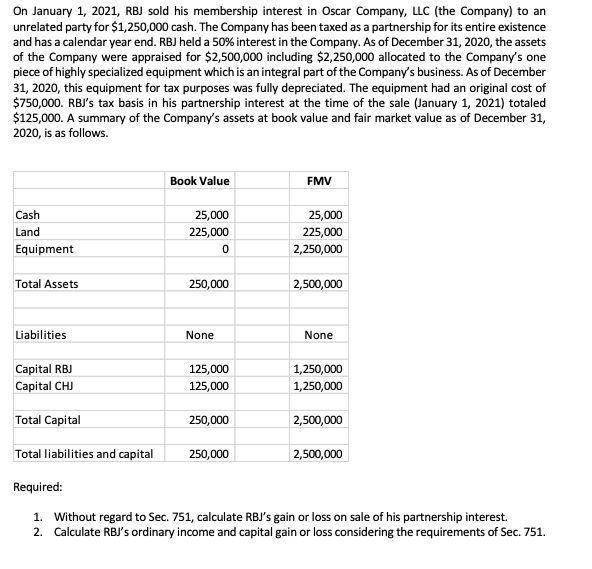

On January 1, 2021, RBJ sold his membership interest in Oscar Company, LLC (the Company) to an unrelated party for $1,250,000 cash. The Company has been taxed as a partnership for its entire existence and has a calendar year end. RBJ held a 50% interest in the Company. As of December 31, 2020, the assets of the Company were appraised for $2,500,000 including $2,250,000 allocated to the Company's one piece of highly specialized equipment which is an integral part of the Company's business. As of December 31, 2020, this equipment for tax purposes was fully depreciated. The equipment had an original cost of $750,000. RBJ's tax basis in his partnership interest at the time of the sale (January 1, 2021) totaled $125,000. A summary of the Company's assets at book value and fair market value as of December 31, 2020, is as follows. Book Value FMV 25,000 25,000 Cash Land 225,000 225,000 Equipment 0 2,250,000 Total Assets 250,000 2,500,000 Liabilities None None Capital RBJ 125,000 1,250,000 Capital CHU 125,000 1,250,000 Total Capital 250,000 2,500,000 Total liabilities and capital 250,000 2,500,000 Required: 1. Without regard to Sec. 751, calculate RBJ's gain or loss on sale of his partnership interest. 2. Calculate RBJ's ordinary income and capital gain or loss considering the requirements of Sec. 751. On January 1, 2021, RBJ sold his membership interest in Oscar Company, LLC (the Company) to an unrelated party for $1,250,000 cash. The Company has been taxed as a partnership for its entire existence and has a calendar year end. RBJ held a 50% interest in the Company. As of December 31, 2020, the assets of the Company were appraised for $2,500,000 including $2,250,000 allocated to the Company's one piece of highly specialized equipment which is an integral part of the Company's business. As of December 31, 2020, this equipment for tax purposes was fully depreciated. The equipment had an original cost of $750,000. RBJ's tax basis in his partnership interest at the time of the sale (January 1, 2021) totaled $125,000. A summary of the Company's assets at book value and fair market value as of December 31, 2020, is as follows. Book Value FMV 25,000 25,000 Cash Land 225,000 225,000 Equipment 0 2,250,000 Total Assets 250,000 2,500,000 Liabilities None None Capital RBJ 125,000 1,250,000 Capital CHU 125,000 1,250,000 Total Capital 250,000 2,500,000 Total liabilities and capital 250,000 2,500,000 Required: 1. Without regard to Sec. 751, calculate RBJ's gain or loss on sale of his partnership interest. 2. Calculate RBJ's ordinary income and capital gain or loss considering the requirements of Sec. 751