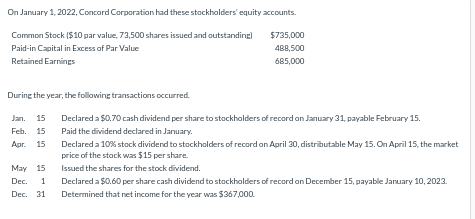

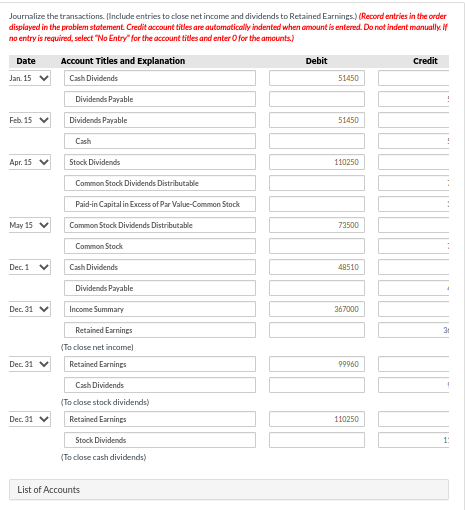

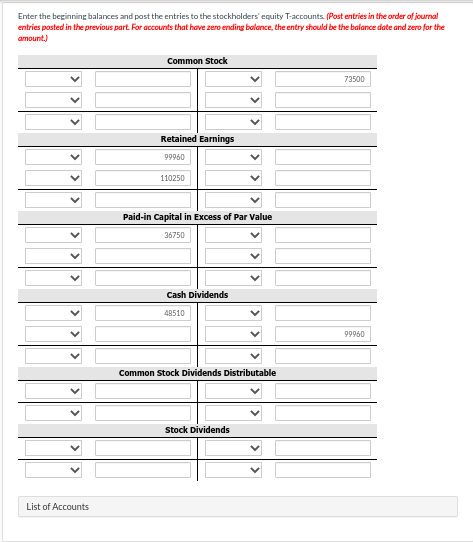

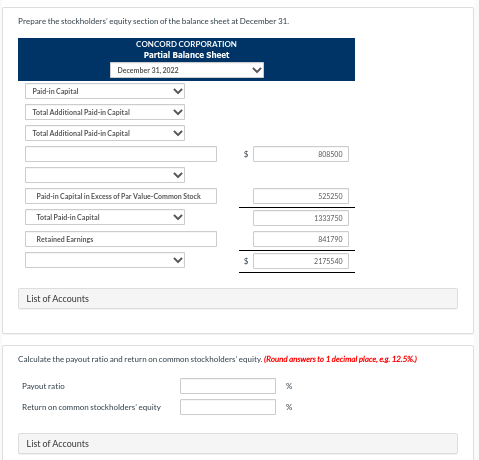

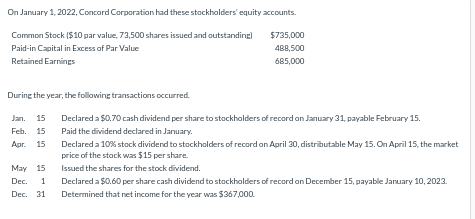

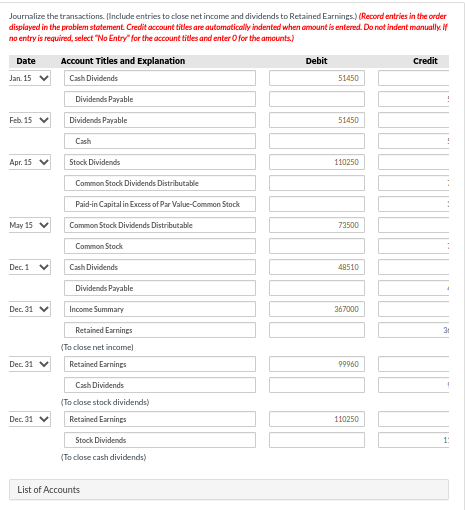

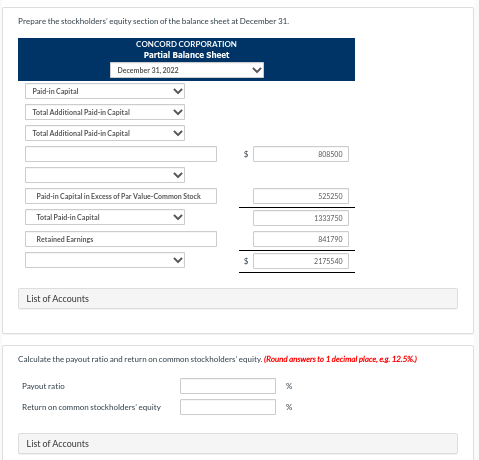

On January 1, 2022. Concord Corporation had these stockholders' equity accounts. Common Stock ($10 par value, 73,500 shares issued and outstanding) $ $735,000 Paid-in Capital in Excess of Par Value 488,500 Retained Earnings 685,000 During the year, the following transactions occurred. Jan. 15 Feb. 15 Apr. 15 Declared a $0.70 cash dividend per share to stockholders of record on January 31, payable February 15. Paid the dividend declared in January. Declared a 10% stock dividend to stockholders of record on April 30, distributable May 15. On April 15, the market price of the stock was $15 per share. Issued the shares for the stock dividend. Declared a $0.60 per share cash dividend to stockholders of record on December 15, payable January 10, 2023. Determined that net income for the year was $367,000 May 15 Dec. 1 Dec. 31 Journalize the transactions. Include entries to close net income and dividends to Retained Earnings.) (Record entries in the order displayed in the problem statement Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter for the amounts.) Date Account Titles and Explanation Debit Credit Jan. 15 Cash Dividends 51450 Dividends Payable Feb 15 Dividends Payable 51450 Cash Apr. 15 Stock Dividends 110250 Common Stock Dividends Distributable Paid-in Capital in Excess of Par Value-Common Stock May 15 Common Stock Dividends Distributable 73500 Common Stock Dec 1 Cash Dividends 48510 Dividends Payable Dec. 31 Income Summary 367000 3: Retained Earnings (To close net income Retained Earnings Dec. 31 99960 Cash Dividends (To close stock dividends) Retained Earnings Dec 31 V 110250 Stock Dividends 1: (To close cash dividends) List of Accounts Enter the beginning balances and post the entries to the stockholders' equity T-accounts (Post entries in the order of journal entries posted in the previous part. For accounts that have zero ending balance, the entry should be the balance date and zero for the amount.) Common Stock 73500 Retained Earnings 99960 110250 Paid-in Capital in Excess of Par Value 36750 Cash Dividends 48510 99960 Common Stock Dividends Distributable Stock Dividends List of Accounts Prepare the stockholders' equity section of the balance sheet at December 31 CONCORD CORPORATION Partial Balance Sheet December 31, 2022 Paid-in Capital Total Additional Paid-in Capital Total Additional Paid-in Capital $ 908500 525250 Paid-in Capital in Excess of Par Value-Common Stock Total Paid-in Capital 1333750 Retained Earnings 841790 $ 2175540 List of Accounts Calculate the payout ratio and return on common stockholders' equity. (Round answers to 1 decimal place, eg. 12.5%.) Payout ratio Return on common stockholders' equity List of Accounts