Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2022, Confirm Company leased the equipment to Passenger Company for 4 years for a total cost of $560,000. At the end

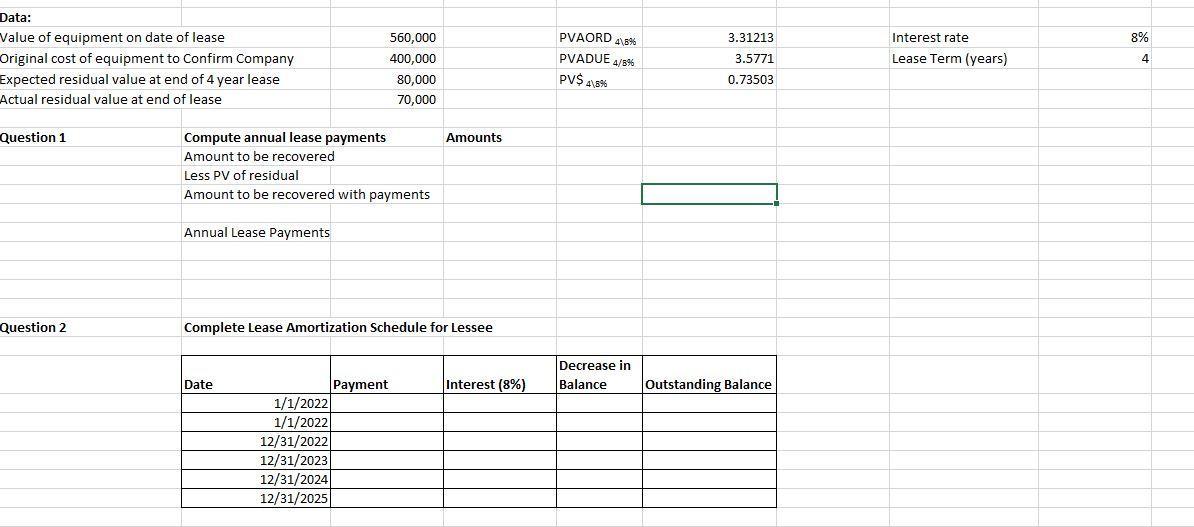

On January 1, 2022, Confirm Company leased the equipment to Passenger Company for 4 years for a total cost of $560,000. At the end of the 4-year lease, the equipment was expected to have a residual value of $80,000, which was guaranteed by Passenger. The asset was originally purchased by Confirm for $400,000. The first lease payment was made immediately (1/1/22) and the remaining payments were made each December 31*. At the end of the lease the residual was determined to be worth $70,000, rather than the expected $80,000. Spreadsheet Requirements Confirm's implicit rate of interest, on which payments are based, is 8% and is known by Passenger. Use the schedule on the sheet labeled Amortization to compute annual lease 1. payments. On the sheet labeled Amortization, complete the lease amortization schedule. 2. Insert amounts in the entries requested for the lessee and the lessor on the sheet labeled Entries by linking to amounts on the Amortization sheet. 4. Insert amounts requested for the lessee's balance sheet on the sheet labeled Financial Statements by linking to amounts on the Amortization sheet. 5. Insert amounts in the entries requested for the lessee and the lessor on the sheet labeled End of Lease by linking to amounts on the Amortizotion sheet. 3. Data: Value of equipment on date of lease 560,000 PVAORD 8% Interest rate 8% 3.31213 Original cost of equipment to Confirm Company 400,000 PVADUE 4/8%. 3.5771 Lease Term (years) 4 Expected residual value at end of 4 year lease 80,000 PV$ A\8% 0.73503 Actual residual value at end of lease 70,000 Question 1 Compute annual lease payments Amounts Amount to be recovered Less PV of residual Amount to be recovered with payments Annual Lease Payments Question 2 Complete Lease Amortization Schedule for Lessee Decrease in Payment Interest (8%) Balance Outstanding Balance Date 1/1/2022 1/1/2022 12/31/2022 12/31/2023 12/31/2024 12/31/2025

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer Question 1 2 At last the a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started