Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2022 XYZ Inc. purchased a used truck for it's operations. The costs of the truck was $50,000. They paid $8,000 to add

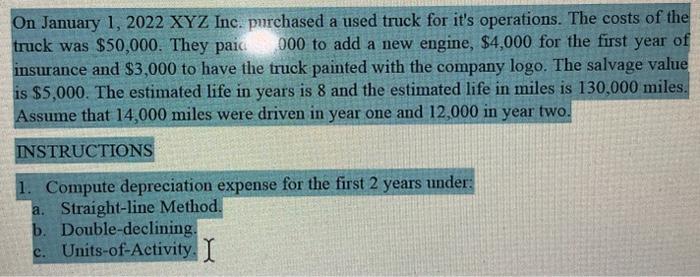

On January 1, 2022 XYZ Inc. purchased a used truck for it's operations. The costs of the truck was $50,000. They paid $8,000 to add a new engine, $4,000 for the first year of insurance and $3,000 to have the truck painted with the company logo. The salvage value is $5,000. The estimated life in years is 8 and the estimated life in miles is 130,000 miles. Assume that 14,000 miles were driven in year one and 12,000 in year two.

INSTRUCTIONS

1. Compute depreciation expense for the first 2 years under:

a. Straight-line Method.

b. Double-declining.

c. Units-of-Activity.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started