on january 1, 2023, ivanhoe inc. enters into a 5-year non-cancellable lease with wilson ltd. for equipment that has an estimated useful life of 5

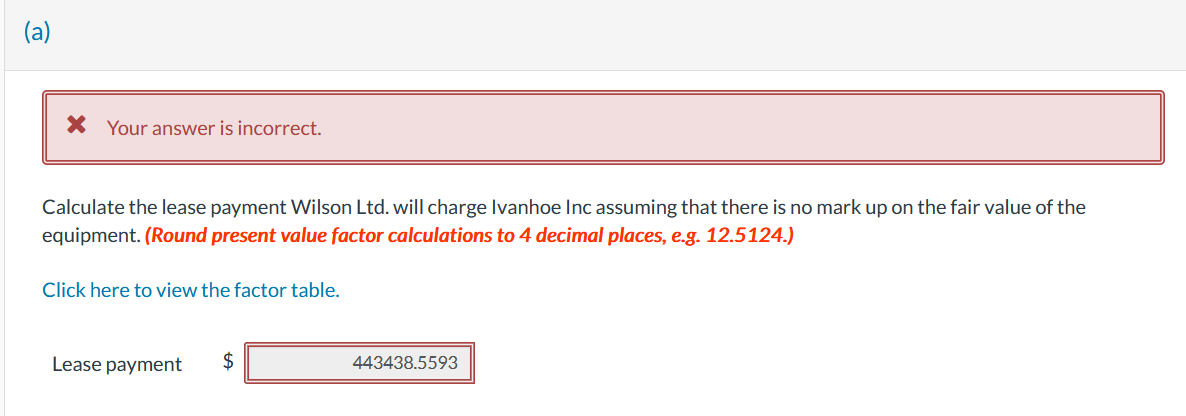

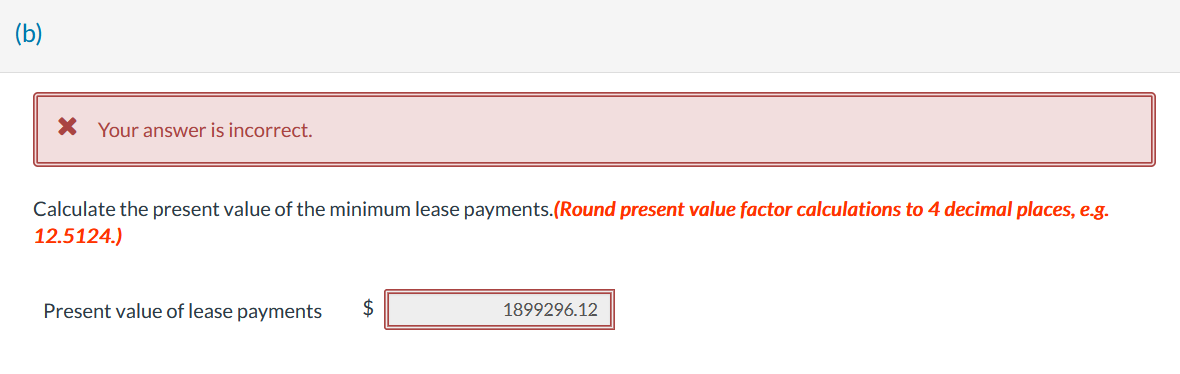

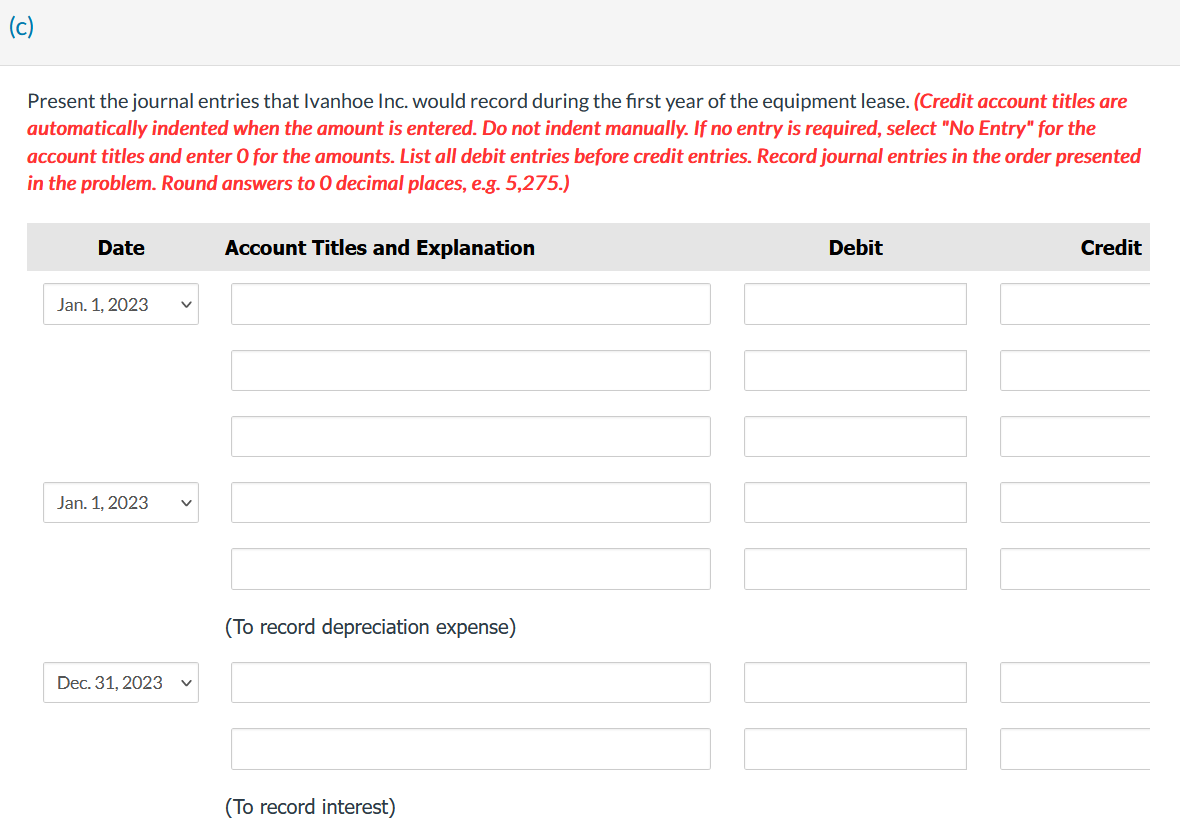

on january 1, 2023, ivanhoe inc. enters into a 5-year non-cancellable lease with wilson ltd. for equipment that has an estimated useful life of 5 years and a fair value of $1,980,000. ivanhoe has an incremental borrowing rate of 8% and Wilson's implicit rate is 6%. ivanhoe uses the straight-line depreciation method to depreciate assets. ivanhoe will make annual lease payments on january 1 of each year (with the first payment due at the beginning of the lease) based on the fair value of the equipment. the lease agreement includes a guarantee that Ivanhoe will take over ownership of the equipment from Wilson for a final payment of $108,000. both companies adhere to IFRS.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started