Answered step by step

Verified Expert Solution

Question

1 Approved Answer

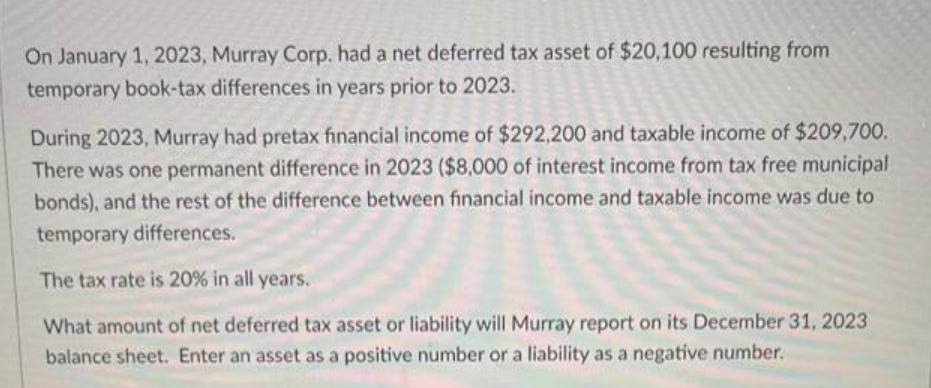

On January 1, 2023, Murray Corp. had a net deferred tax asset of $20,100 resulting from temporary book-tax differences in years prior to 2023.

On January 1, 2023, Murray Corp. had a net deferred tax asset of $20,100 resulting from temporary book-tax differences in years prior to 2023. During 2023, Murray had pretax financial income of $292,200 and taxable income of $209,700. There was one permanent difference in 2023 ($8,000 of interest income from tax free municipal bonds), and the rest of the difference between financial income and taxable income was due to temporary differences. The tax rate is 20% in all years. What amount of net deferred tax asset or liability will Murray report on its December 31, 2023 balance sheet. Enter an asset as a positive number or a liability as a negative number.

Step by Step Solution

★★★★★

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

To determine the net deferred tax asset or liability that Murray Corp will report on its December ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started