Question

On January 1, 2023, Palo Verde Corporation acquired 100 percent of the voting stock of Silverstone Corporation in exchange for $2,344,500 in cash and securities.

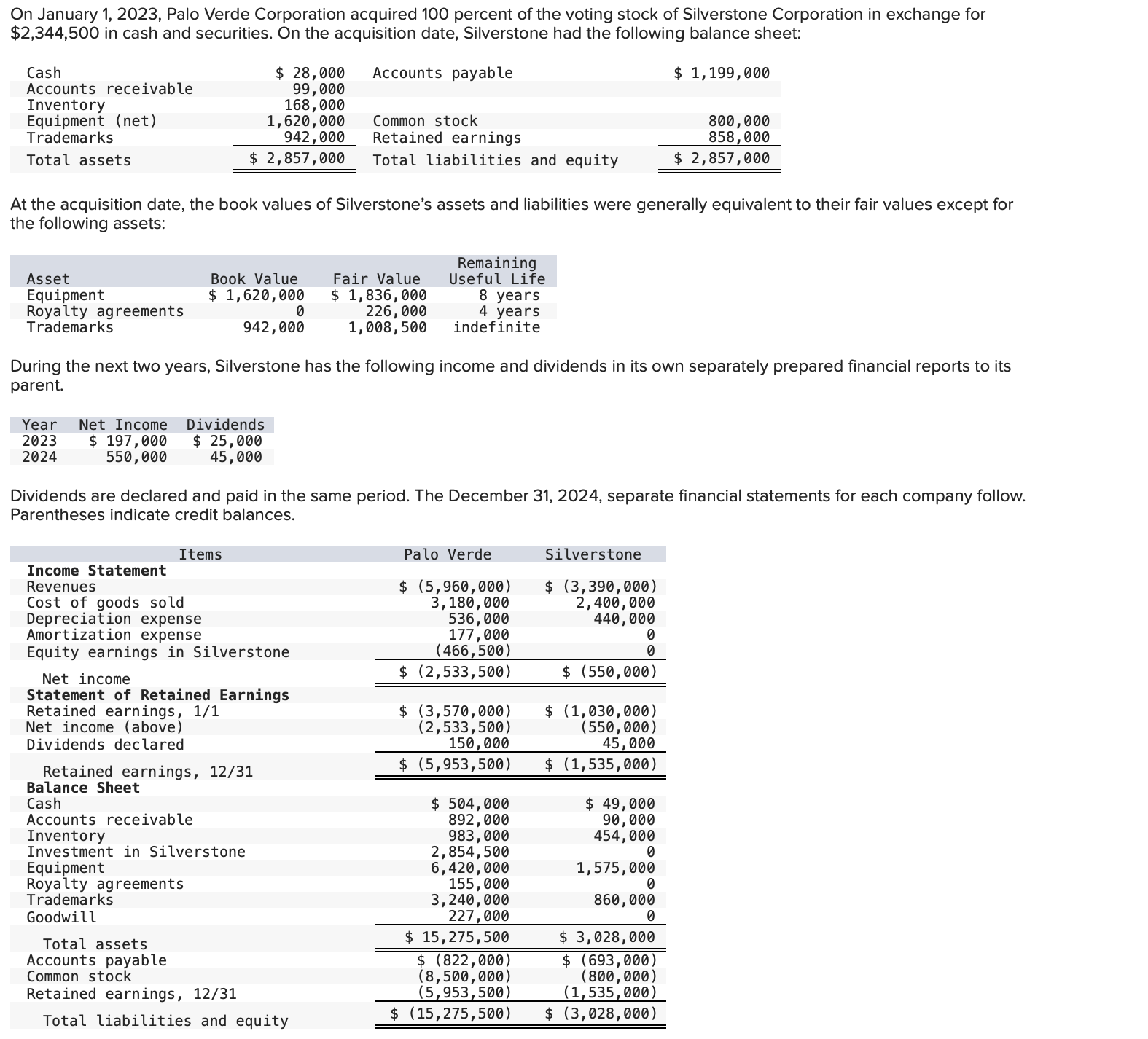

On January 1, 2023, Palo Verde Corporation acquired 100 percent of the voting stock of Silverstone Corporation in exchange for $2,344,500 in cash and securities. On the acquisition date, Silverstone had the following balance sheet:

| Cash | $ 28,000 | Accounts payable | $ 1,199,000 |

| Accounts receivable | 99,000 | ||

| Inventory | 168,000 | ||

| Equipment (net) | 1,620,000 | Common stock | 800,000 |

| Trademarks | 942,000 | Retained earnings | 858,000 |

| Total assets | $ 2,857,000 | Total liabilities and equity | $ 2,857,000 |

At the acquisition date, the book values of Silverstones assets and liabilities were generally equivalent to their fair values except for the following assets:

| Asset | Book Value | Fair Value | Remaining Useful Life |

|---|---|---|---|

| Equipment | $ 1,620,000 | $ 1,836,000 | 8 years |

| Royalty agreements | 0 | 226,000 | 4 years |

| Trademarks | 942,000 | 1,008,500 | indefinite |

During the next two years, Silverstone has the following income and dividends in its own separately prepared financial reports to its parent.

| Year | Net Income | Dividends |

|---|---|---|

| 2023 | $ 197,000 | $ 25,000 |

| 2024 | 550,000 | 45,000 |

Dividends are declared and paid in the same period. The December 31, 2024, separate financial statements for each company follow. Parentheses indicate credit balances.

| Items | Palo Verde | Silverstone |

|---|---|---|

| Income Statement | ||

| Revenues | $ (5,960,000) | $ (3,390,000) |

| Cost of goods sold | 3,180,000 | 2,400,000 |

| Depreciation expense | 536,000 | 440,000 |

| Amortization expense | 177,000 | 0 |

| Equity earnings in Silverstone | (466,500) | 0 |

| Net income | $ (2,533,500) | $ (550,000) |

| Statement of Retained Earnings | ||

| Retained earnings, 1/1 | $ (3,570,000) | $ (1,030,000) |

| Net income (above) | (2,533,500) | (550,000) |

| Dividends declared | 150,000 | 45,000 |

| Retained earnings, 12/31 | $ (5,953,500) | $ (1,535,000) |

| Balance Sheet | ||

| Cash | $ 504,000 | $ 49,000 |

| Accounts receivable | 892,000 | 90,000 |

| Inventory | 983,000 | 454,000 |

| Investment in Silverstone | 2,854,500 | 0 |

| Equipment | 6,420,000 | 1,575,000 |

| Royalty agreements | 155,000 | 0 |

| Trademarks | 3,240,000 | 860,000 |

| Goodwill | 227,000 | 0 |

| Total assets | $ 15,275,500 | $ 3,028,000 |

| Accounts payable | $ (822,000) | $ (693,000) |

| Common stock | (8,500,000) | (800,000) |

| Retained earnings, 12/31 | (5,953,500) | (1,535,000) |

| Total liabilities and equity | $ (15,275,500) | $ (3,028,000) |

Required:

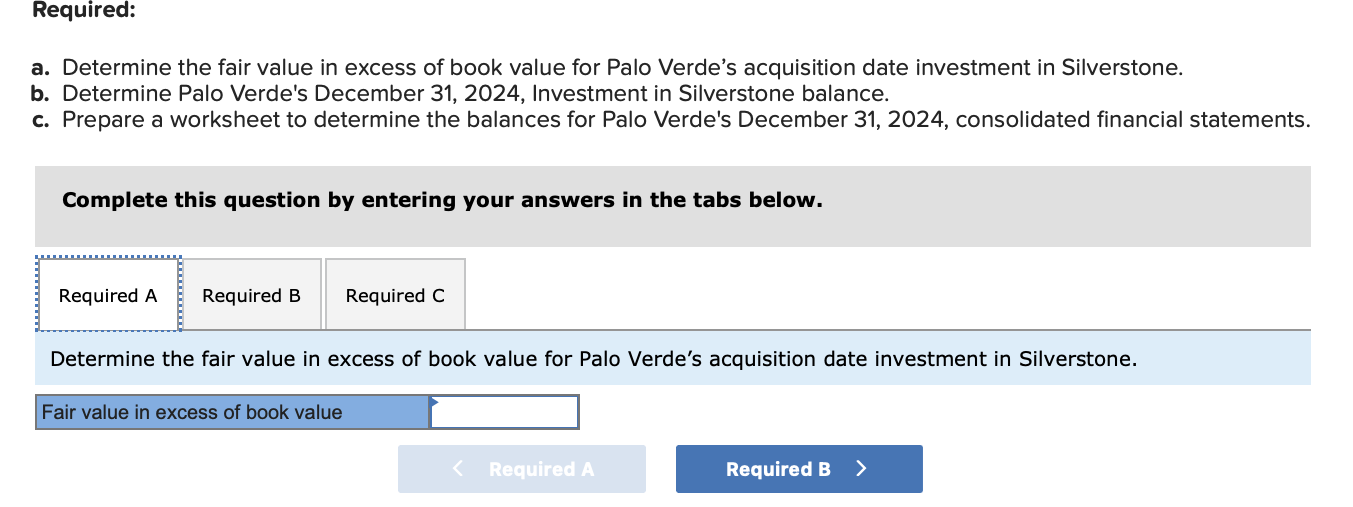

Determine the fair value in excess of book value for Palo Verdes acquisition date investment in Silverstone.

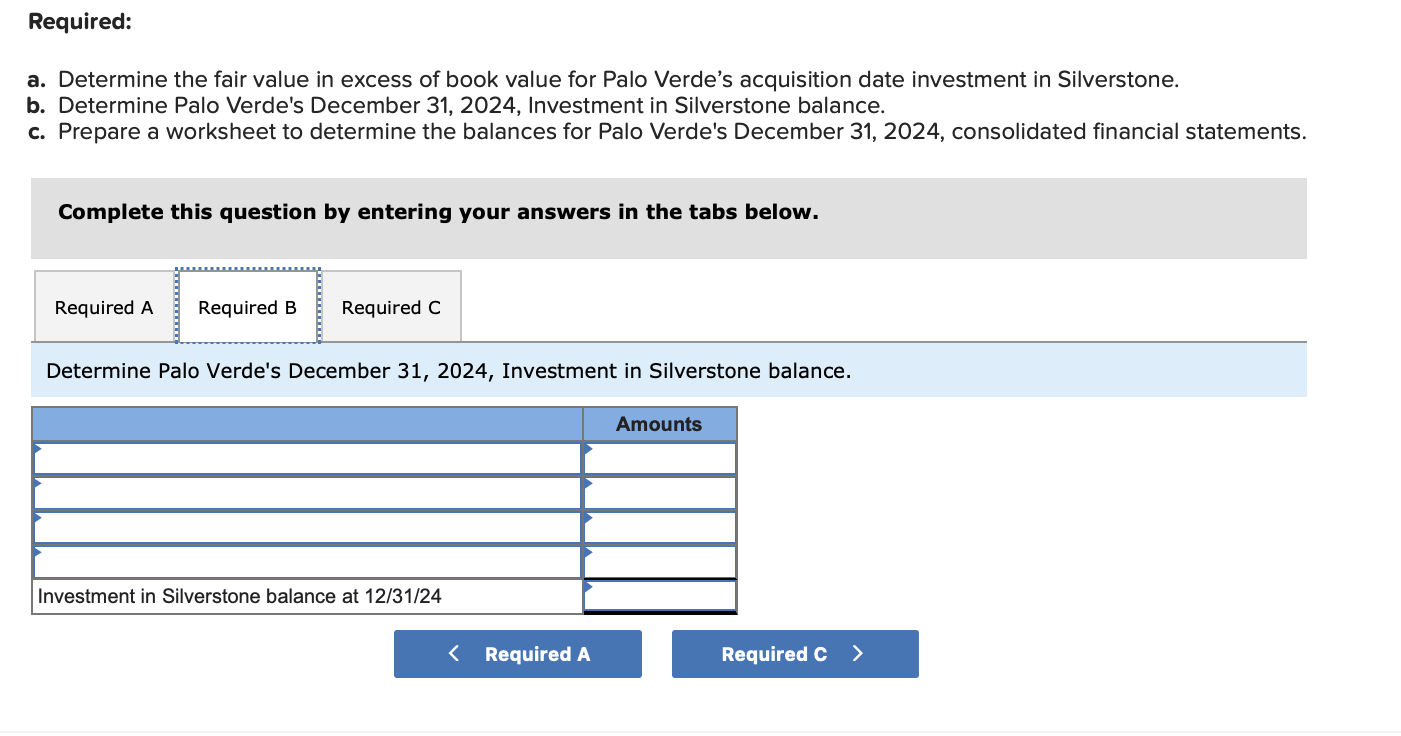

Determine Palo Verde's December 31, 2024, Investment in Silverstone balance.

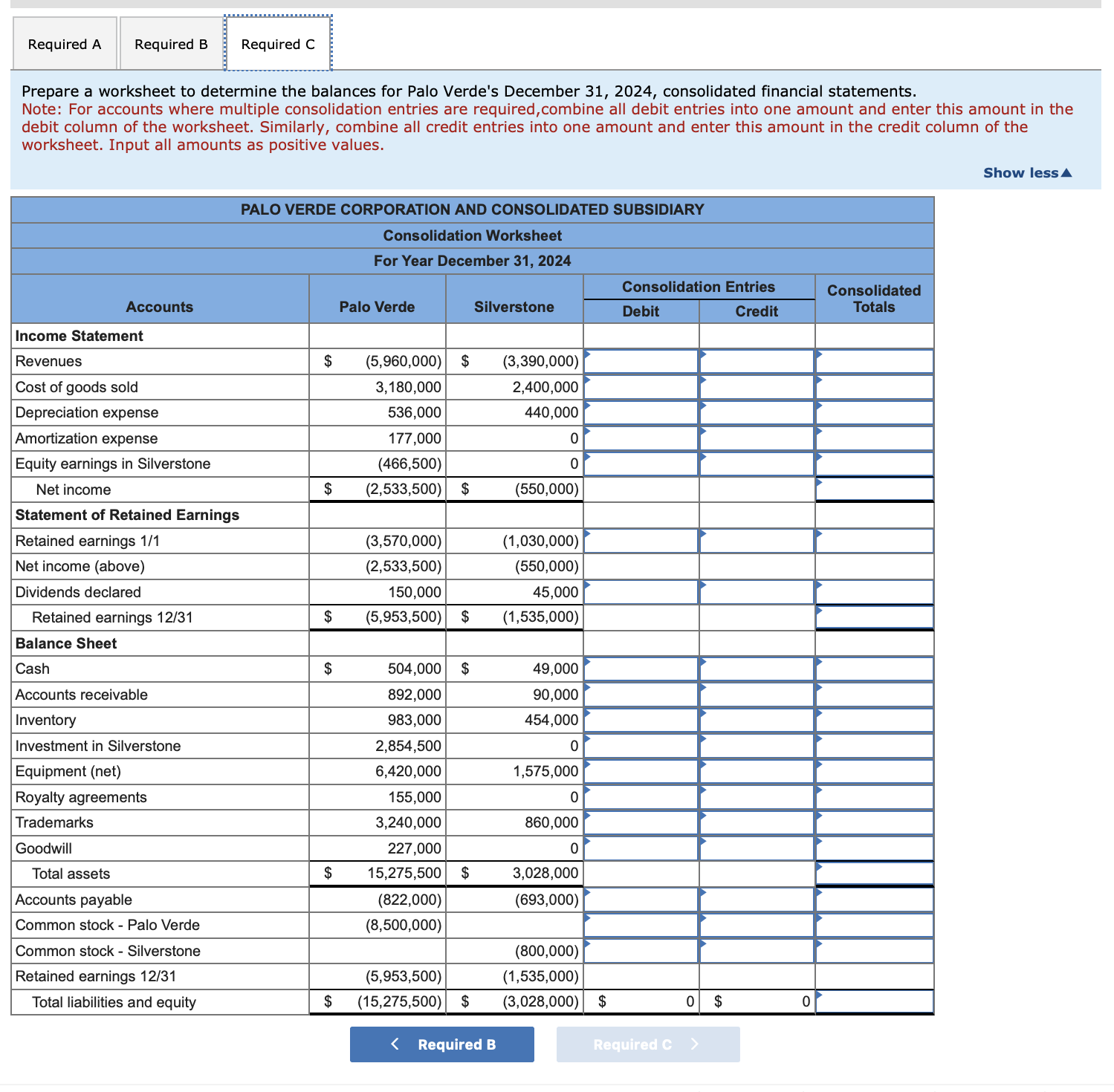

Prepare a worksheet to determine the balances for Palo Verde's December 31, 2024, consolidated financial statements.

a. Determine the fair value in excess of book value for Palo Verde's acquisition date investment in Silverstone. b. Determine Palo Verde's December 31, 2024, Investment in Silverstone balance. c. Prepare a worksheet to determine the balances for Palo Verde's December 31, 2024, consolidated financial statements Complete this question by entering your answers in the tabs below. Determine the fair value in excess of book value for Palo Verde's acquisition date investment in Silverstone. a. Determine the fair value in excess of book value for Palo Verde's acquisition date investment in Silverstone. b. Determine Palo Verde's December 31, 2024, Investment in Silverstone balance. c. Prepare a worksheet to determine the balances for Palo Verde's December 31, 2024, consolidated financial statements Complete this question by entering your answers in the tabs below. Determine Palo Verde's December 31, 2024, Investment in Silverstone balance. Prepare a worksheet to determine the balances for Palo Verde's December 31, 2024, consolidated financial statements. Note: For accounts where multiple consolidation entries are required,combine all debit entries into one amount and enter this amount in the debit column of the worksheet. Similarly, combine all credit entries into one amount and enter this amount in the credit column of the worksheet. Input all amounts as positive values

a. Determine the fair value in excess of book value for Palo Verde's acquisition date investment in Silverstone. b. Determine Palo Verde's December 31, 2024, Investment in Silverstone balance. c. Prepare a worksheet to determine the balances for Palo Verde's December 31, 2024, consolidated financial statements Complete this question by entering your answers in the tabs below. Determine the fair value in excess of book value for Palo Verde's acquisition date investment in Silverstone. a. Determine the fair value in excess of book value for Palo Verde's acquisition date investment in Silverstone. b. Determine Palo Verde's December 31, 2024, Investment in Silverstone balance. c. Prepare a worksheet to determine the balances for Palo Verde's December 31, 2024, consolidated financial statements Complete this question by entering your answers in the tabs below. Determine Palo Verde's December 31, 2024, Investment in Silverstone balance. Prepare a worksheet to determine the balances for Palo Verde's December 31, 2024, consolidated financial statements. Note: For accounts where multiple consolidation entries are required,combine all debit entries into one amount and enter this amount in the debit column of the worksheet. Similarly, combine all credit entries into one amount and enter this amount in the credit column of the worksheet. Input all amounts as positive values Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started