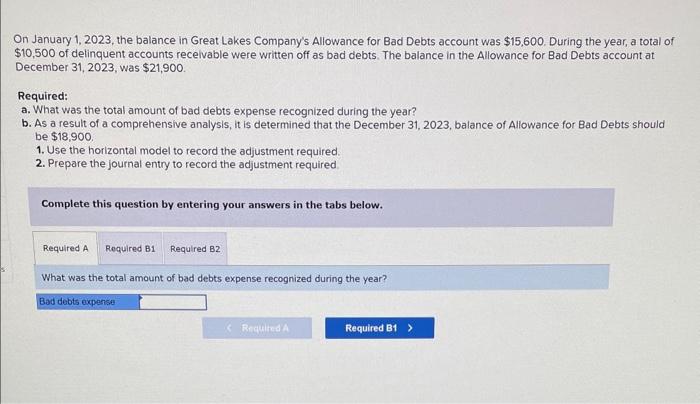

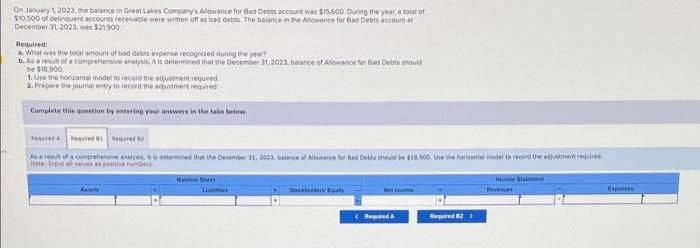

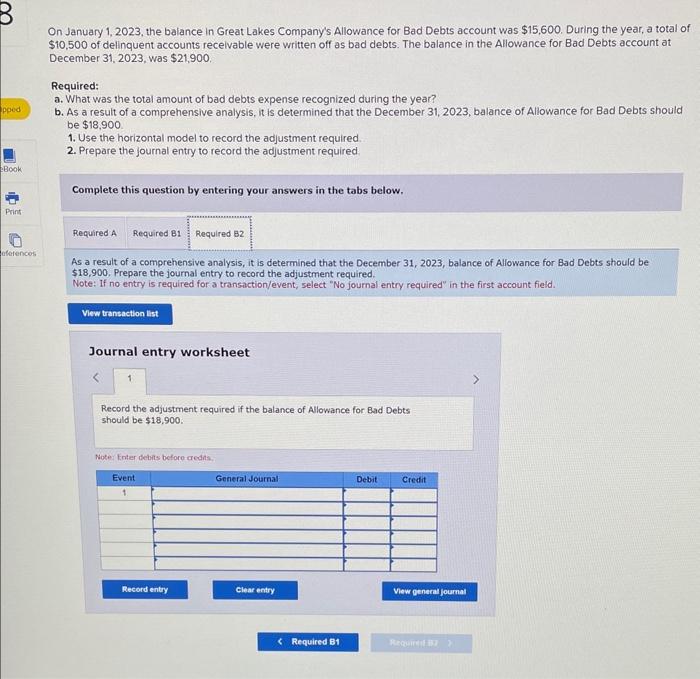

On January 1, 2023, the balance in Great Lakes Company's Allowance for Bad Debts account was $15,600. During the year, a total of $10,500 of delinquent accounts recelvable were written off as bad debts. The balance in the Allowance for Bad Debts account at December 31,2023, was $21,900 Required: a. What was the total amount of bad debts expense recognized during the year? b. As a result of a comprehensive analysis, it is determined that the December 31,2023 , balance of Allowance for Bad Debts should be $18,900, 1. Use the horizontal model to record the adjustment required. 2. Prepare the journal entry to record the adjustment required. Complete this question by entering your answers in the tabs below. What was the total amount of bad debts expense recognized during the year? G7 Jaruary 1, 2023, the beionce in Greot Lakes Compony's Alowance for Bad Debts acceunt was 515,600 Dung the yeat a sotal of $10.500 of delinquer accounts recevable were wimen ofl as bad debts. The belance in Ehe Alowance for bed Debss accourt at . December 31, 2023, wes $21900 Pequired: A. What was the tetal amount of bed obbts eapense recognised during the year? 6. As o cesut of a comprehenuve analyais, it is detemined that the becember 31, 2023, balance of Alewance for Ead Debts should be 110,900 1. Use the horisonal madel to recerd the bdivitiment requiced 2. Prepare the journal entry 10 iscold the adsustmert required Complele this quewtion try entering rour answeis in the labs below. On January 1, 2023, the baiance in Great Lakes Company's Allowance for Bad Debts account was \$15,600. During the year, a total of $10,500 of delinquent accounts recelvable were written off as bad debts. The balance in the Allowance for Bad Debts account at December 31,2023 , was $21,900. Required: a. What was the total amount of bad debts expense recognized during the year? b. As a result of a comprehensive analysis, it is determined that the December 31,2023 , balance of Allowance for Bad Debts should be $18,900. 1. Use the horizontal model to record the adjustment required. 2. Prepare the journal entry to record the adjustment required. Complete this question by entering your answers in the tabs below. As a result of a comprehensive analysis, it is determined that the December 31, 2023, balance of Allowance for Bad Debts should be $18,900. Prepare the journal entry to record the adjustment required. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet Record the adjustment required if the balance of Allowance for Bad Debts should be $18,900. Notei Enter dehts before aredats