Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2024 Sea Limited purchased 40% of the common shares Shore Ltd for $200,000 cash. Sea Limited has recorded the investment as

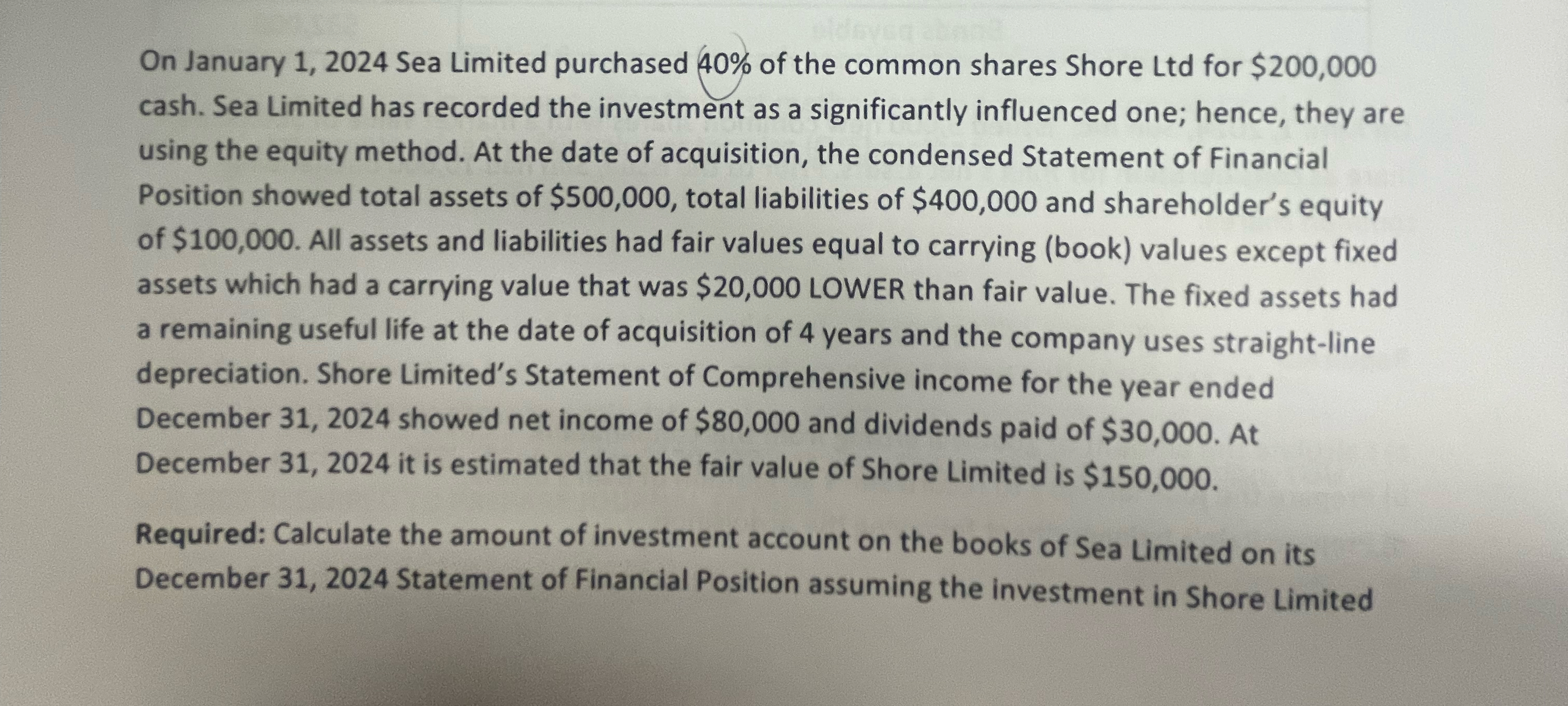

On January 1, 2024 Sea Limited purchased 40% of the common shares Shore Ltd for $200,000 cash. Sea Limited has recorded the investment as a significantly influenced one; hence, they are using the equity method. At the date of acquisition, the condensed Statement of Financial Position showed total assets of $500,000, total liabilities of $400,000 and shareholder's equity of $100,000. All assets and liabilities had fair values equal to carrying (book) values except fixed assets which had a carrying value that was $20,000 LOWER than fair value. The fixed assets had a remaining useful life at the date of acquisition of 4 years and the company uses straight-line depreciation. Shore Limited's Statement of Comprehensive income for the year ended December 31, 2024 showed net income of $80,000 and dividends paid of $30,000. At December 31, 2024 it is estimated that the fair value of Shore Limited is $150,000. Required: Calculate the amount of investment account on the books of Sea Limited on its December 31, 2024 Statement of Financial Position assuming the investment in Shore Limited

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the amount of the investment account on the books of Sea Limited on its December 31 202...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started