Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2024, Sweet Acacia Ltd. issued bonds with a maturity value of $5.70 million for $5,479,931, when the market rate of interest was

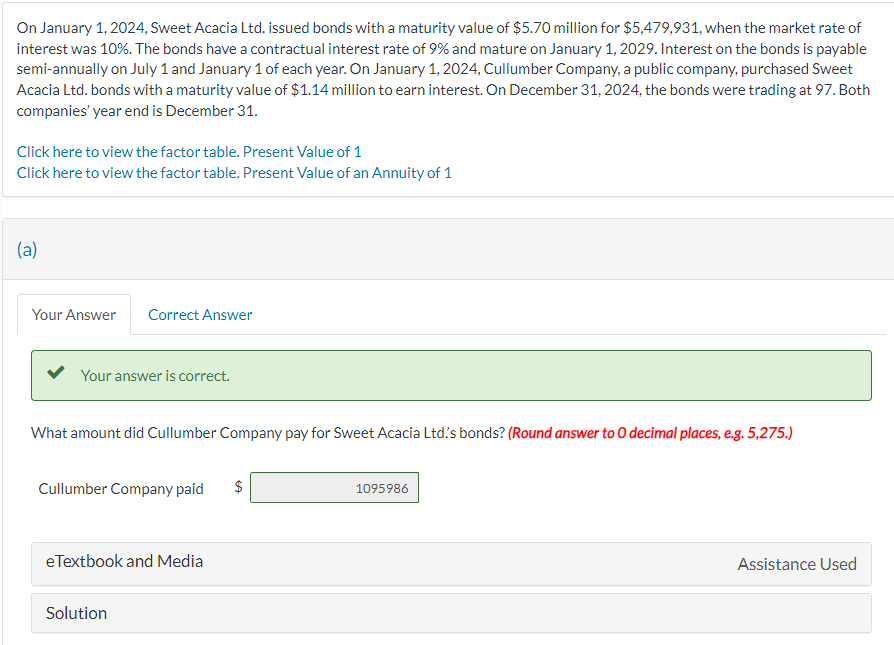

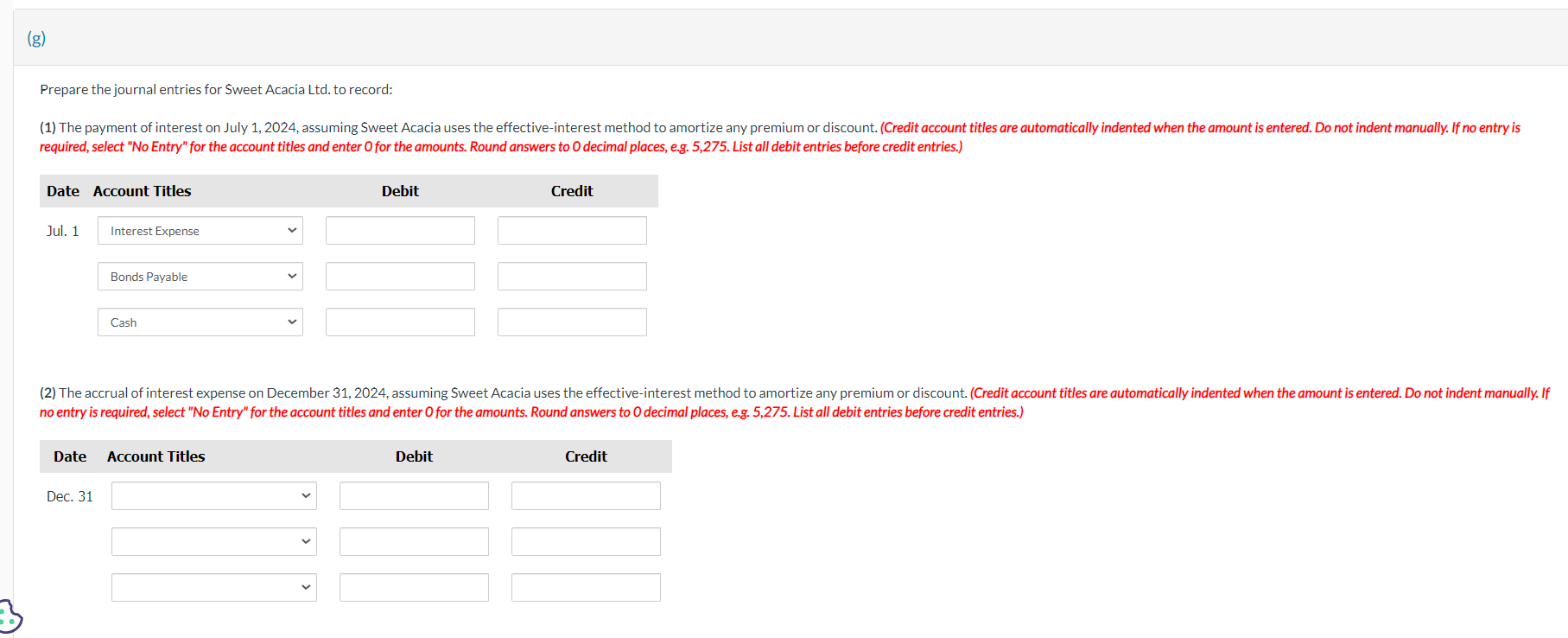

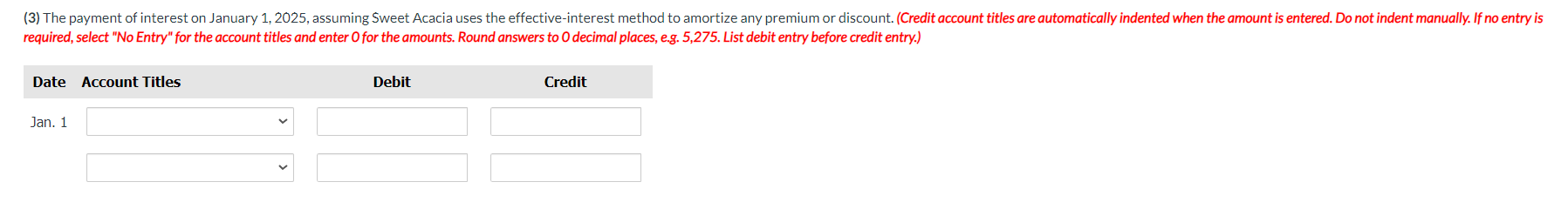

On January 1, 2024, Sweet Acacia Ltd. issued bonds with a maturity value of $5.70 million for $5,479,931, when the market rate of interest was 10%. The bonds have a contractual interest rate of 9% and mature on January 1,2029 . Interest on the bonds is payable semi-annually on July 1 and January 1 of each year. On January 1, 2024, Cullumber Company, a public company, purchased Sweet Acacia Ltd. bonds with a maturity value of $1.14 million to earn interest. On December 31,2024 , the bonds were trading at 97 . Both companies' year end is December 31. Click here to view the factor table. Present Value of 1 Click here to view the factor table. Present Value of an Annuity of 1 (a) Your answer is correct. What amount did Cullumber Company pay for Sweet Acacia Ltd's bonds? (Round answer to 0 decimal places, e.g. 5,275.) Cullumber Company paid $ eTextbook and Media Assistance Used Prepare the journal entries for Sweet Acacia Ltd. to record: required, select "No Entry" for the account titles and enter O for the amounts. Round answers to O decimal places, e.g. 5,275. List all debit entries before credit entries.) required, select "No Entry" for the account titles and enter 0 for the amounts. Round answers to 0 decimal places, e.g. 5,275. List debit entry before credit entry.)

On January 1, 2024, Sweet Acacia Ltd. issued bonds with a maturity value of $5.70 million for $5,479,931, when the market rate of interest was 10%. The bonds have a contractual interest rate of 9% and mature on January 1,2029 . Interest on the bonds is payable semi-annually on July 1 and January 1 of each year. On January 1, 2024, Cullumber Company, a public company, purchased Sweet Acacia Ltd. bonds with a maturity value of $1.14 million to earn interest. On December 31,2024 , the bonds were trading at 97 . Both companies' year end is December 31. Click here to view the factor table. Present Value of 1 Click here to view the factor table. Present Value of an Annuity of 1 (a) Your answer is correct. What amount did Cullumber Company pay for Sweet Acacia Ltd's bonds? (Round answer to 0 decimal places, e.g. 5,275.) Cullumber Company paid $ eTextbook and Media Assistance Used Prepare the journal entries for Sweet Acacia Ltd. to record: required, select "No Entry" for the account titles and enter O for the amounts. Round answers to O decimal places, e.g. 5,275. List all debit entries before credit entries.) required, select "No Entry" for the account titles and enter 0 for the amounts. Round answers to 0 decimal places, e.g. 5,275. List debit entry before credit entry.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started