Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2024, Syth, Inc. purchased several industrial forklifts for use in its warehouse. The forklifts had a list price of $205,000. The

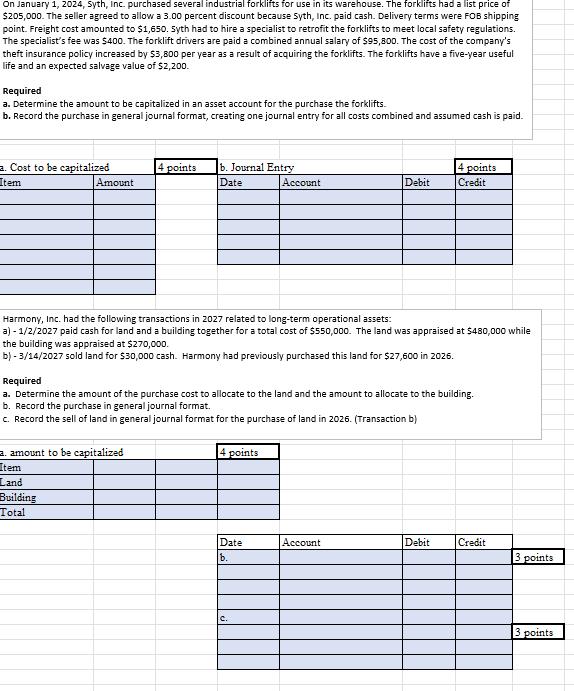

On January 1, 2024, Syth, Inc. purchased several industrial forklifts for use in its warehouse. The forklifts had a list price of $205,000. The seller agreed to allow a 3.00 percent discount because syth, Inc. paid cash. Delivery terms were FOB shipping point. Freight cost amounted to $1,650. Syth had to hire a specialist to retrofit the forklifts to meet local safety regulations. The specialist's fee was $400. The forklift drivers are paid a combined annual salary of $95,800. The cost of the company's theft insurance policy increased by $3,800 per year as a result of acquiring the forklifts. The forklifts have a five-year useful life and an expected salvage value of $2,200. Required a. Determine the amount to be capitalized in an asset account for the purchase the forklifts. b. Record the purchase in general journal format, creating one journal entry for all costs combined and assumed cash is paid. a. Cost to be capitalized Item 4 points Amount b. Journal Entry Date Account Debit 4 points Credit Harmony, Inc. had the following transactions in 2027 related to long-term operational assets: a) - 1/2/2027 paid cash for land and a building together for a total cost of $550,000. The land was appraised at $480,000 while the building was appraised at $270,000. b) - 3/14/2027 sold land for $30,000 cash. Harmony had previously purchased this land for $27,600 in 2026. Required a. Determine the amount of the purchase cost to allocate to the land and the amount to allocate to the building. b. Record the purchase in general journal format. c. Record the sell of land in general journal format for the purchase of land in 2026. (Transaction b) amount to be capitalized 4 points Item Land Building Total Date b. Account Debit Credit 3 points c. 3 points

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started