Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 2 (38 Marks) Mike is employed by Cookie Inc., a CCPC in the technology industry as a sales manager. He has requested your

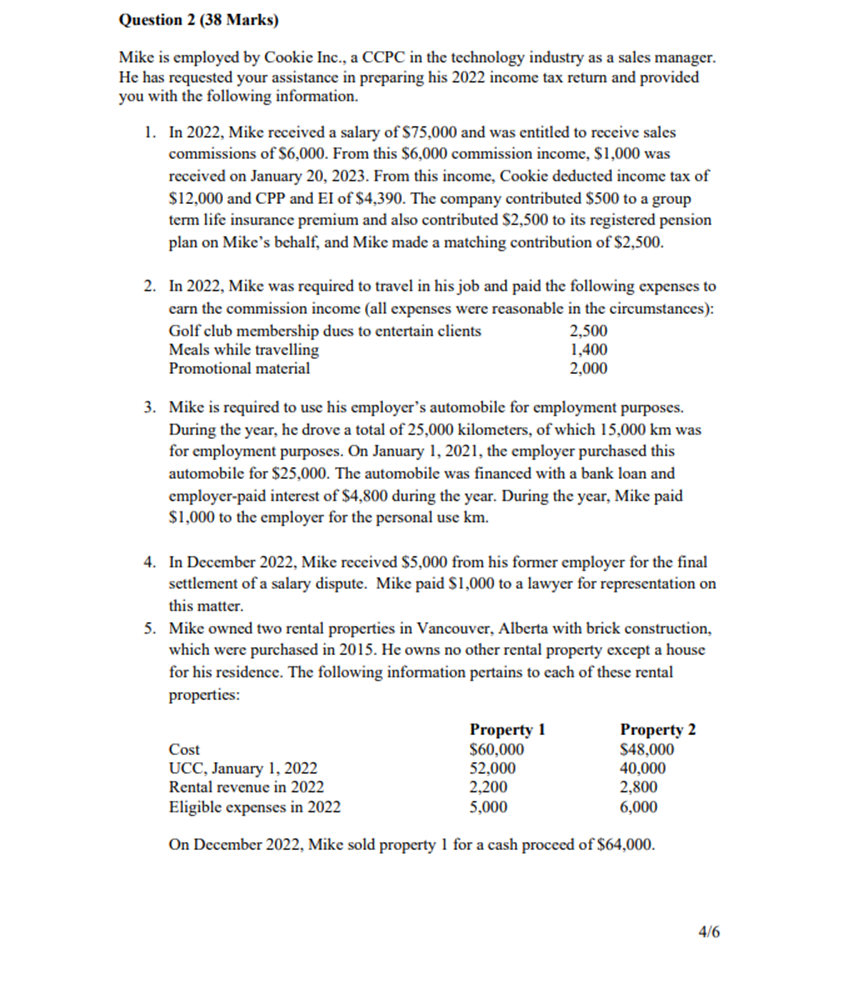

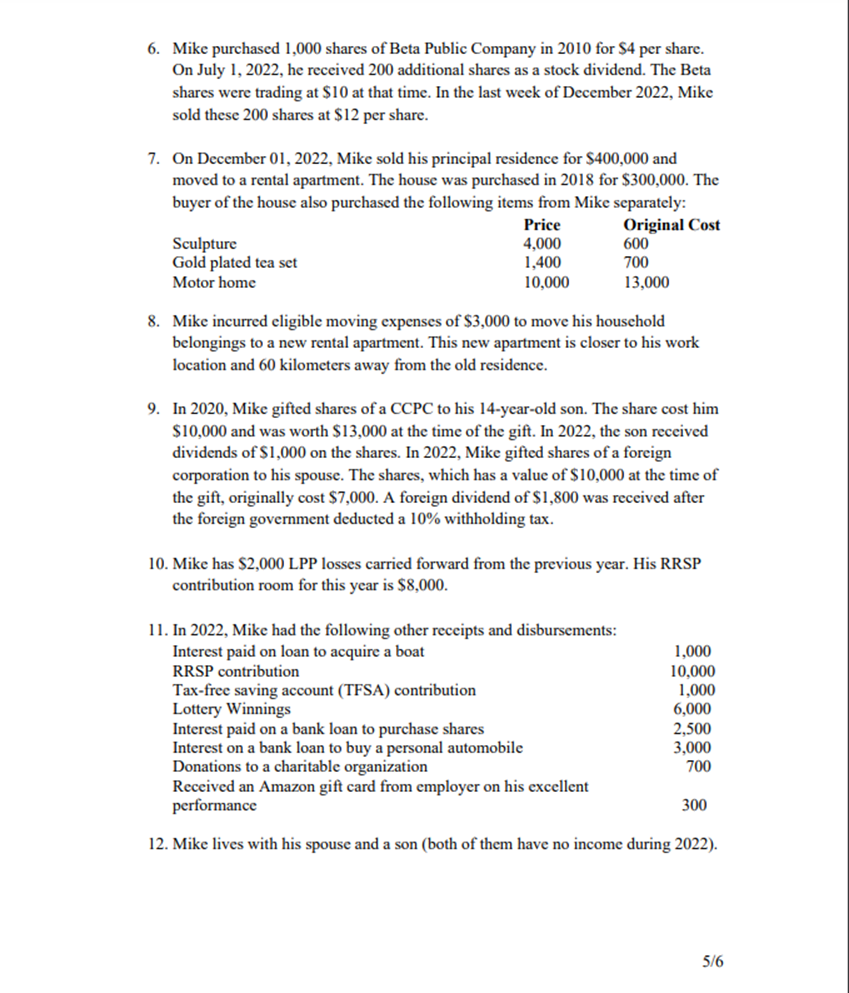

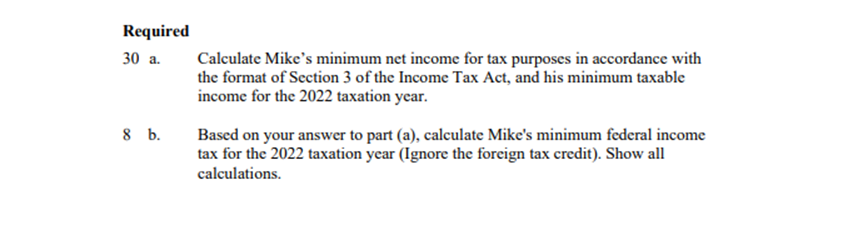

Question 2 (38 Marks) Mike is employed by Cookie Inc., a CCPC in the technology industry as a sales manager. He has requested your assistance in preparing his 2022 income tax return and provided you with the following information. 1. In 2022, Mike received a salary of $75,000 and was entitled to receive sales commissions of $6,000. From this $6,000 commission income, $1,000 was received on January 20, 2023. From this income, Cookie deducted income tax of $12,000 and CPP and EI of $4,390. The company contributed $500 to a group term life insurance premium and also contributed $2,500 to its registered pension plan on Mike's behalf, and Mike made a matching contribution of $2,500. 2. In 2022, Mike was required to travel in his job and paid the following expenses to earn the commission income (all expenses were reasonable in the circumstances): Golf club membership dues to entertain clients Meals while travelling Promotional material 2,500 1,400 2,000 3. Mike is required to use his employer's automobile for employment purposes. During the year, he drove a total of 25,000 kilometers, of which 15,000 km was for employment purposes. On January 1, 2021, the employer purchased this automobile for $25,000. The automobile was financed with a bank loan and employer-paid interest of $4,800 during the year. During the year, Mike paid $1,000 to the employer for the personal use km. 4. In December 2022, Mike received $5,000 from his former employer for the final settlement of a salary dispute. Mike paid $1,000 to a lawyer for representation on this matter. 5. Mike owned two rental properties in Vancouver, Alberta with brick construction, which were purchased in 2015. He owns no other rental property except a house for his residence. The following information pertains to each of these rental properties: Cost UCC, January 1, 2022 Rental revenue in 2022 Eligible expenses in 2022 Property 1 Property 2 $60,000 $48,000 52,000 40,000 2,200 2,800 5,000 6,000 On December 2022, Mike sold property 1 for a cash proceed of $64,000. 4/6 6. Mike purchased 1,000 shares of Beta Public Company in 2010 for $4 per share. On July 1, 2022, he received 200 additional shares as a stock dividend. The Beta shares were trading at $10 at that time. In the last week of December 2022, Mike sold these 200 shares at $12 per share. 7. On December 01, 2022, Mike sold his principal residence for $400,000 and moved to a rental apartment. The house was purchased in 2018 for $300,000. The buyer of the house also purchased the following items from Mike separately: Original Cost Sculpture Gold plated tea set Motor home Price 4,000 600 1,400 700 10,000 13,000 8. Mike incurred eligible moving expenses of $3,000 to move his household belongings to a new rental apartment. This new apartment is closer to his work location and 60 kilometers away from the old residence. 9. In 2020, Mike gifted shares of a CCPC to his 14-year-old son. The share cost him $10,000 and was worth $13,000 at the time of the gift. In 2022, the son received dividends of $1,000 on the shares. In 2022, Mike gifted shares of a foreign corporation to his spouse. The shares, which has a value of $10,000 at the time of the gift, originally cost $7,000. A foreign dividend of $1,800 was received after the foreign government deducted a 10% withholding tax. 10. Mike has $2,000 LPP losses carried forward from the previous year. His RRSP contribution room for this year is $8,000. 11. In 2022, Mike had the following other receipts and disbursements: Interest paid on loan to acquire a boat RRSP contribution Tax-free saving account (TFSA) contribution Lottery Winnings Interest paid on a bank loan to purchase shares Interest on a bank loan to buy a personal automobile Donations to a charitable organization 1,000 10,000 1,000 6,000 2,500 3,000 700 300 Received an Amazon gift card from employer on his excellent performance 12. Mike lives with his spouse and a son (both of them have no income during 2022). 5/6 Required 30 a. 8 b. Calculate Mike's minimum net income for tax purposes in accordance with the format of Section 3 of the Income Tax Act, and his minimum taxable income for the 2022 taxation year. Based on your answer to part (a), calculate Mike's minimum federal income tax for the 2022 taxation year (Ignore the foreign tax credit). Show all calculations.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started